Morning View:

I apologise for not being around for yesterday morning’s Asia Morning View. We’re undergoing a few changes at the Vantage FX Sydney office and I wasn’t able to sit down and get any writing done. There might be a few more disruptions to the normal routine for the rest of this week, but we’ll see how we go.

Nice Day for a Rate Cut:

With 22 of the 26 economists polled by Bloomberg expecting a 0.25% cut, not to mention an apparent insider article out of the Sydney Morning Herald last week, the market has positioned itself accordingly. AUD/USD has come down hard off it’s 80c highs we saw last week along with all other Aussie pairs showing weakness.

Public expectation is that the RBA will cut AND maintain an easing bias on the back of lowering outlooks on growth. The futures market suggesting a 70% chance of a cut compared to 30% of no change. Just remember that in April, the market also priced in a 75% chance of a cut and we got no change…

But what about looking at today’s RBA decision from a trader’s viewpoint? Given market expectations that we have all read about, a no cut will be the bigger market surprise and almost definitely send the Aussie soaring. The market is already starting to price in a follow up August cut no matter what, so no matter the associated language, if the RBA leaves rates unchanged then the Aussie will fly.

On the other hand, if the RBA does cut rates as expected, but talks down the need for future cuts then we could get a spike down but then a rally as traders start to digest a possible change to a more hawkish bias.

Run a few scenarios yourself and try to figure out the best way to attack the Aussie leading into the announcement. Remember that Twitter is always here to bounce ideas off if you need.

I’ll put my neck on the line and say I actually agree with Tony Prove from NAB who had this to say:

“It is my view the RBA will not cut and that would see AUD higher and a return to 0.7900 at least.”

“Should the RBA cut it would likely put the AUD on the path to test the 50 day moving average at 0.7745.”

In times like these, just make sure you expect the unexpected.

———-

On the Calendar Today:

Plenty on the calendar but it’s all about the RBA decision later this afternoon during Asia. The Trade Balance won’t have too much of an impact on the Aussie leading into the announcement.

Later in the evening we have a whole raft of tier 1 data through Europe and the US so set some alerts and manage your trades around each release.

Tuesday:

AUD Trade Balance

AUD Cash Rate

AUD RBA Rate Statement

EUR Spanish Unemployment Change

GBP Construction PMI

CAD Trade Balance

USD Trade Balance

USD ISM Non-Manufacturing PMI

———-

Chart of the Day:

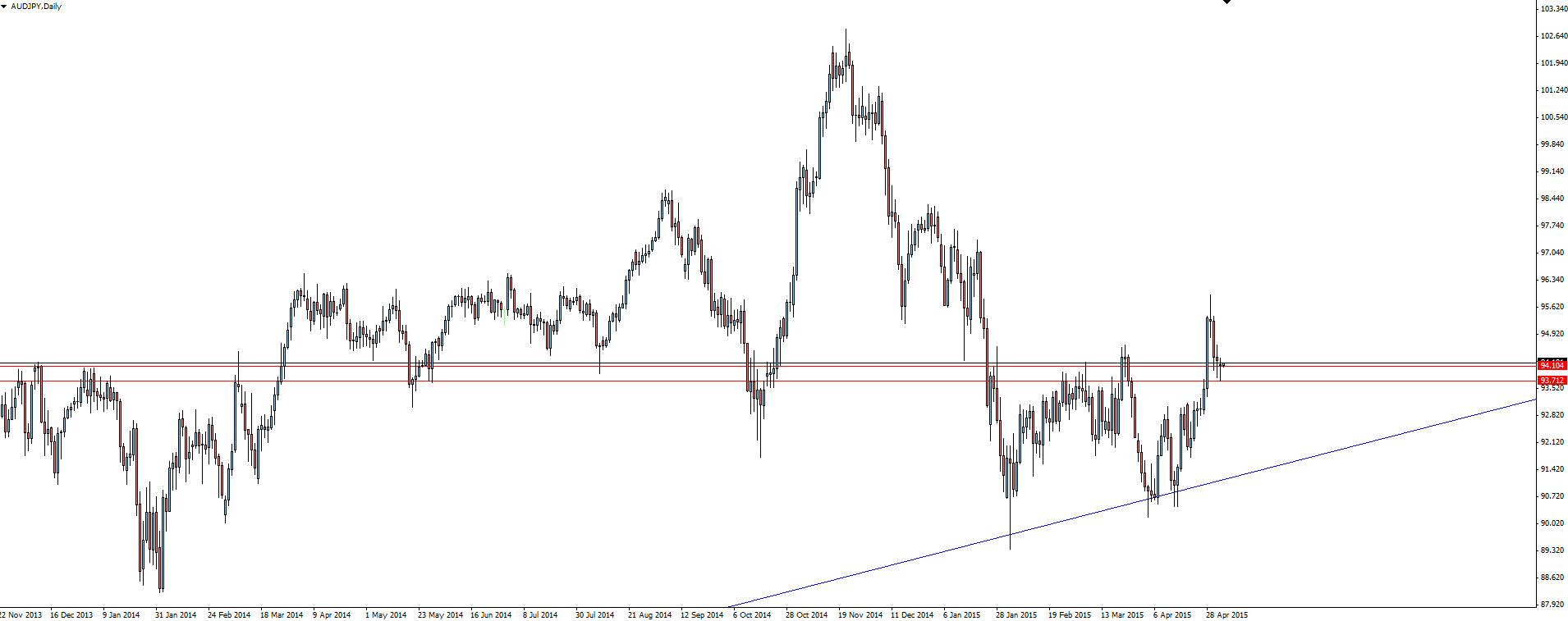

All eyes on the Aussie on RBA Tuesday. Most charting attention elsewhere online will be focused on AUD/USD so I’ve taken a look at something slightly different and gone with an AUD/JPY chart.

AUD/JPY Daily:

Click on chart to see a larger view.

If you’ve been following @VantageFX on Twitter then you’ll know that I’ve been talking about an AUD/JPY weekly channel for a few weeks now. Price tested the bottom trend line support level of the channel and bounced nicely off some better than expected economic news and then the expectation that a rate cut would not happen kept price off it’s lows.

As you can see from the daily chart above, after the Sydney Morning Herald article that greatly hinted the journalist was ‘in the know’, price has now started to pull back and is retesting a shorter term, daily SR zone which I have marked on the chart.

I really like the price action heading into this zone and will go into more detail in a stand alone post a little later in the morning. Keep an eye out on Twitter or the Technical Analysis section of the Vantage FX News Centre.

My thinking is really that from a technical point of view, this could be the 2nd chance to get long off the weekly channel support which I missed. Of course this will depend massively on what the RBA does this afternoon but the level is there giving an opportunity to get in first if price lets us.

Recommended Content

Editors’ Picks

AUD/USD tests lows near 0.6550 after dismal Aussie Retail Sales, mixed China's PMIs

AUD/USD is testing lows near 0.6550 after Australian Retail Sales dropped by 0.4% in March while China's NBS April PMI data came in mixed. Upbeat China's Caixin Manufacturing PMI data fails to lift the Aussie Dollar amid a softer risk tone and the US Dollar rebound.

USD/JPY rebounds to 157.00 after Monday's suspected intervention-led crash

USD/JPY is trading close to 157.00, staging a solid rebound in the Asian session on Tuesday. The pair reverses a part of heavy losses incurred on Monday after the Japanese Yen rallied hard on probable FX market intervention by Japan's authorities. Poor Japan's jobs and Retail Sales data weigh on the Yen.

Gold prices soften as traders gear up for Fed monetary policy decision

Gold price snaps two days of gains, yet it remains within familiar levels, with traders bracing for the US Fed's monetary policy decision on May 1. The XAU/USD retreats below the daily open and trades at $2,334, down 0.11%, courtesy of an improvement in risk appetite.

BNB price risks a 10% drop as Binance founder and ex-CEO Changpeng Zhao eyes Tuesday sentencing

Binance Coin price is dumping, with the one-day chart showing a defined downtrend. While the broader market continues to bleed, things could get worse for BNB price ahead of Binance executive Changpeng Zhao sentencing on Tuesday, April 30.

FX market still on intervention watch

Asian foreign exchange traders will be particularly attentive to any signs of Japanese intervention on Tuesday, following reports of Tokyo's involvement in the market on Monday. This intervention action propelled the yen upward from its 34-year low of 160 per dollar, setting off shockwaves of volatility.