Default Looms Large:

“It shouldn’t feel like Lehman Brothers. But it does.”

Greece has once again failed to come to a deal with it’s creditors to secure the credit that it needs to keep it’s floundering banking system above water. With the key IMF loan deadline set to expire on June 30, default is now well and truly in play. For all the talk and lead up, I can’t say I ever actually expected things to get this far… But here we are.

This morning Greece has been forced to announce capital controls on it’s banks after the ECB, on the back of European and IMF preesure has frozen the level of funding they will provide.

This move threatens to bring the entire financial system to a halt. With a deluge of ATM withdrawals as you can see by the multitude of photos doing the rounds on Twitter, a cap on the amount of cash available to the system has been kept at previous levels set on Friday, essentially forcing a bank holiday on Monday.

“As many as 500 of the country’s more than 7000 ATMs had run out of cash as of Saturday morning.”

So Greece will shut its banks Monday to avert a financial collapse and remain shut until after the July 5 referendum that Greek Prime Minister Alexis Tsipras has called, giving the Greek people the final say on whether the nation should accept the harsh austerity proposals from the IMF in exchange for a continued place in the Eurozone.

However, with the referendum set for after the deadline, what exactly are they going to be voting on asks the IMF’s Christine Lagarde:

“I can’t speak for the IMF program, because the IMF program is on, but the European financial arrangement expires June 30.”

“So, at least legally speaking, the referendum will relate to proposals and arrangements that are no longer valid.”

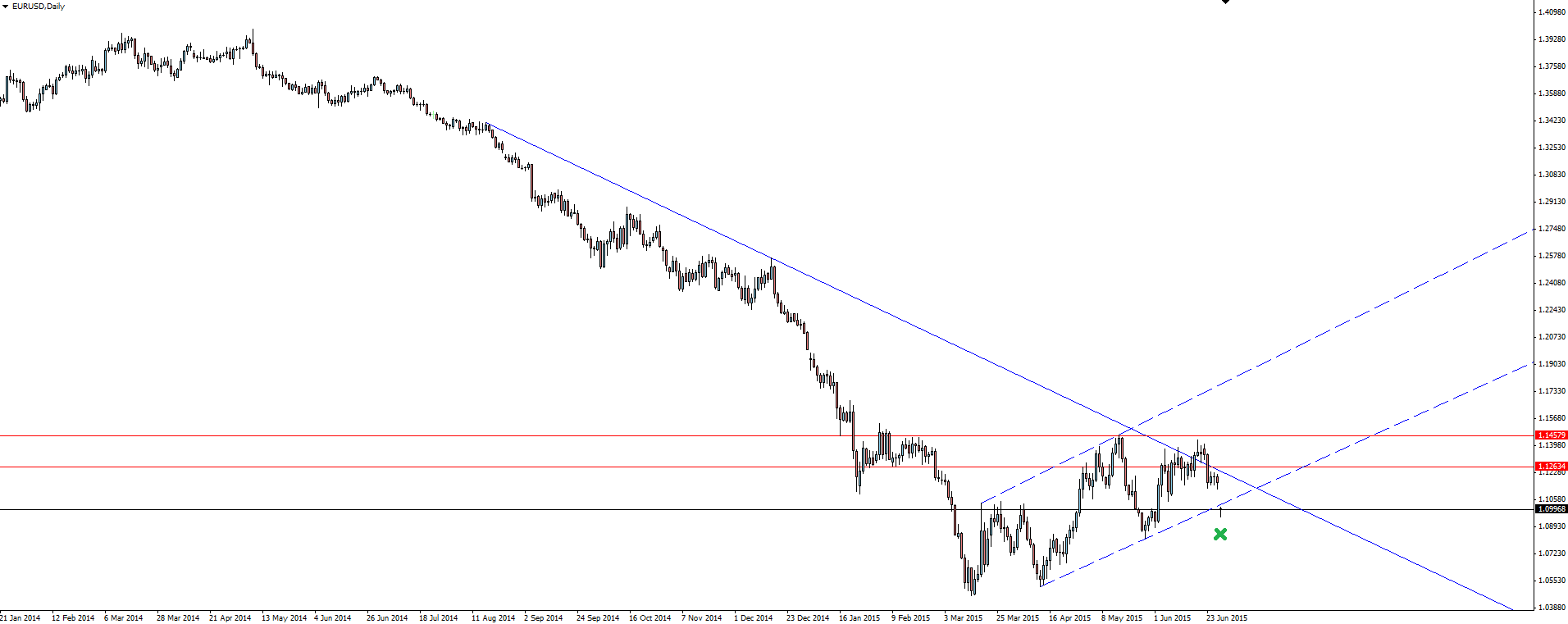

EUR/USD Daily:

Click on chart to see a larger view.

EUR/USD opened with a 200+ pip gap down, breaking short term channel/flag support and opening up new lows. Something that could be achieved very quickly if fear sets in later tonight.

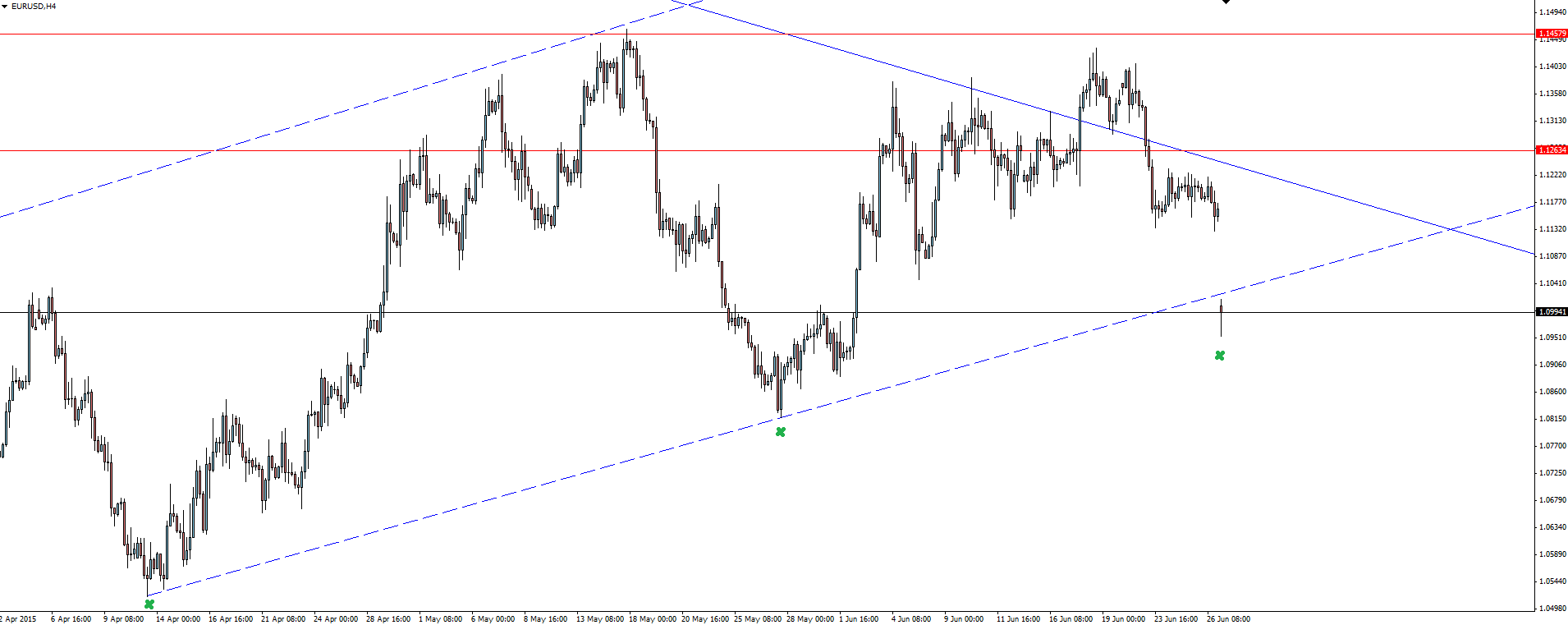

EUR/USD 4 Hourly:

Click on chart to see a larger view.

I can’t stress enough using caution in your trading to begin the week. This is not the type of climate to be fading moves at key technical levels. Key technical levels do not exist right now.

European open is going to get scary.

———-

On the Calendar Today:

All about the Greek headlines as we approach the June 30 deadline so keep Twitter or your News Terminal open as we head into the European session and beyond tonight.

The calendar is light on tier 1 data today and tonight but here are a few things to take note of just in case.

Monday:

JPY Retail Sales

JPY Prelim Industrial Production

EUR Italian Bank Holiday

USD Pending Home Sales

———-

Chart of the Day:

Having looked at EUR/USD and AUD/USD above, lets take a look at something a little different in the chart of the day section.

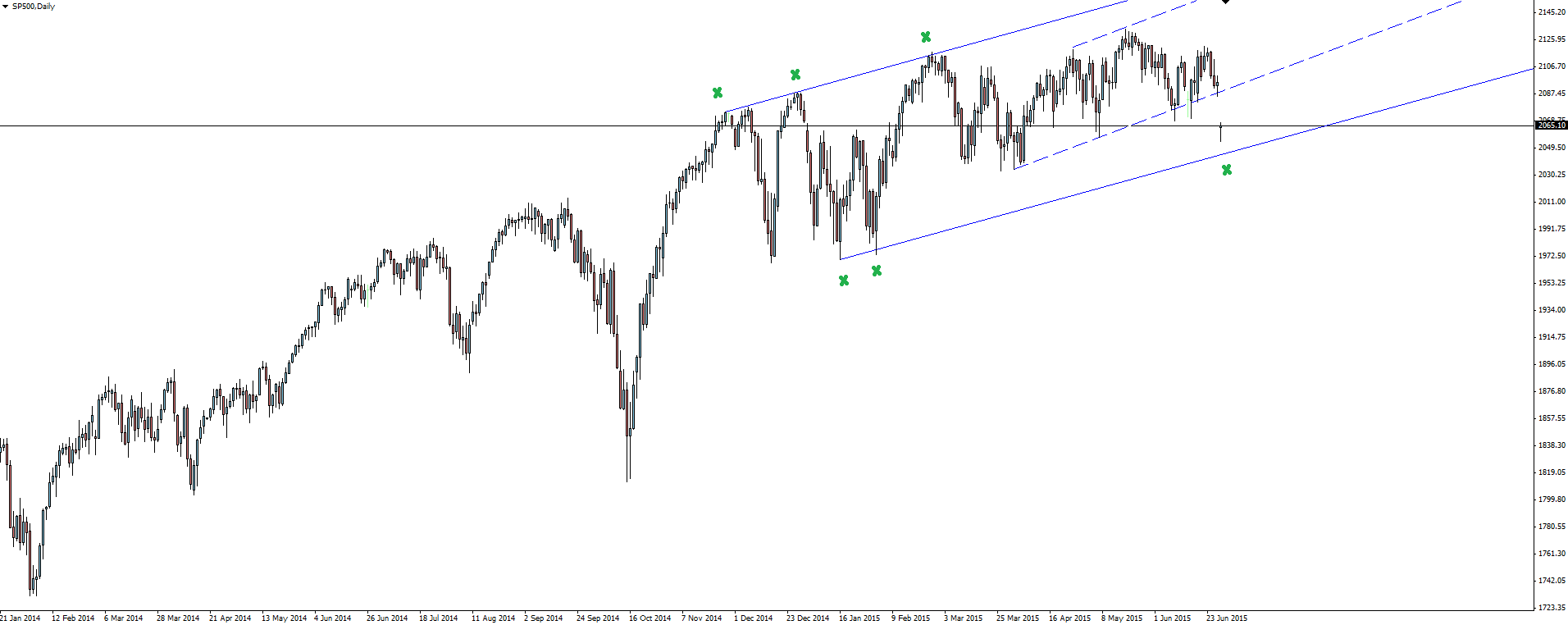

SP500 Daily:

Click on chart to see a larger view.

US stocks have had a juicy gap down through short term channel support.

This daily chart is just a tiny section of the massive bullish run that stocks have had over the last couple of years so as I’ve said when looking at the similar Australian SPI200 index chart, it never hurts to zoom out and take a longer term view on what sort of ‘correction’ this actually is.

Recommended Content

Editors’ Picks

EUR/USD holds positive ground above 1.0700, eyes on German CPI data

EUR/USD trades on a stronger note around 1.0710 during the early Monday. The weaker US Dollar below the 106.00 mark provides some support to the major pair. All eyes will be on the Federal Reserve monetary policy meeting on Wednesday, with no change in rate expected.

USD/JPY recovers 156.00 after testing 155.50 on likely Japanese intervention

USD/JPY has recovered some ground above 156.00 after crashing to 155.00 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold tests critical daily support line, will it defend?

Gold price is seeing a negative start to a new week on Monday, having booked a weekly loss. Gold price bears the brunt of resurgent US Dollar (USD) demand and a risk-on market mood amid Japanese holiday-thinned market conditions.

XRP plunges to $0.50, wipes out recent gains as Ripple community debates ETHgate impact

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.