The news of Ukraine tension has once again ignited investors’ pursuit of safe-haven assets. On Friday, Ukraine stated that their forces were attacked by shelling from Russian territory. Ukrainian artillery has also tracked a Russian armoured column destroying a significant part of it.

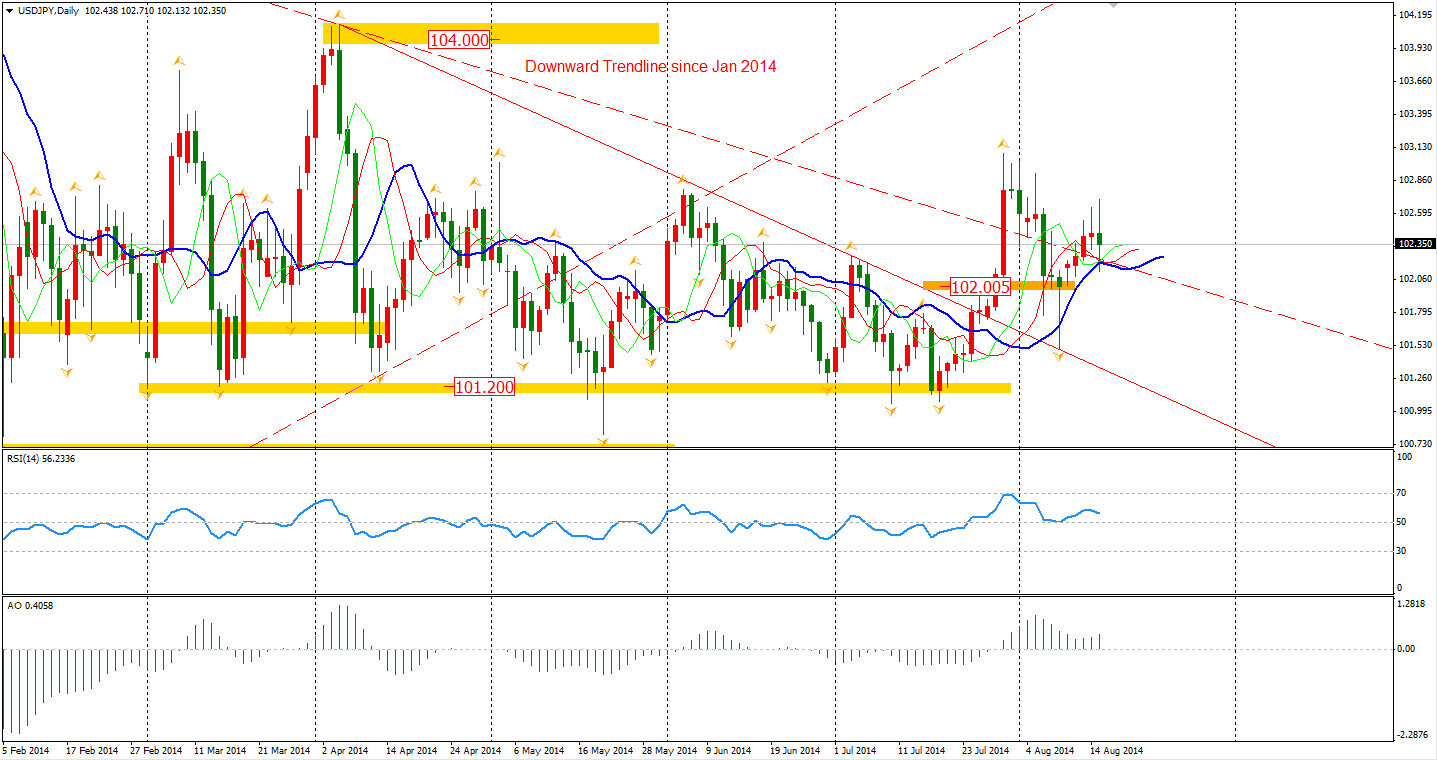

Against this news, the US Dollar slid 0.4% to as low as 102.13 from 102.63 as the yen strengthened. Now, we are seeing more worrisome signals if this tension does indeed escalate. We should in the least review the outlook of a weaker Yen. The potential of rising USDJPY is limited – unless the situation in the Ukraine subsides.

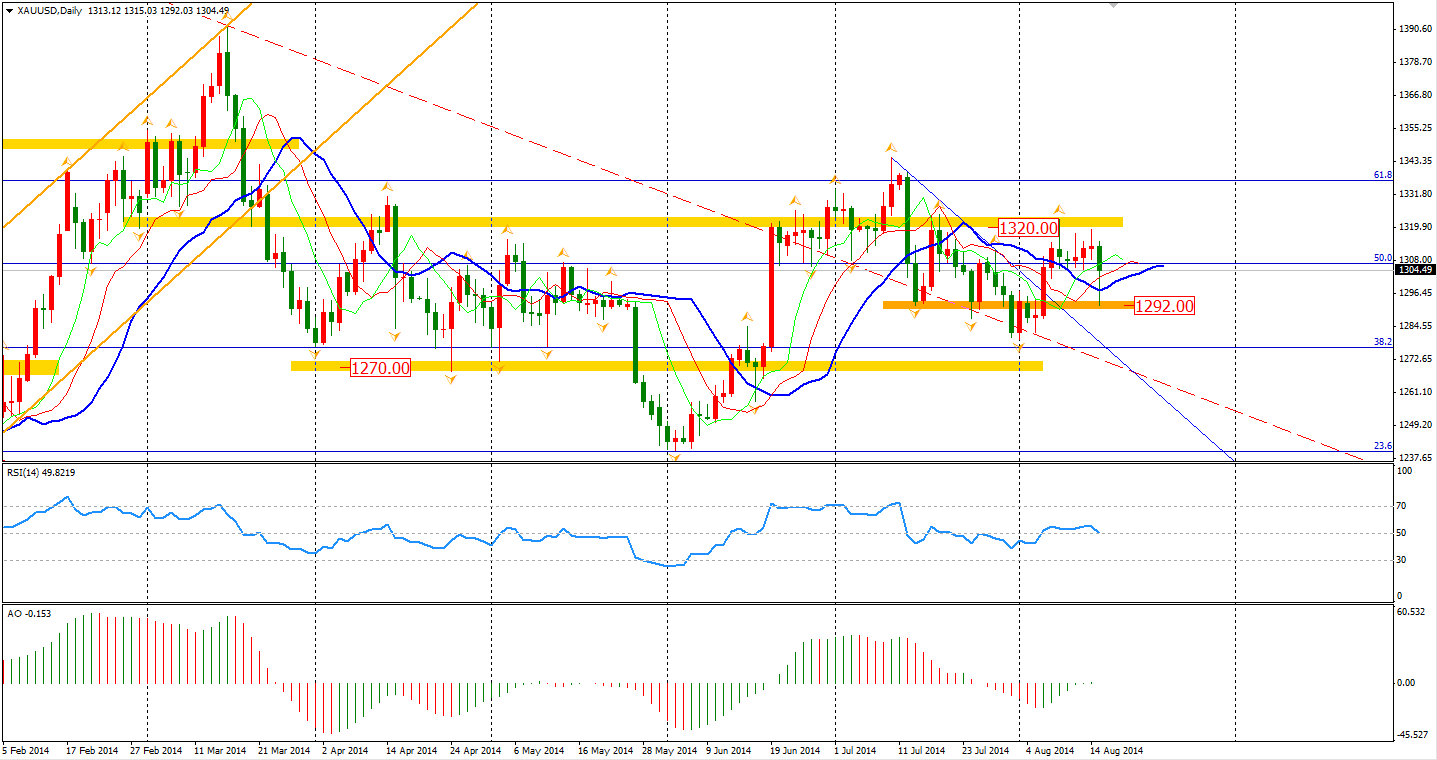

What a rollercoaster day it has been for Gold. Its prices plummeted over $20 from a day high of $1315 per ounce to $1292 within only two hours. However, the prices strongly bounced back from that low to $1310 following reports of renewed hostilities in the Eastern Ukraine. It is hard to tell which way Gold is heading as warfare is almost impossible to forecast. However, the fact that the $1320 resistance has not been broken is a permissible sign. The speculation of a healthier U.S. economy and an early rate rising from Fed limits the Gold appreciation. Also, traders should watch the support level of $1292 breaking, of which could be a sign for selling.

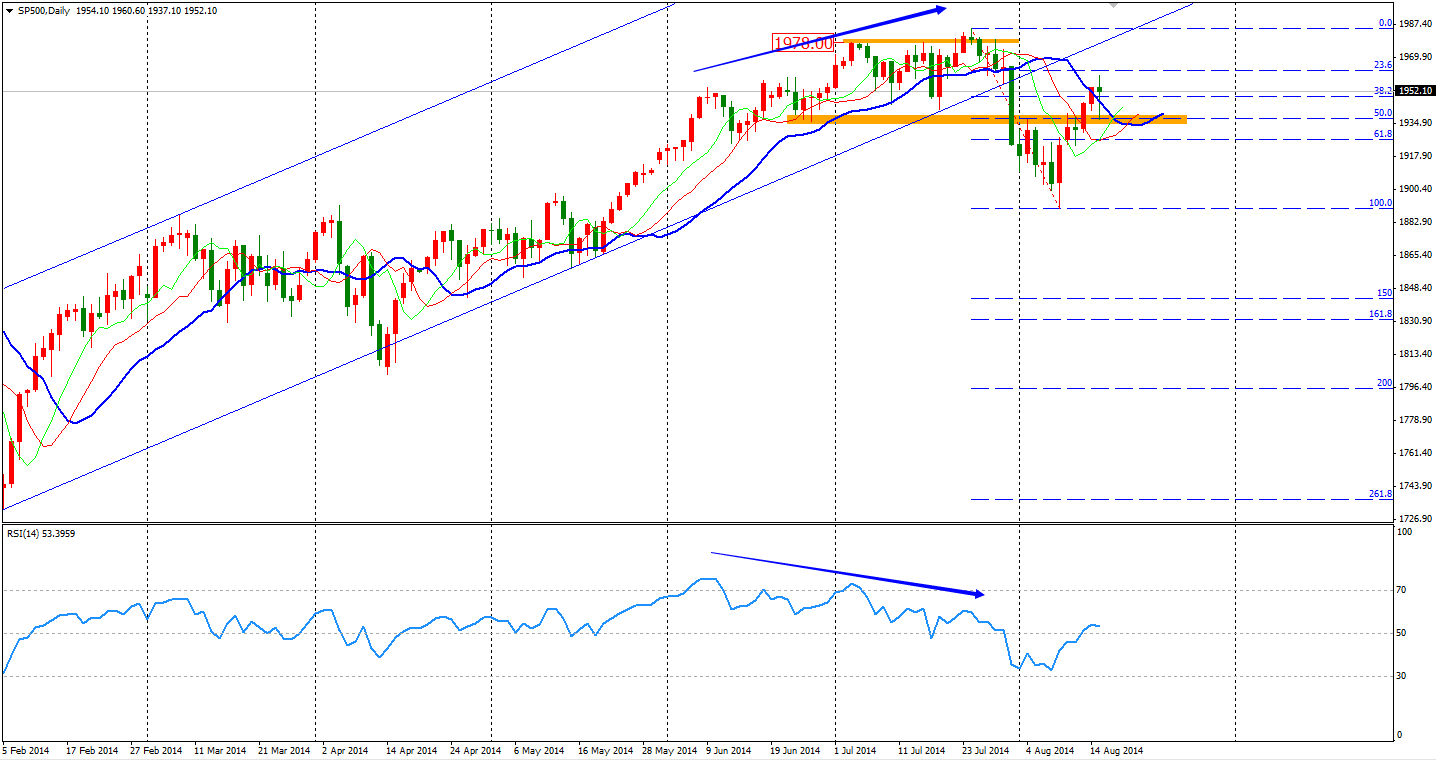

The Asian stock markets edged higher on Friday, led by Chinese market. The Shanghai Composite surged 0.92% to 2226. The Nikkei Stock Average closed flat. The Australian ASX 200 retreated 0.33% to 5566. The European stock markets were mixed. The FTSE gained 0.06%, the German DAX gained 0.73%, and the French CAC Index fell 0.74%. U.S. stocks opened in a positive territory but lost most gains on the fresh conflict. The Dows closed fell 0.3% to 16662. The S&P 500 closed as unchanged at 1955, and the Nasdaq Composite Index was up 0.27% to 4465.

A side of news worth noting was that Solos is betting on a market collapse and the bet has been doubled to 2.2 billion. Shall we be alarmed for the fall of S&P500?

On the data front today, we only have the Australia New Motor Vehicle Sales which will be out at 11:30am AEST, but we will see the Monetary Policy Meeting Minutes for RBA, BOE and Fed later this week, along with PMI data of China, Japan and Eurozone.

Recommended Content

Editors’ Picks

AUD/USD stays defensive below 0.6500 ahead of Fed

AUD/USD is on the back foot below 0.6500, consolidating the previous decline early Wednesday. China's holiday-led thin conditions and pre-Fed policy decision caution trading leave Aussie traders on the edge.

USD/JPY holds higher ground near 158.00, Fed in focus

USD/JPY holds the rebound near 158.00 in Asian trading on Wednesday. The US Dollar remains on the bid amid a risk-off market environment, underpinning the major. The interest rate differential between Japan and the US is likely to maintain a bullish pressure on the pair ahead of the Fed decision.

Gold pullbacks on rising US yields, buoyant US Dollar as inflation heats up

Gold prices drop below the $2,300 threshold on Tuesday as data from the United States show that employment costs are rising, thus putting upward pressure on inflation. XAU/USD trades at $2,296 amid rising US Treasury bond yields and a stronger US Dollar.

Bitcoin price dips into $60K range as spot traders flock to Coinbase Lightning Network

Bitcoin price slid lower on Tuesday during the opening hours of the New York session, dipping its toes into a crucial chart area. It comes as markets continue to digest the performance of Hong exchange-traded funds after their first day of issuance.

Federal Reserve meeting preview: The stock market expects the worst

US stocks are a sea of red on Tuesday as a mixture of fundamental data and jitters ahead of the Fed meeting knock risk sentiment. The economic backdrop to this meeting is not ideal for stock market bulls.