klThe US data, on the whole, beat or equalled expectations. Core CPI month-on-month rose by 0.2%; unemployment claims remains at a low of 291,000; Philly Fed Manufacturing Index and Existing Home Sales was upbeat for the forecast. However, those data results did not help the Dollar step out of the range for the European session.

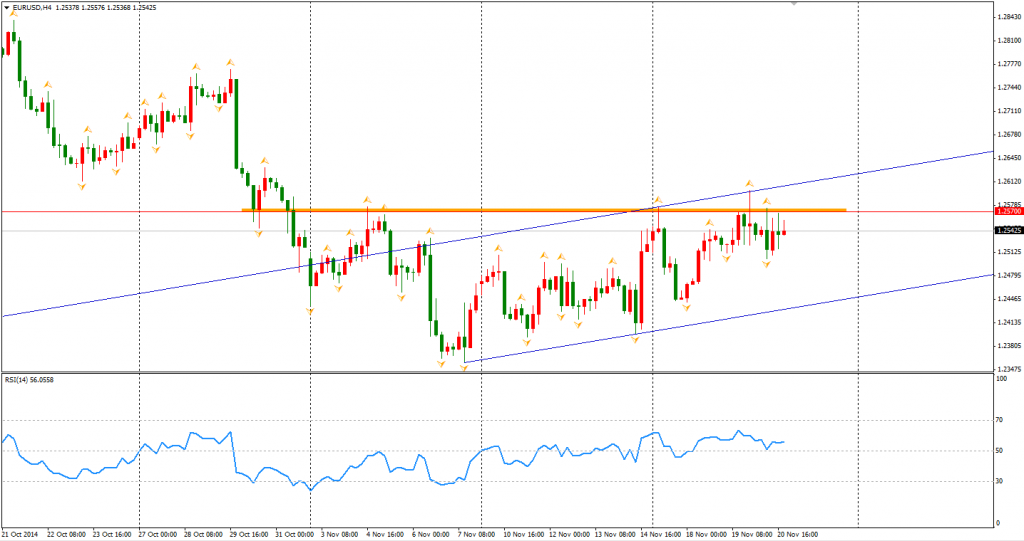

The Eurozone PMIs are still disappointing for November and hit the Euro to 1.25 against the Dollar. The Composite PMI fell to a 16-month low of 51.4, lower than the expected 52.3. The data implies the risk of another Eurozone recession on the rise. The German and French data is also weak and worrisome. However, the Euro didn’t break the range between 1.25-1.2575.

The Flag pattern remains in the H4 chart.

The Dollar Yen refreshed multi-year highs to the 119 level, but quickly jumped back to an area around 118. The retracement shows that the bulls are taking profit as the current level is quite close to 120 mid run target. Traders may need to raise some caution on Yen trading as a major pull back may be coming in with the daily chart leaving a long shadow.

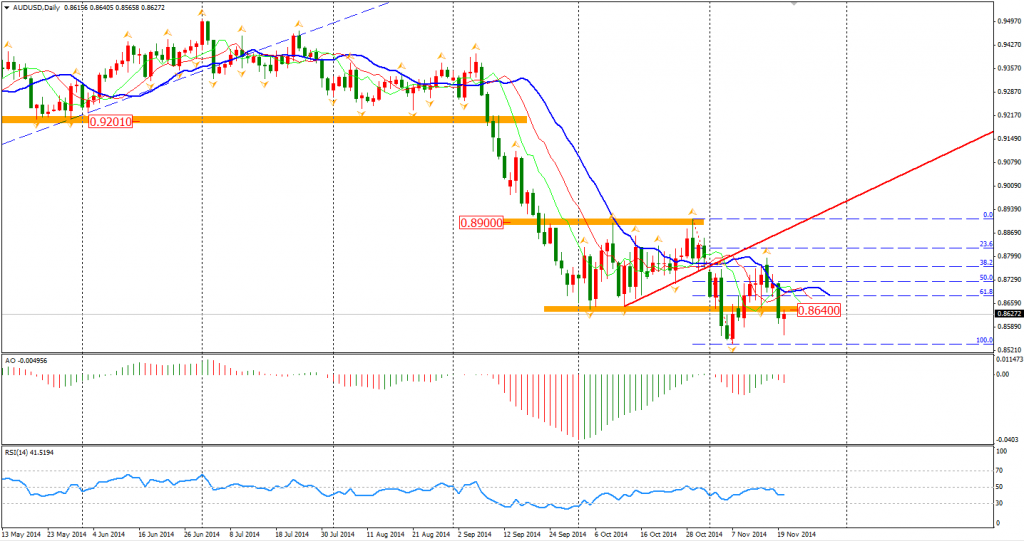

The Aussie Dollar remains below 0.8640 and is one step away from former lows of 0.8540.

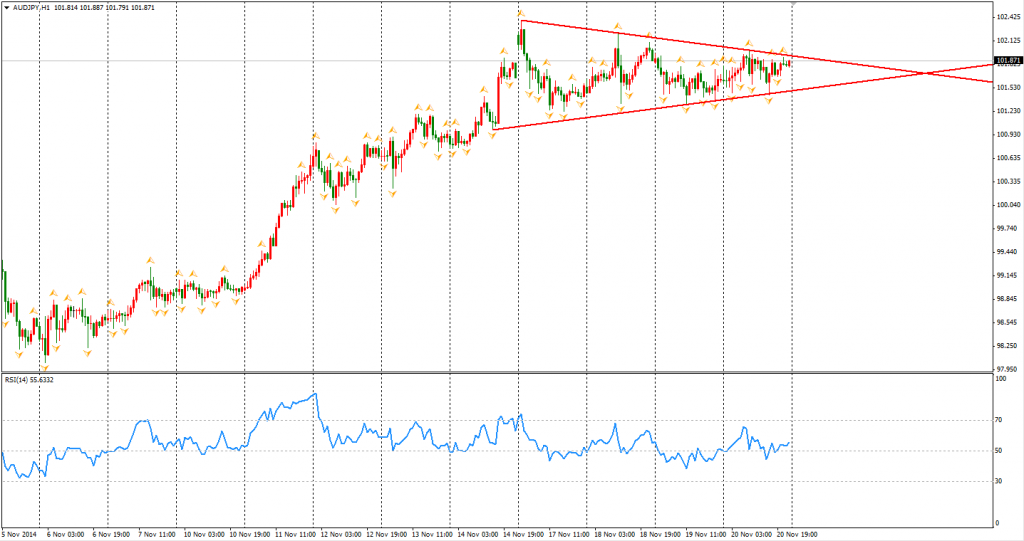

We can also see a convergent triangle in AUDJPY H1 chart. Is it a continuation or a reversal? I It will probably be best to leave it until next week to decide which is the weakest currency.

The Asian stock markets were trading in limited range, except for the Australian market which slumped in the session. The ASX 200 lost 0.98% to 5316. The Nikkei Stock Average was up 0.1% whilst the Shanghai Composite gained 0.07% to 2453. In European stock markets, the UK FTSE was down 0.35%, the German DAX rose by 0.12% and the French CAC Index lost 0.75%. The US market inched to a new high. The S&P 500 gained 0.20% to 2053. The Dow rose 0.2% to 17719, and the Nasdaq Composite Index rose 0.56% to 4701.

On the data front, ECB President Draghi’s speech will start from at 19:00 AEDST. At midnight, Canada CPI will be released at 0:30 AEDST.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after German inflation data

EUR/USD trades modestly higher on the day above 1.0700. The data from Germany showed that the annual HICP inflation edged higher to 2.4% in April. This reading came in above the market expectation of 2.3% and helped the Euro hold its ground.

USD/JPY recovers above 156.00 following suspected intervention

USD/JPY recovers ground and trades above 156.00 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.