The US Dollar index fell from 100 again on concerns that Fed may consider to delay the rate hike as USD rocketed and inflation is still at low level. The bulls of USD shall be aware that if Fed remains “patient” in its March statement and warn on the negative effects of strong Dollar on US economy, USD may face a significant retracement in a short time.

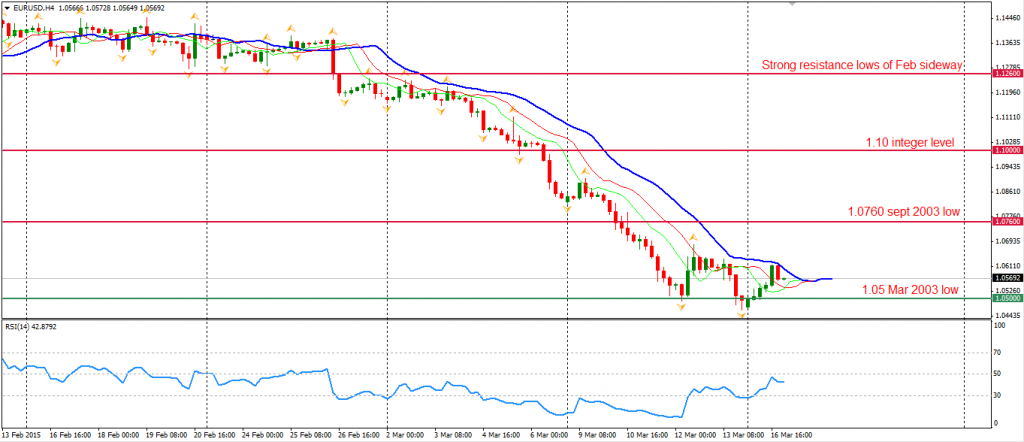

Euro rebounded from 1.05 yesterday, but failed twice on standing beyond 1.06. The ECB president Draghi said earlier this morning that Euro-area economy has started recovery, boosted by the easing policy and tumbled oil prices. The resistances upward are 1.06 and 1.0760; 1.05 is still the critical support.

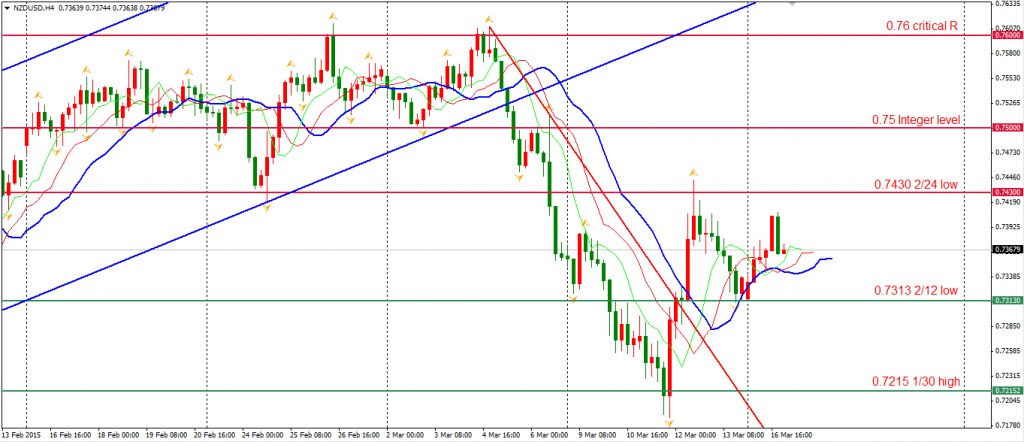

Kiwi Dollar bounced on Monday from support at 0.7320 and closed near 0.7370. The currency was supported by the fundamental aspect as RBNZ has no plan for monetary easing. Market participants will watch the GDT prices, New Zealand Q4 GDP data, and FOMC meeting at this week. The current range of NZDUSD is between 0.7313 and 0.7430.

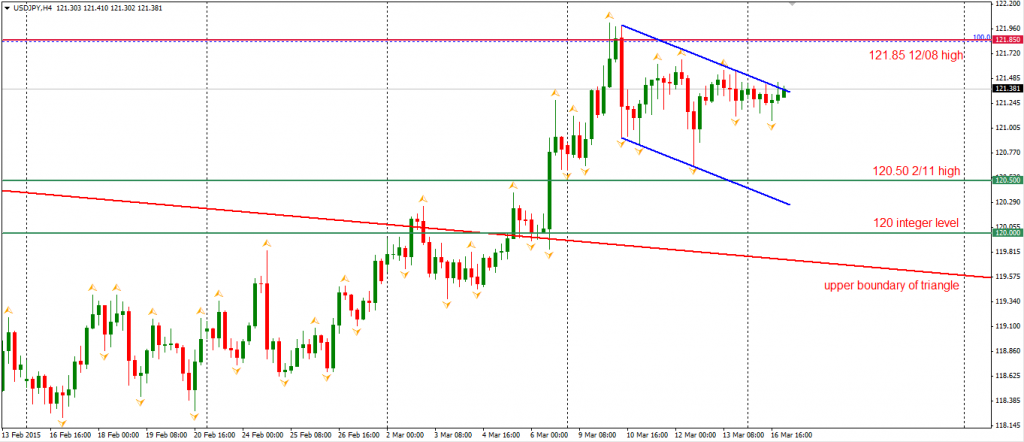

Last week Dollar Yen reached 122 by the assistance of strong Dollar, but fell later and has not effectively broken the former high 121.85. Now, the pair is moving in a flag pattern in the H4 chart. If USDJPY rises beyond 121.60, then it may refresh the high to 125.

Back to stock markets, Shanghai Composite surged 2.3% to 3449. The Nikkei Stock Average slid 0.1%. Australian ASX 200 lost 0.29% to 5798. In European markets, the UK FTSE climbed 0.94%, the German DAX rocketed 2.24% and reached 12000 the first time in history. The French CAC Index also rose 1%. The US stocks rose after the European markets. The S&P 500 closed 1.35% at 2081. The Dow rose 1.29% to 17977, and the Nasdaq Composite Index gained 1.19% to 4930.

On the data front, market will focus on RBA policy statement and BOJ policy decisions during the Asian session. Eurozone final CPI will be out at 21:00 pm AEDST. US Empire State Building Permits and Canadian Manufacturing Sales will be released at 23:30 pm AEDST.

Recommended Content

Editors’ Picks

EUR/USD retreats to 1.0750, eyes on Fedspeak

EUR/USD stays under modest bearish pressure and trades slightly near 1.0750 on Wednesday. Hawkish comments from Fed officials help the US Dollar stay resilient and don't allow the pair to stage a rebound.

GBP/USD struggles to hold above 1.2500 ahead of Thursday's BoE event

GBP/USD stays on the back foot and trades in negative territory below 1.2500 after losing nearly 0.5% on Tuesday. The renewed US Dollar strength on hawkish Fed comments weighs on the pair as market focus shifts to the BoE's policy announcements on Thursday.

Gold fluctuates in narrow range below $2,320

After retreating to the $2,310 area early Wednesday, Gold regained its traction and rose toward $2,320. Hawkish tone of Fed policymakers help the US Treasury bond yields edge higher and make it difficult for XAU/USD to gather bullish momentum.

SEC vs. Ripple lawsuit sees redacted filing go public, XRP dips to $0.51

Ripple (XRP) dipped to $0.51 low on Wednesday, erasing its gains from earlier this week. The Securities and Exchange Commission (SEC) filing is now public, in its redacted version.

Softer growth, cooler inflation and rate cuts remain on the horizon

Economic growth in the US appears to be in solid shape. Although real GDP growth came in well below consensus expectations, the headline miss was mostly the result of larger-than-anticipated drags from trade and inventories.