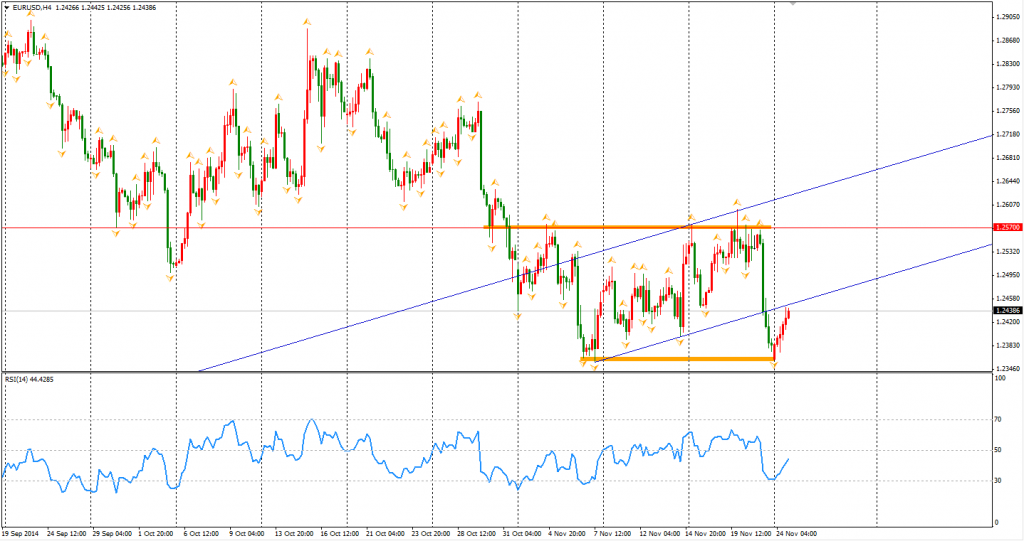

The upbeat German business confidence assisted in a Euro rebound against the dollar away from its month’s low. The business climate index rose for the first time in seven months to 104.7. It gives some hope to the Eurozone against other weak data. The Euro Dollar was around 1.2440 this morning – still weak considering the slump of last Friday. Traders can keep their bearish view on Euro as long as it remains below the lower boundary of the flag pattern.

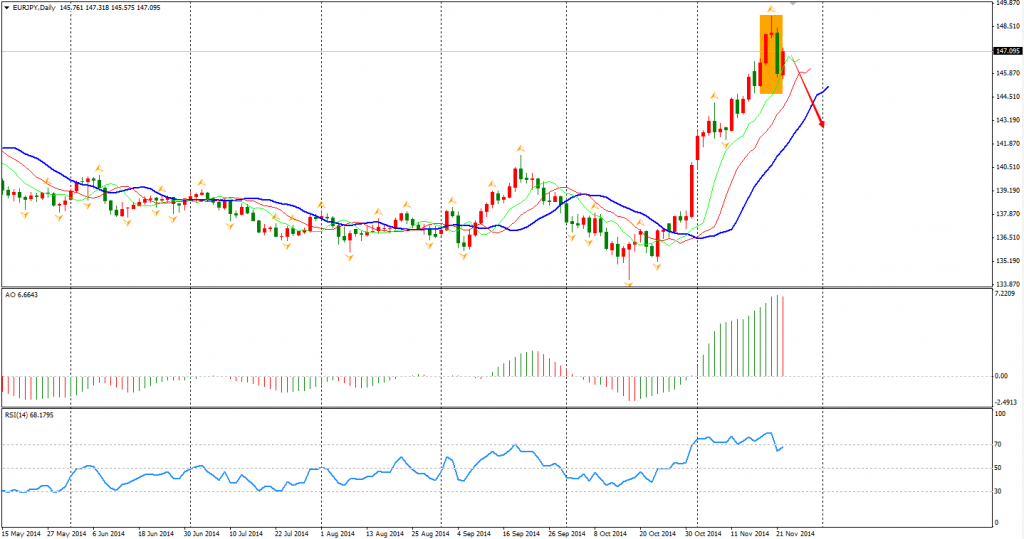

We can also see some trading opportunities in the Euro crosses. EURJPY for instance, left an evening star in the daily chart on last Friday and a doji in the weekly chart. Considering the Dollar Yen has been close to the 120 level and the Euro is expected to be under pressure from ECB’s further easing, the Euro Yen may fall in the mid-term.

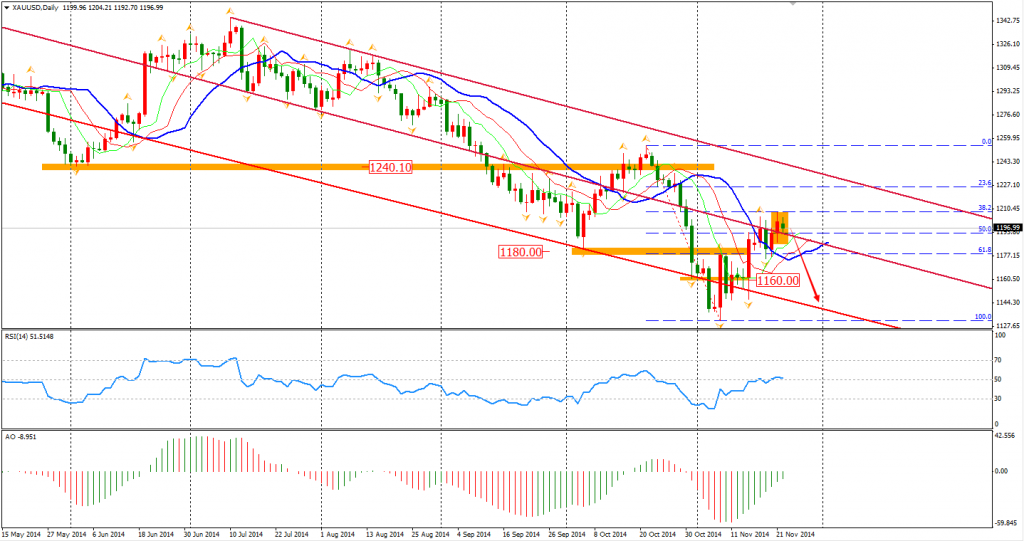

Traders maintain their doubts for the next move of gold price as gold closed as a harami in the daily chart. Some hedge funds added their wagers on a bullishness after China joined Japan and Eurozone in the team of monetary easing. However, other participants are still keeping their bearish bets as the Fed is heading to rate hike and demands from China and India are weak compared with last year. The Harami pattern may imply that the rebound is over.

Most Asian stock markets closed higher after the China rate cut. The Shanghai Composite surged 1.85% to a 3-year high of 2533. The ASX 200 also advanced 1.08% to 5362. In the European stock markets, the UK FTSE was down 0.31%, the German DAX rose 0.54% and the French CAC Index gained 0.49%. The US market kept climbing. The S&P 500 gained 0.29% to 2069. The Dow rose 0.05% to 17818, and the Nasdaq Composite Index rose 0.88% to 4754.

On the data front, BOJ Governor Kuroda will speak at 12:00 AEDST. Canada Retail Sales and US Prelim GDP will be released at 0:30 AEDST.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0750 to start the week

EUR/USD trades in positive territory above 1.0750 in the European session on Monday. The US Dollar struggles to find demand following Friday's disappointing labor market data and helps the pair hold its ground.

GBP/USD edges higher toward 1.2600

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the modest improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold rebounds above $2,310 after downbeat NFP data, eyes on Fedspeak

Gold price trades in positive territory above $2,310 after closing the previous week in the red. The weaker-than-expected US employment data have boosted the odds of a September Fed rate cut, hurting the USD and helping XAU/USD find support.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.