Morning Recap:

Warren Buffet!

Overnight CNBC ran an interview with Warren Buffet in which they asked the man a wide range of questions from the ‘Grexit’ issue all the way to ‘what he would do if he ran the Federal Reserve’ (Yes, seriously…). You probably shouldn’t really care what Warren Buffet has to say on any of these issues, but his name continues to prick people’s attention so here we are leading our Morning View with his name.

Similarly, the market really is sick of reading the same headlines around Greece, but like the name Warren Buffet, it keeps us clicking. It’s gotten to the point where they are treated as entertainment rather than market sensitive news. Keep that in mind when you see a headline with Greece flash up while in a trade.

A combination of Iron Ore falling to fresh lows and further expectation of a rate cut by the RBA next week has the Aussie still under the most pressure when it comes to risk currencies. AUD/USD sits close to it’s swing low which I like as a level to manage risk around. With the raft of data coming out in the near future, I’ll be talking more about this level with charts on the Vantage FX Twitter and Facebook page.

Oh, and just if you’re wondering what Warren Buffet would do if he ran the Federal Reserve:

“I probably wouldn’t do much.”

Brilliant insight.

On the Calendar Today:

Today is the first day of the week that we get a good steady stream of data releases around the globe. We start in Australia with Building Approvals off the back of yesterday’s housing data. This shouldn’t affect the RBA’s thinking next week too much but with housing the buzz word when it comes to the health of the two-stream Australian economy, it’s something to take note of.

A group of Chinese PMI’s are up next on the day, ending with a raft of EUR, GBP and USD sensitive news releases later in the night. Also keep your eye on ADP for clues before the big NFP number on Good Friday.

Wednesday:

AUD Building Approvals

CNY Manufacturing PMI

HSBC Final Manufacturing PMI

GBP Manufacturing PMI

USD ADP Non-Farm Employment Change

USD ISM Manufacturing PMI

Chart of the Day:

Got a couple of charts I want to share here this morning. As always, keep an eye on the Vantage FX Twitter and Facebook pages for more discussion around the charts throughout the trading day.

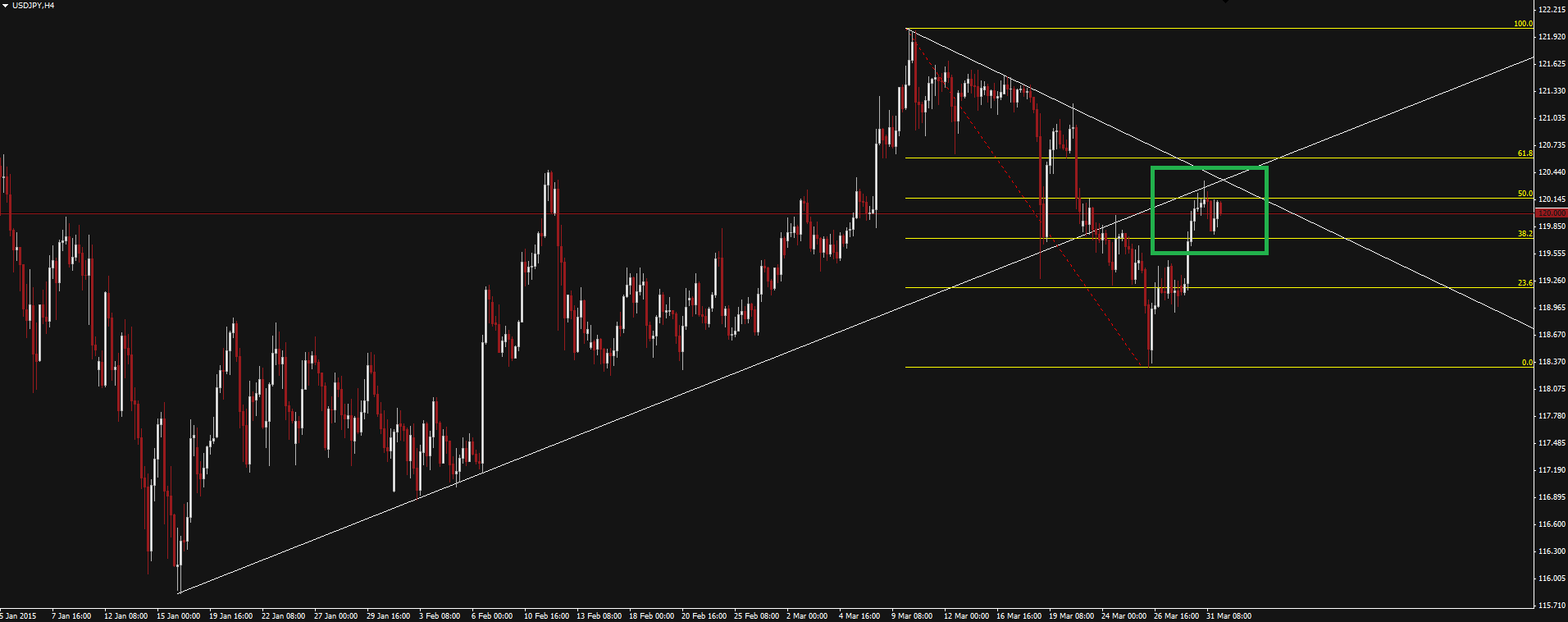

USD/JPY 4 hour:

Click on chart to see a larger view.

Got a nice 50 pip rejection off the fib level I was Tweeting about yesterday. I’m always cautious trading these sort of ‘textbook setups’ featuring a mix of multiple trend line levels and just watch for price to break back above and continue it’s up trend.

AUD/USD 4 hour:

Click on chart to see a larger view.

This is the chart I briefly mentioned above. The 0.7560 level at the swing low will be a key level to manage your risk around no matter which way you are trading. It’s always interesting to me how technicals and fundamentals work in tandem like this. Heading into some of the biggest data releases in the coming days, price finds itself at one of it’s biggest technical levels.

Recommended Content

Editors’ Picks

EUR/USD clings to marginal gains above 1.0750

EUR/USD trades in positive territory above 1.0750 in the second half of the day on Monday. The US Dollar struggles to find demand as investors reassess the Fed's rate outlook following Friday's disappointing labor market data.

GBP/USD edges higher toward 1.2600 on improving risk mood

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the modest improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold climbs above $2,320 as US yields push lower

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Three fundamentals for the week: Two central bank decisions and one sensitive US Premium

The Reserve Bank of Australia is set to strike a more hawkish tone, reversing its dovish shift. Policymakers at the Bank of England may open the door to a rate cut in June.