Even though the China Q3 beat market expectations, the 7.3% annual expansion is still a six-year low and lower than the official target of 7.5%. The fixed-asset investment rate increased by 16.1% for the first month from the previous year – the lowest since 2001. On the flip side, it provides some with comfort knowing that the external demand has quickened and the services sector has expanded in Q3. Beijing repeatedly stresses economic reform over short term stimulus as the priority for the government. Hence, China’s demand for commodities may stay weak in the near future.

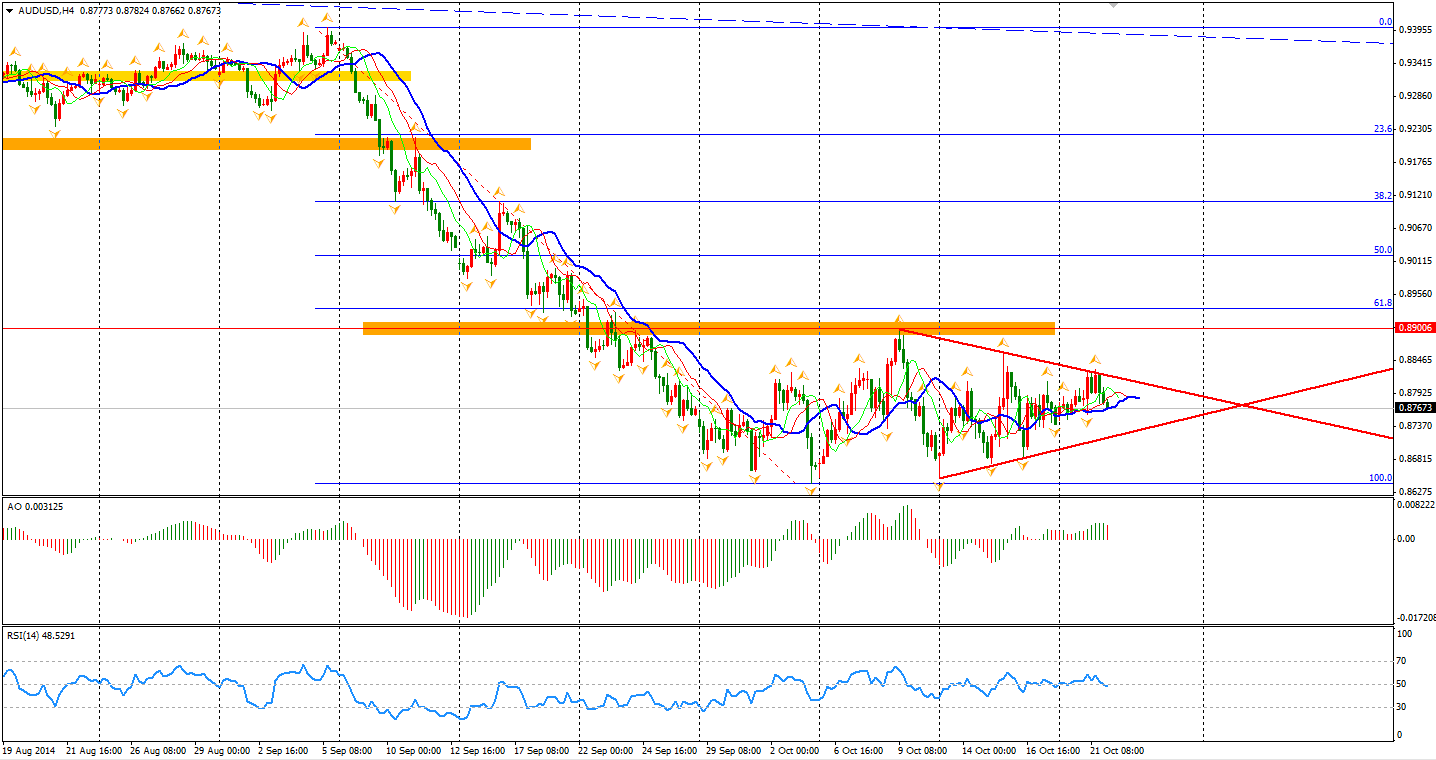

This is certainly not good news for Australia of which China is its largest trade partner. The Aussie Dollar is still in consolidation between 0.8650 and 0.89. In the 4-hour chart, a demand pattern is quite clear now, which we may see a breakout soon.

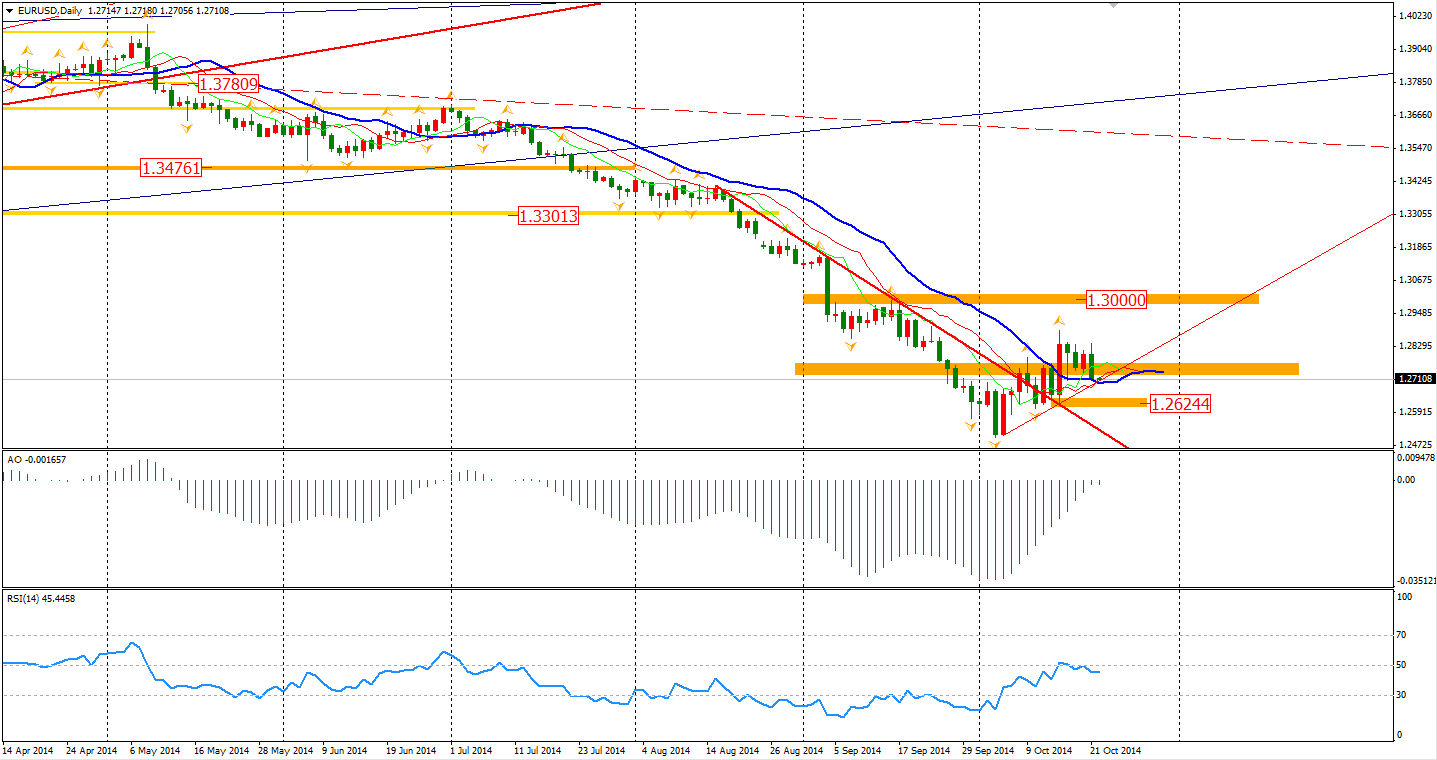

The Euro also fell against the Dollar yesterday, breaking the 1.2740 support and fell to 1.27 again. The breakout is not a good sign for the bulls and may imply that this round of rebound is over. The next support will be last Wednesday’s low of 1.2624, of which, if broken may confirm that the bearishness has come back.

The Asian stock markets fell across the board on Tuesday on the China GDP data. The Shanghai Composite lost 0.72% to 2339. ASX 200 gained 0.11% to 5325. The Nikkei Stock Average fell 2.03% as an adjustment of Monday’s surge. In European stock markets, the UK FTSE was up 1.68%, the German DAX gained 1.94% and the French CAC Index surged 2.25%. The US market bounced strongly, led by technology stocks. The Dow once gained 1.31% to 16614, while the Nasdaq Composite Index edge up 2.4% to 4419. The S&P 500 surged 1.46% to 1941.

For the data front, Australian CPI will be released at 11:30 AEST, followed by Chinese GDP and its disaggregated data. UK MPC minutes will be published at 19:30 AEST and US CPI and Canada Retail Sales are at midnight.

Recommended Content

Editors’ Picks

EUR/USD holds positive ground above 1.0700, eyes on German CPI data

EUR/USD trades on a stronger note around 1.0710 during the early Monday. The weaker US Dollar below the 106.00 mark provides some support to the major pair. All eyes will be on the Federal Reserve monetary policy meeting on Wednesday, with no change in rate expected.

USD/JPY recovers 156.00 after testing 155.50 on likely Japanese intervention

USD/JPY has recovered some ground above 156.00 after crashing to 155.00 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold tests critical daily support line, will it defend?

Gold price is seeing a negative start to a new week on Monday, having booked a weekly loss. Gold price bears the brunt of resurgent US Dollar (USD) demand and a risk-on market mood amid Japanese holiday-thinned market conditions.

XRP plunges to $0.50, wipes out recent gains as Ripple community debates ETHgate impact

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.