Jobs:

Yes that’s right, it’s NFP Thursday this week due to the Independence Day holiday in the US Friday so don’t get caught out. On trading desks I’ve sat on in the past, this has happened and makes funny stories when you look back… Just as long as it wasn’t you that missed the trade!

Last night’s infamous ADP number came in better than expected with an increase of 237K jobs compared to the 219K expected. A further sign of the improving US labour market and throwing yet another spanner in the works when it comes to when the Fed will provide liftoff on raising rates.

If tonight’s NFP report is similarly strong, the Fed could ignore Greek uncertainty and go ahead with raising rates. If it disappoints, the ‘uncertainty’ and ‘data dependent’ rhetoric will no doubt be regurgitated to the market.

US Non-Farm Employment Change is expected to come in at 231K with a previous reading of 280K also to be revised.

Calling Tsipras’ Bluff:

If Tsipras is a poker player, I can see him being the one throwing away his chips…

Prime Minister Alexis Tsipras urged citizens to vote “No” in Sunday’s referendum.

“A no vote would not be tantamount to a rejection of Europe or the Euro”

“It would step up pressure on creditors to give Greece what it considered an economically viable agreement.”

It seems as though Tsipras thinks that Europe would be forced to budge on their terms, but with all quotes out of Europe suggesting nothing will now be done until after the referendum, it seems as though Tsipras’ bluff has been called and it could very well be the end of his government.

If you’re not sick of it, I also recommend taking a look at today’s Yanis Varoufakis blog post titled “Why we recommend a NO in the referendum – in 6 short bullet points” with the last being the most important:

“6. The future demands a proud Greece within the Eurozone and at the heart of Europe. This future demands that Greeks say a big NO on Sunday, that we stay in the Euro Area, and that, with the power vested upon us by that NO, we renegotiate Greece’s public debt as well as the distribution of burdens between the haves and the have nots.”

‘Restructuring’ is such a broad term that has been thrown around for years now. With neither side willing to budge, I can’t say I’m optimistic.

———-

On the Calendar Today:

Thursday:

AUD Trade Balance

GBP Construction PMI

USD Non-Farm Employment Change

USD Unemployment Rate

EUR ECB President Draghi Speaks

———-

Chart of the Day:

On NFP day, we take a look at one of the pairs most affected by the number in USD/JPY.

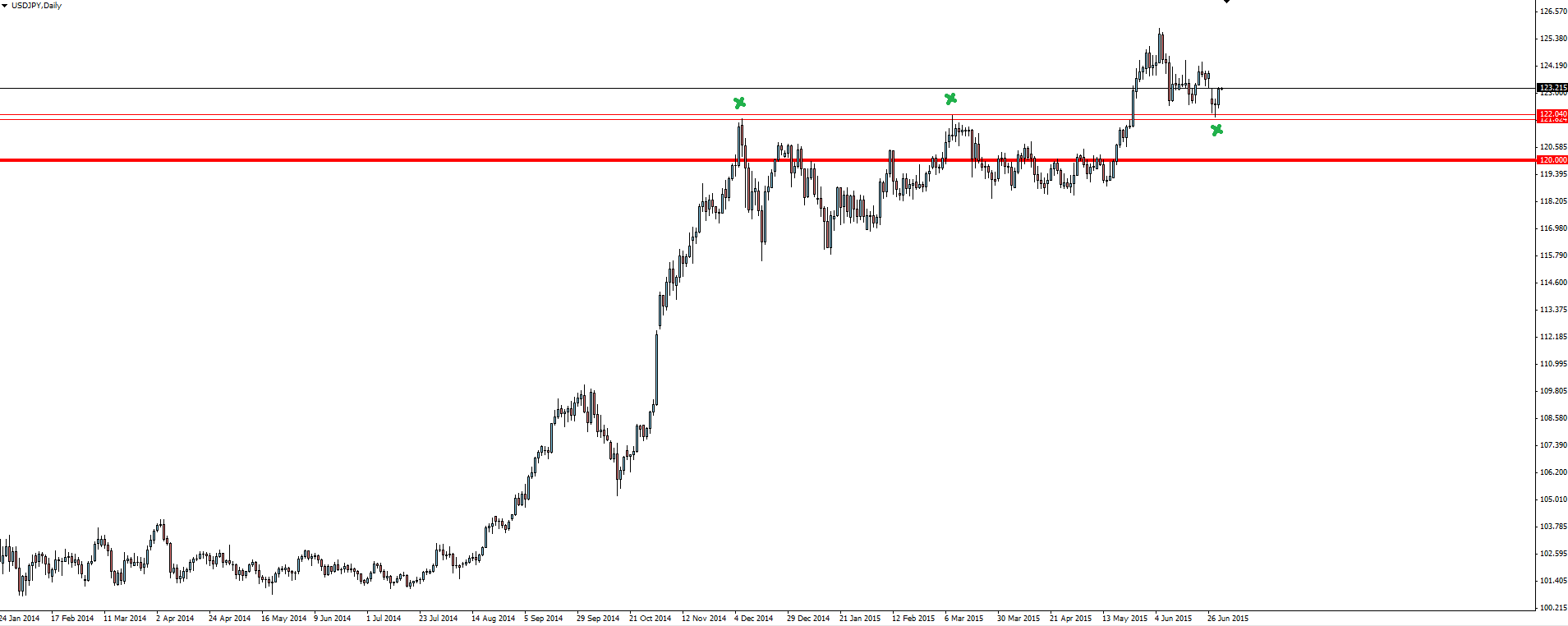

USD/JPY Daily:

Click on chart to see a larger view.

The daily USD/JPY chart is almost a perfect bullish picture. The huge, almost parabolic uptrend into a consolidation around the 120.000 level. Price has then slowly accumulated the sellers making higher lows with each push down before finally breaking out of the the 122.000 resistance level.

After this break-out, price has now come back to retest this former resistance level as support, giving us a place to manage our risk around.

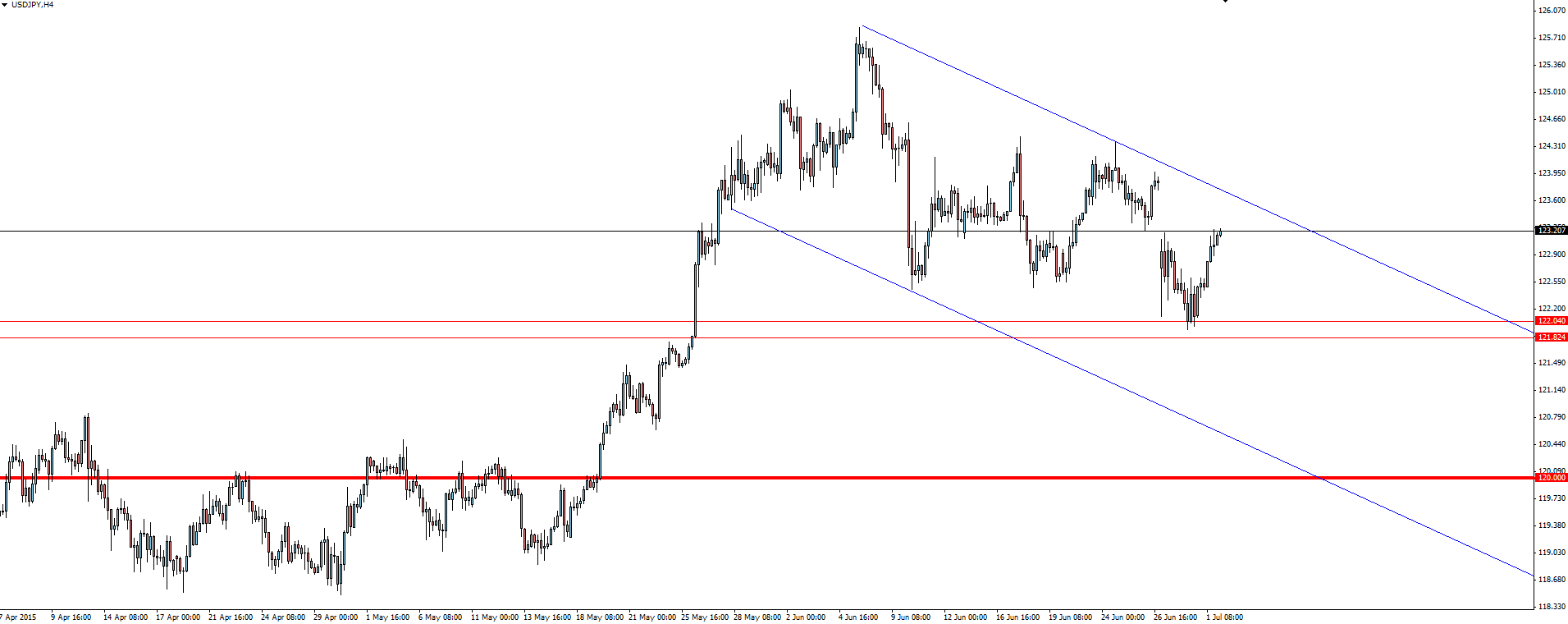

USD/JPY 4 Hourly:

Click on chart to see a larger view.

Zooming into the 4 hour chart, price has put in a short term descending channel (and flag if you take a look at the daily again). Taking this pattern as a flag in a major bullish up trend, the safer play would be longs with stops below the most recent swing low while trying to play for a breakout of the channel but a counter trend trade isn’t a terrible idea with some profit taking sure to come into play as we head into NFP tonight.

Recommended Content

Editors’ Picks

EUR/USD holds positive ground above 1.0700, eyes on German CPI data

EUR/USD trades on a stronger note around 1.0710 during the early Monday. The weaker US Dollar below the 106.00 mark provides some support to the major pair. All eyes will be on the Federal Reserve monetary policy meeting on Wednesday, with no change in rate expected.

USD/JPY extends recovery after testing 155.00 on likely Japanese intervention

USD/JPY is recovering ground after crashing to 155.00 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold tests critical daily support line, will it defend?

Gold price is seeing a negative start to a new week on Monday, having booked a weekly loss. Gold price bears the brunt of resurgent US Dollar (USD) demand and a risk-on market mood amid Japanese holiday-thinned market conditions.

XRP plunges to $0.50, wipes out recent gains as Ripple community debates ETHgate impact

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.