Morning Recap:

Here we are already at the end of our Good Friday shortened week!

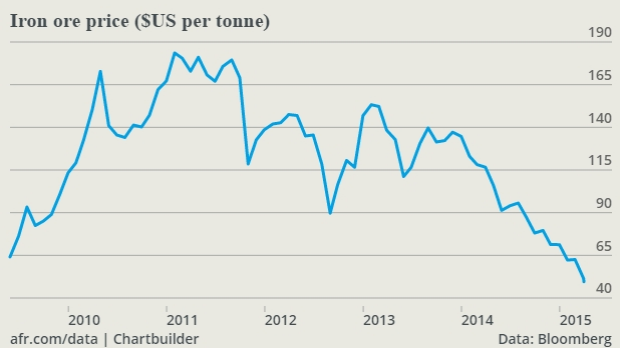

First up, overnight the price of Iron Ore was still the big issue for Asian traders. Markets are still concerned about growth in the Chinese economy and compounded by over an over supply of Iron Ore, the price of the commodity was again hammered. As you can see in the data below from Bloomberg, it’s been almost all downhill for the last couple of years, with falls exaggerated more recently:

The supply issue isn’t going anywhere and the big players still have room to move on price, as Westpac’s Justin Smirk notes:

“As noted, BHP and Rio Tinto can deliver into the Chinese market for around $US40 per tonne and have an objective to drive costs even lower.”

It’s tough for the junior miner’s but it’s good business if you’re BHP or Rio…

On the back of this, combined with the general market consensus that the RBA will cut rates next week, the Aussie was one of the hardest hit. The bears are fully in control here. Be careful swimming against the tide in this sort of environment.

Heading to the US, the overnight fall in the ADP Employment Change and Manufacturing ISM indicate that the risk is more so to the downside for Good Friday’s NFP. It’s also another miss on a key economic growth indicator while the FED is still considering the issue of when to raise rates.

Neither of these data releases were huge market movers, with ranges of only around 50 pips on the majors. Price is also still capped inside the FOMC bar I was speaking about on Twitter earlier in the week. It’s all about NFP tomorrow night.

Make sure you have your seat belts on, it’s going to be a wild one!

On the Calendar Today:

Light one during Asia but we are starting to ramp up the US releases into NFP tomorrow. I’m thinking that like yesterday, we aren’t going to get huge swings on the back of these pre-NFP numbers and it could be a good opportunity to position yourself heading into tomorrow.

Thursday:

AUD Trade Balance

GBP Construction PMI

USD Trade Balance

USD Unemployment Claims

Chart of the Day:

Click on chart to see a larger view.

We were talking about this candle yesterday on Twitter after the Chinese Manufacturing data release and AUD/USD sold off from there. Price spiked back up on the US data misses overnight, but with NFP tomorrow, it’s the domestic and Chinese issues that are keeping it well offered.

So long as price is at lows like it is now, it’s always a risk to be a seller. But getting in early and playing for the break lower could be the play if you believe in the Iron Ore and RBA stories above.

Recommended Content

Editors’ Picks

EUR/USD trades above 1.0700 after EU inflation data

EUR/USD regained its traction and climbed above 1.0700 in the European session. Eurostat reported that the annual Core HICP inflation edged lower to 2.7% in April from 2.9% in March. This reading came in above the market expectation of 2.6% and supported the Euro.

GBP/USD recovers to 1.2550 despite US Dollar strength

GBP/USD is recovering losses to trade near 1.2550 in the European session on Tuesday. The pair rebounds despite a cautious risk tone and broad US Dollar strength. The focus now stays on the mid-tier US data amid a data-light UK docket.

Gold price remains depressed near $2,320 amid stronger USD, ahead of US macro data

Gold price (XAU/USD) remains depressed heading into the European session on Tuesday and is currently placed near the lower end of its daily range, just above the $2,320 level.

XRP hovers above $0.51 as Ripple motion to strike new expert materials receives SEC response

Ripple (XRP) trades broadly sideways on Tuesday after closing above $0.51 on Monday as the payment firm’s legal battle against the US Securities and Exchange Commission (SEC) persists.

Mixed earnings for Europe as battle against inflation in UK takes step forward

Corporate updates are dominating this morning after HSBC’s earnings report contained the surprise news that its CEO is stepping down after 5 years in the job. However, HSBC’s share price is rising this morning and is higher by nearly 2%.