The meeting between Eurogroup and Greek leaders is in spotlight as there is still yet no sign of agreement and today is the deadline. Eurogroup first confirmed they received a letter from Greece indicating this as a positive signal. However, Greece requested to extend its loan agreement in the email which was then rejected by Germany. Market participants are now waiting for the confirmed news whether either party will compromise to an agreement on Friday.

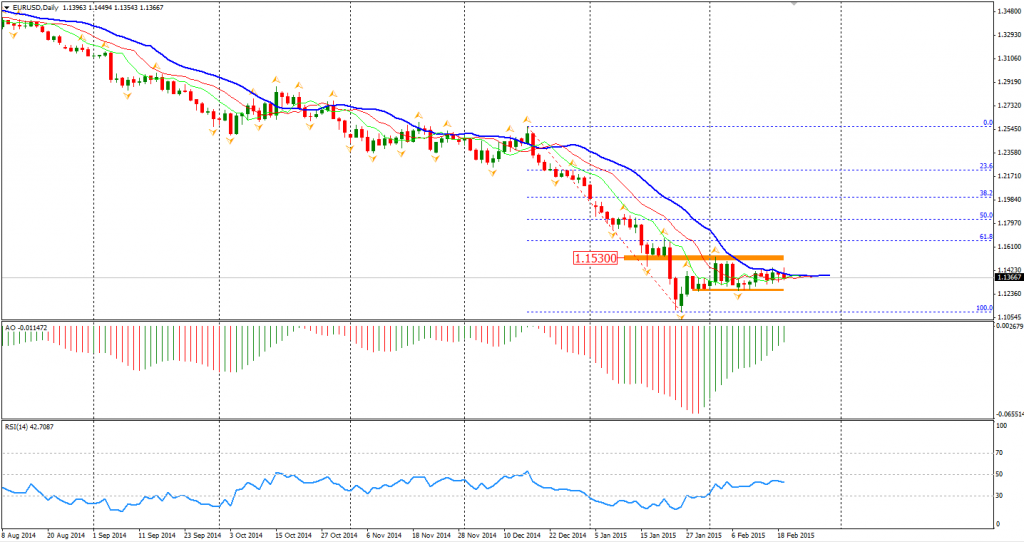

The Euro rose and tested the 1.1450 resistance level in the European morning but failed as the huge amount of offers laid still at that level. It later fell on Germany’s cold response to Greece clsoing at 1.1370 this morning.

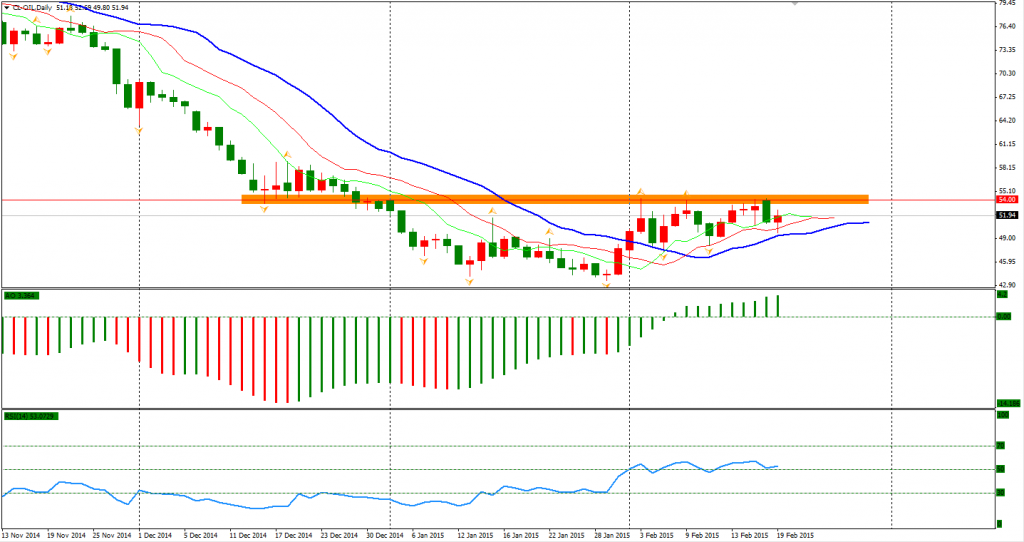

US Oil prices once slumped by 5% to the day low of $49.80 per barrel before the crude oil inventories data was released with traders expecting storage to increase and short WTI contracts in advance. The data finally confirmed the forecast, but oil prices surged back to $52 as expectation was met. The outlook of oil prices is still bearish as demand remains weak. Technically, the $54 resistance level has thwarted three times the bounce of prices. Only when this resistance is broken will oil prices continue the rebound.

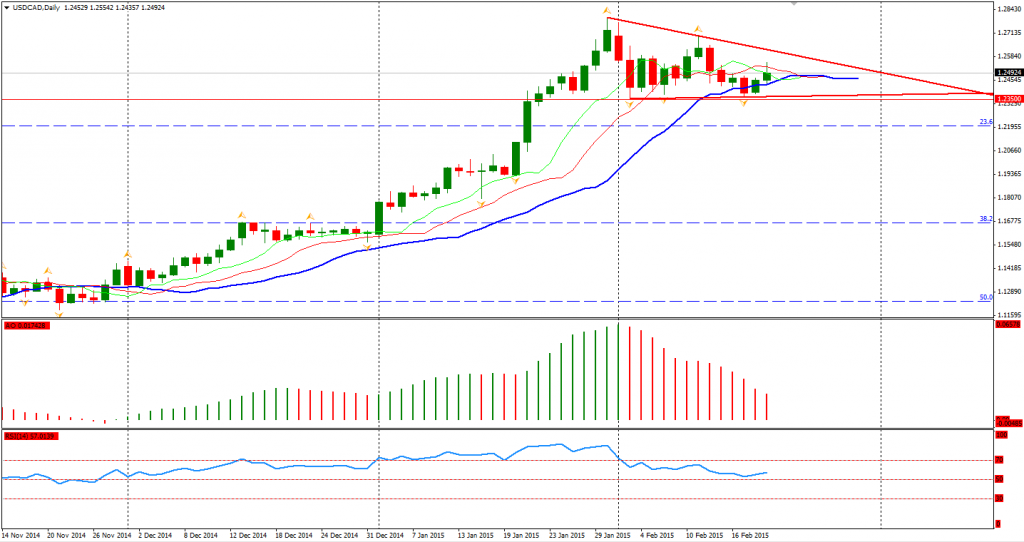

The tumbled oil prices put pressure on the Canadian Dollar, which led the commodity currency to fall against the US Dollar. A triangle consolidation pattern is forming. The low from February 3rd, 1.2350, provides strong support for the USDCAD. If oil prices slumped again as mentioned above, the USDCAD will probably upside break the triangle pattern and resume its rally.

Looking to the stock markets, the Nikkei Stock Average gained 0.35% to 18265, highest level in 15 years. Australian ASX 200 lost 0.19% to 5904. In European markets, the UK FTSE was down 0.13%, the German DAX climbed 0.4% and the French CAC Index gained 0.71%. US stocks rose broadly after the President Day. The S&P 500 closed 0.11% lower at 2097. The Dow slid 0.24% to 18030, and the Nasdaq Composite Index rose 0.37% to 4924.

On the data front, Eurozone February Flash Manufacturing PMI will be released today. UK retail sales will be at 20:30 AEDST. US Flash Manufacturing PMI and Canada retail sales will be out at 0:30 AEDST.

Recommended Content

Editors’ Picks

Fed’s Powell said further conviction that inflation is returning to the target is needed before start cutting rates – LIVE

Chair Powell reiterated that the Fed's policy rate remains restrictive, although further confidence that inflation is retreating towards the bank's target is needed before deciding on reducing rates.

EUR/USD extends gains above 1.0700 on Powell’s presser

The selling bias in the Greenback gathers extra pace as Powell’s press conference is under way, lifting EUR/USD to daily tops past the 1.0700 hurdle.

GBP/USD rises above 1.2500 on weaker Dollar

The resumption of the upward pressure sends GBP/USD back above 1.2500 the figure in response to increasing selling pressure hurting the Greenback.

Gold surpasses $2,300 as Dollar tumbles

The precious metal maintains its constructive stance and trespasses the $2,300 region on Wednesday after the Federal Reserve left its FFTR intact, matching market expectations.

A new stage of Bitcoin's decline

Bitcoin's closing price on Tuesday became the lowest since late February, confirming the downward trend and falling under March and April support and the psychologically important round level.