The trading was relatively light in the American session as US market celebrated Thanksgiving. However, we still saw some movements as Dollar strengthened on the first day this week while commodities slumped.

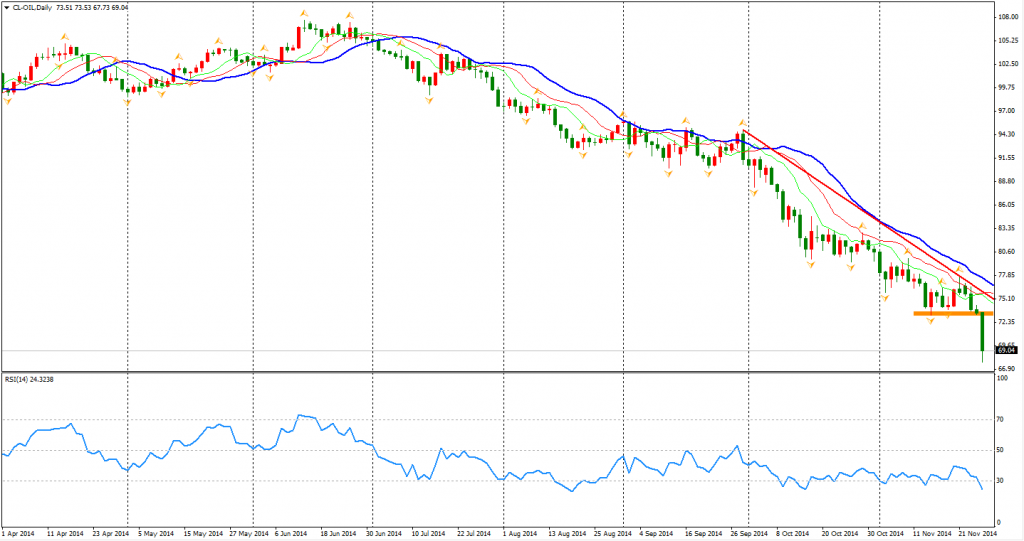

The news about OPEC deciding not to cut the oil production sent WTI to $70 per barrel below level. The price war started as Saudi Arabia want to use lower price to drive out the US shale gas manufacturers. However, since the oil price has already fallen to $69, the space for further decline was already limited. Technical buys may support the price.

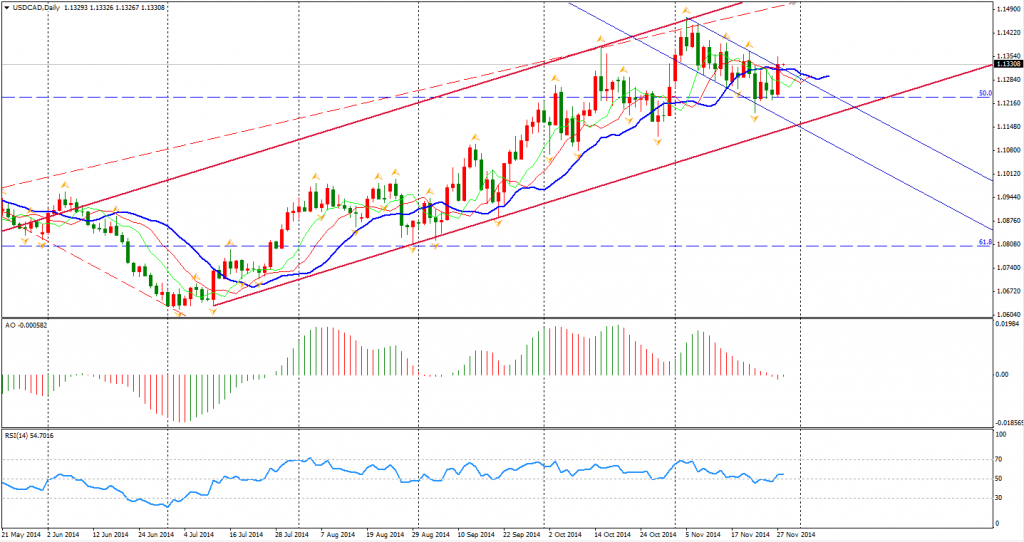

As the bearishness of oil continues, Canadian Dollar also fell yesterday. We may see USDCAD rise back to 1.14 level again.

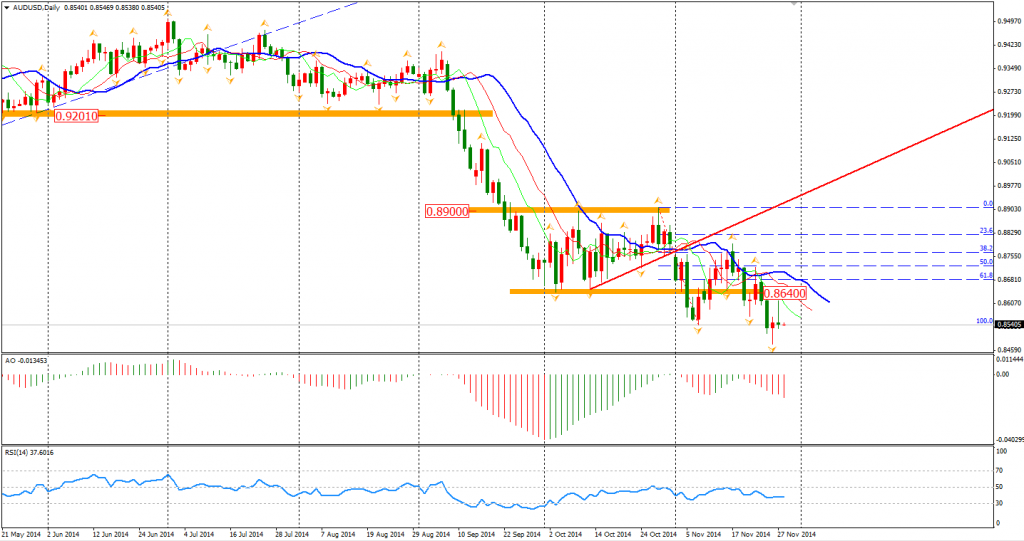

Australian Dollar rebounded back to the 0.86 level during Asian trading hours but erased the whole gain back to 0.8540 after the day, leaving a doji on the daily chart. The outlook of Aussie Dollar remains bearish. The market seems to have no intention to change the current bearishness.

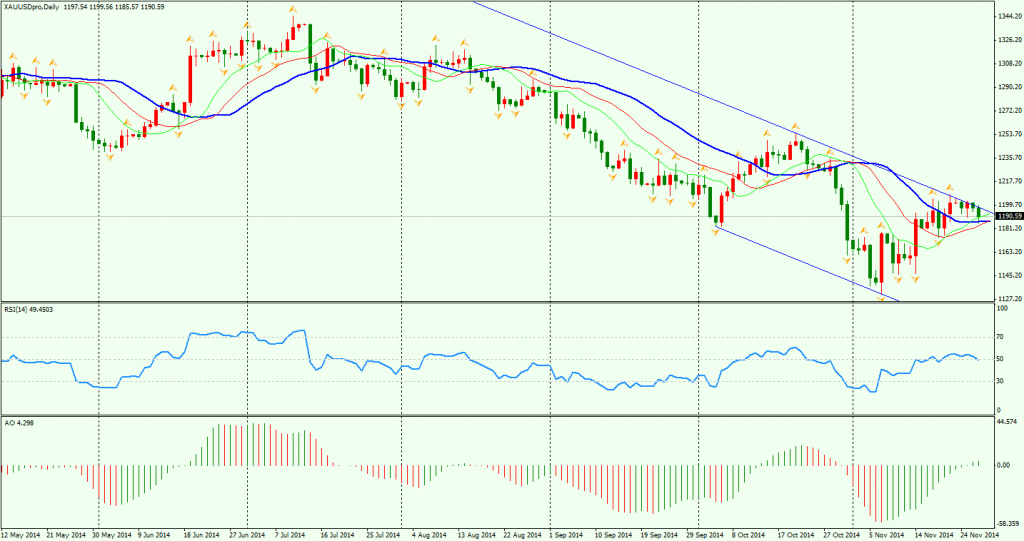

Gold once fell to $1186 per ounce during the Asian session but shortly recovered. However, as we discussed yesterday, the price was suppressed by the downward channel. The support levels below are the low of last Friday $1186.7 and $1180.

Most Asian stock markets remained rising. The rose of Shanghai Composite continues. The index surged 1% to 2630, refreshed 3-year high for 4 days in a row. ASX 200 also advanced 0.1% to 5400. In the European stock markets, the UK FTSE was down 0.09%, the German DAX rose 0.6% and the French CAC Index gained 0.2%.

On the data front, New Zealand ANZ Business Confidence will be released at 11:00 AEDST. Euro area Unemployment rate and CPI Flash Estimate are the main data in European session. Also, Canada GDP will be released at midnight.

Recommended Content

Editors’ Picks

EUR/USD clings to marginal gains above 1.0750

EUR/USD trades in positive territory above 1.0750 in the second half of the day on Monday. The US Dollar struggles to find demand as investors reassess the Fed's rate outlook following Friday's disappointing labor market data.

GBP/USD edges higher toward 1.2600 on improving risk mood

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the modest improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold climbs above $2,320 as US yields push lower

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Three fundamentals for the week: Two central bank decisions and one sensitive US Premium

The Reserve Bank of Australia is set to strike a more hawkish tone, reversing its dovish shift. Policymakers at the Bank of England may open the door to a rate cut in June.