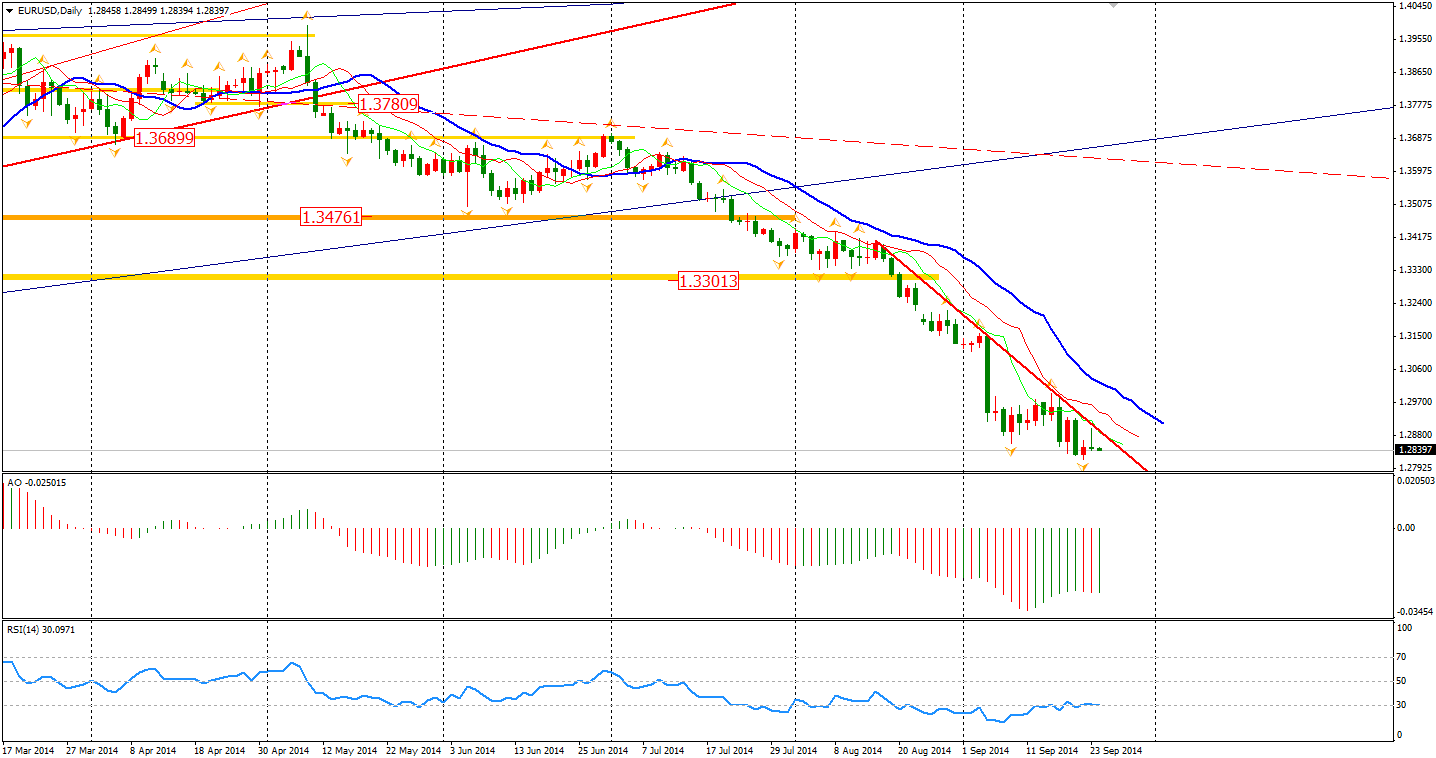

The Eurozone PMIs were generally in line with expectations, boosting the Euro to 1.29 against Dollar. The rebound however did not last that long with the composite PMI announcing a fall to 52.9 – the lowest level this year. The growths of outputs and demands were weak with enterprises continually cutting prices to attract consumers. The result has magnified the concerns of deflation risk in the Eurozone. The bearish trend remains unless the Euro upward breaks yesterday’s high.

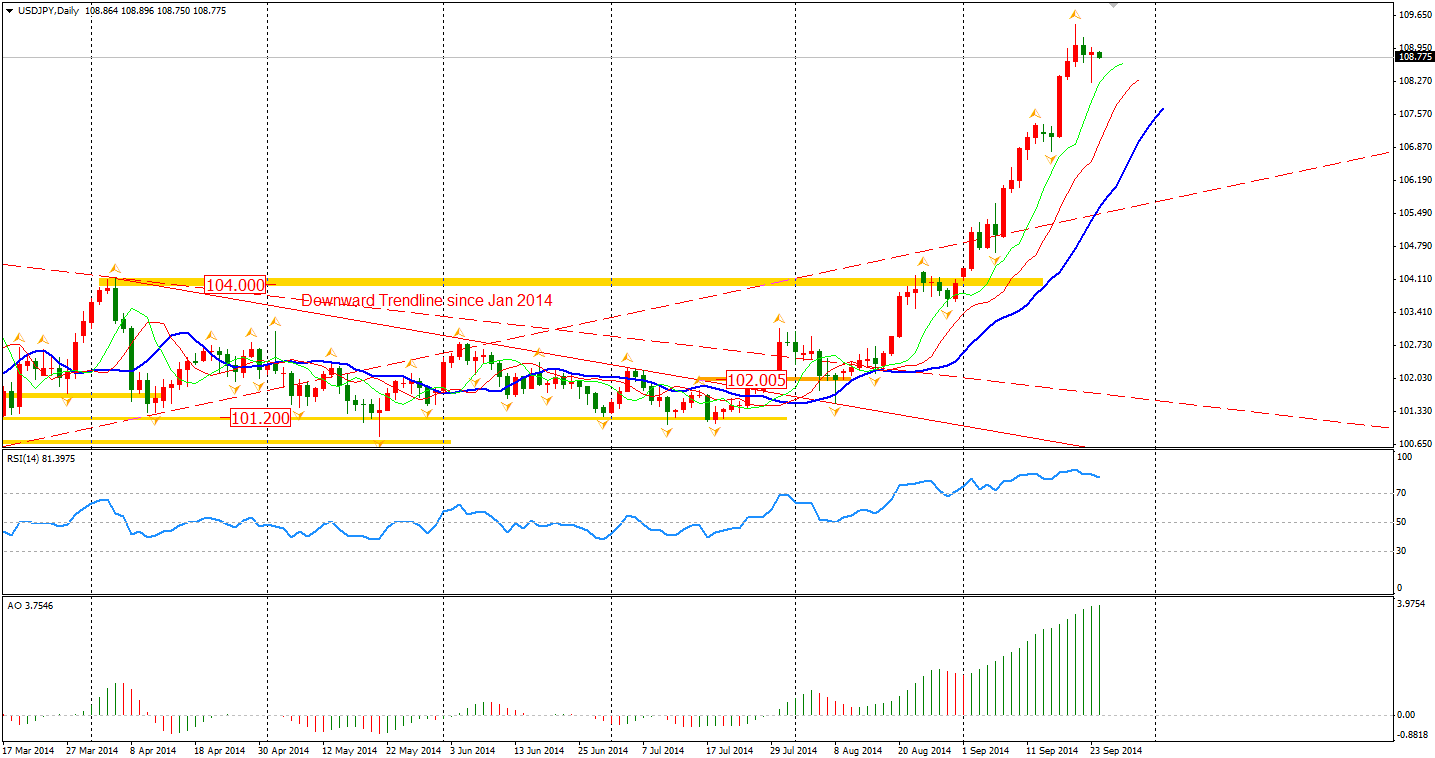

The Yen also took this chance to bounce. Dollar Yen once dipped to a four-day low, below 108.30. This can be viewed as partially being a knee-jerk reaction to US airstrikes on Syria boosting the need for safe-havens. The implied skewness from the option market shows that traders are now expecting a deeper retreat of this pair. The possibility is increasing as there has been no significant retreat yet since the Dollar Yen broke the 104 integer level.

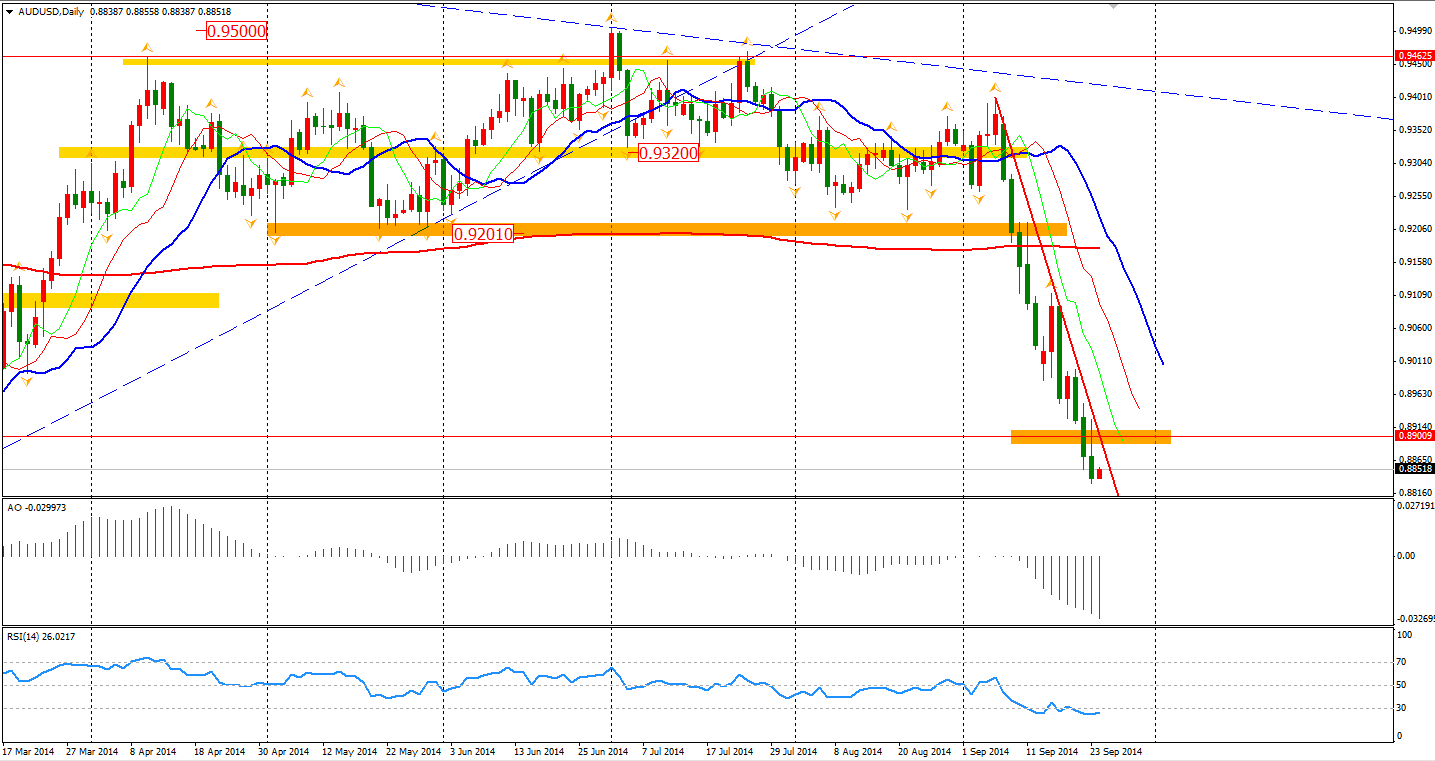

The Aussie Dollar climbed to an area around 0.8922 after the upbeat China HSBC Flash Manufacturing PMI was released. However, the pair barely remained at this level with a typical hourly double top pattern and again refreshed the recent low to 0.8840. Economists expect the reasonable level for the Aussie Dollar to be 0.85, considering the lower commodity prices. However, there still is a risk that funds may support the pair beyond this level as the interest rate spread between Australia and Eurozone is further widened.

Asian stocks rose from a four-month low as the preliminary gauge of Chinese manufacturing unexpectedly rose. The Shanghai Composite rebounded 0.87% to 2310. The Nikkei Stock Average fell 0.71%. The Australian ASX 200 bounced 0.98% to 5416. European stock markets fell on a weak report on Europe’s economy, the UK FTSE was down 1.44%, the German DAX lost 1.58% and the French CAC Index slumped 1.87%. U.S. stocks retreated as well. The S&P 500 fell 0.58% to 1983. The Dow edged down 0.68% to 17056, while the Nasdaq Composite Index dipped 0.42 % to 4509.

On the data front, German Ifo Business Climate will be released at 18:00 AEST. U.S. New Home Sales will be at midnight.

Recommended Content

Editors’ Picks

Australian Dollar maintains ground amid subdued US Dollar, US Nonfarm Payrolls awaited

The Australian Dollar rises on hawkish sentiment surrounding the RBA prolonging higher interest rates. Australia’s central bank is expected to maintain its current rate at 4.35% until the end of September. US Nonfarm Payrolls is expected to print a reading of 243K for April, compared to 303K prior.

EUR/USD: Optimism prevailed, hurting US Dollar demand

The EUR/USD pair advanced for a third consecutive week, accumulating a measly 160 pips in that period. The pair trades around 1.0760 ahead of the close after tumultuous headlines failed to trigger a clear directional path.

Gold bears take action on mixed signals from US economy

Gold price fell more than 2% for the second consecutive week, erased a small portion of its losses but finally came under renewed bearish pressure. The near-term technical outlook points to a loss of bullish momentum as the market focus shifts to Fedspeak.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.