Are we experiencing a calm before a great raging storm?

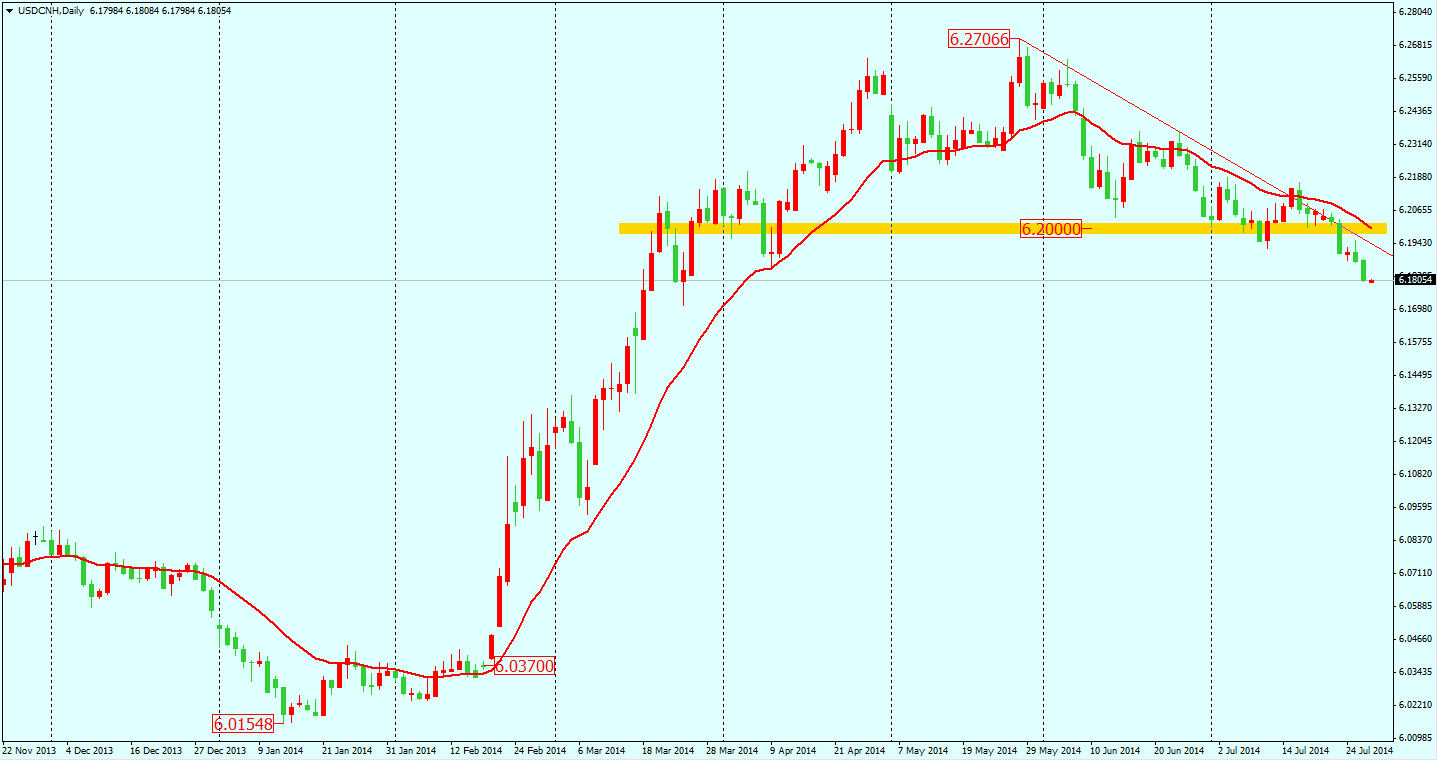

The Chinese Yuan rebounded from its weakness in the first quarter and reached a four-month high yesterday. USDCNH fell to 6.1820 as the RMB was inspired by the Chinese upbeat economic data released in the weekend. The recent data is showing signs of the Chinese economy gradually recovering and the business confidence has improved. In the mid-term, Chinese Yuan should continue its strength against Dollar.

On the other side of the planet, Argentina is confronting its second default in 14 years as its government has limited reserves to repay the debt that will expire at the end of this month.

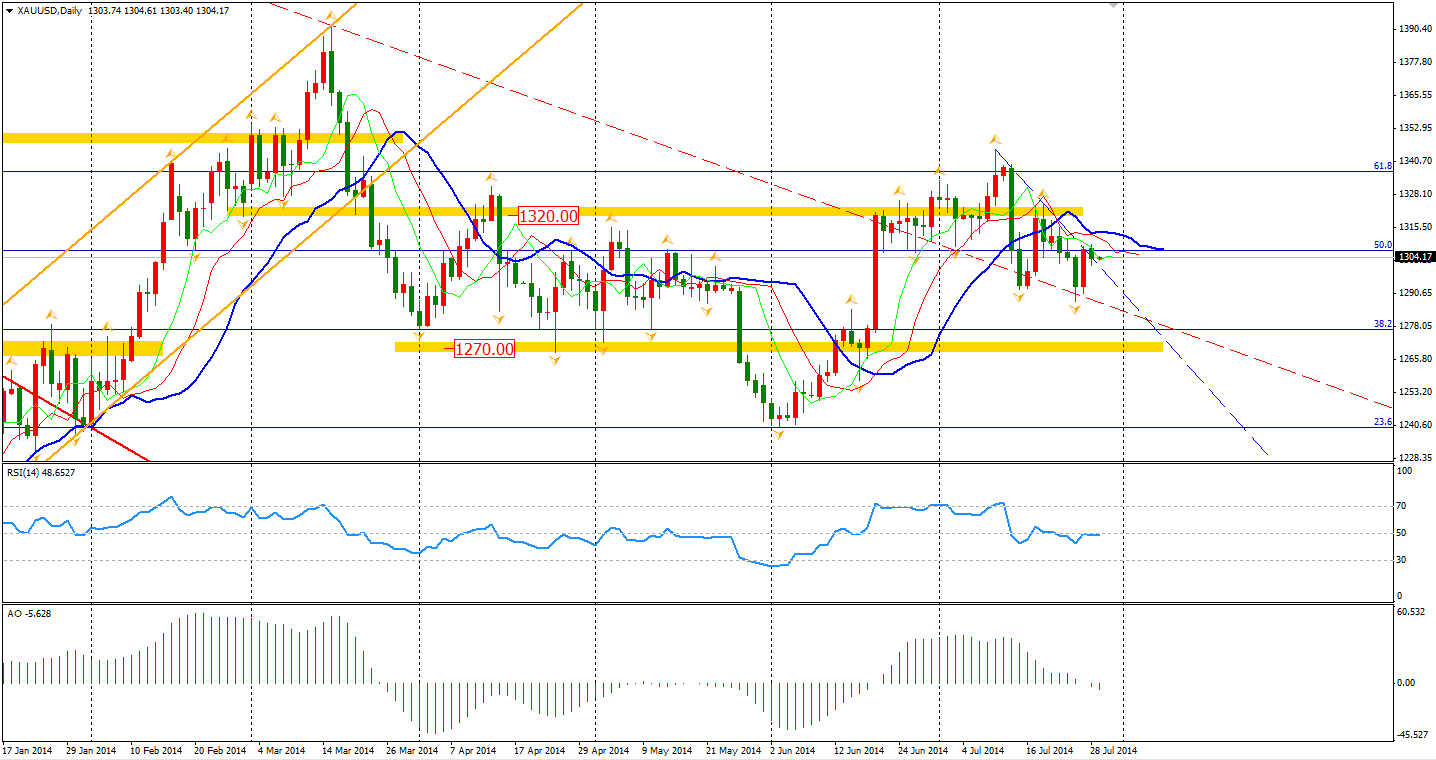

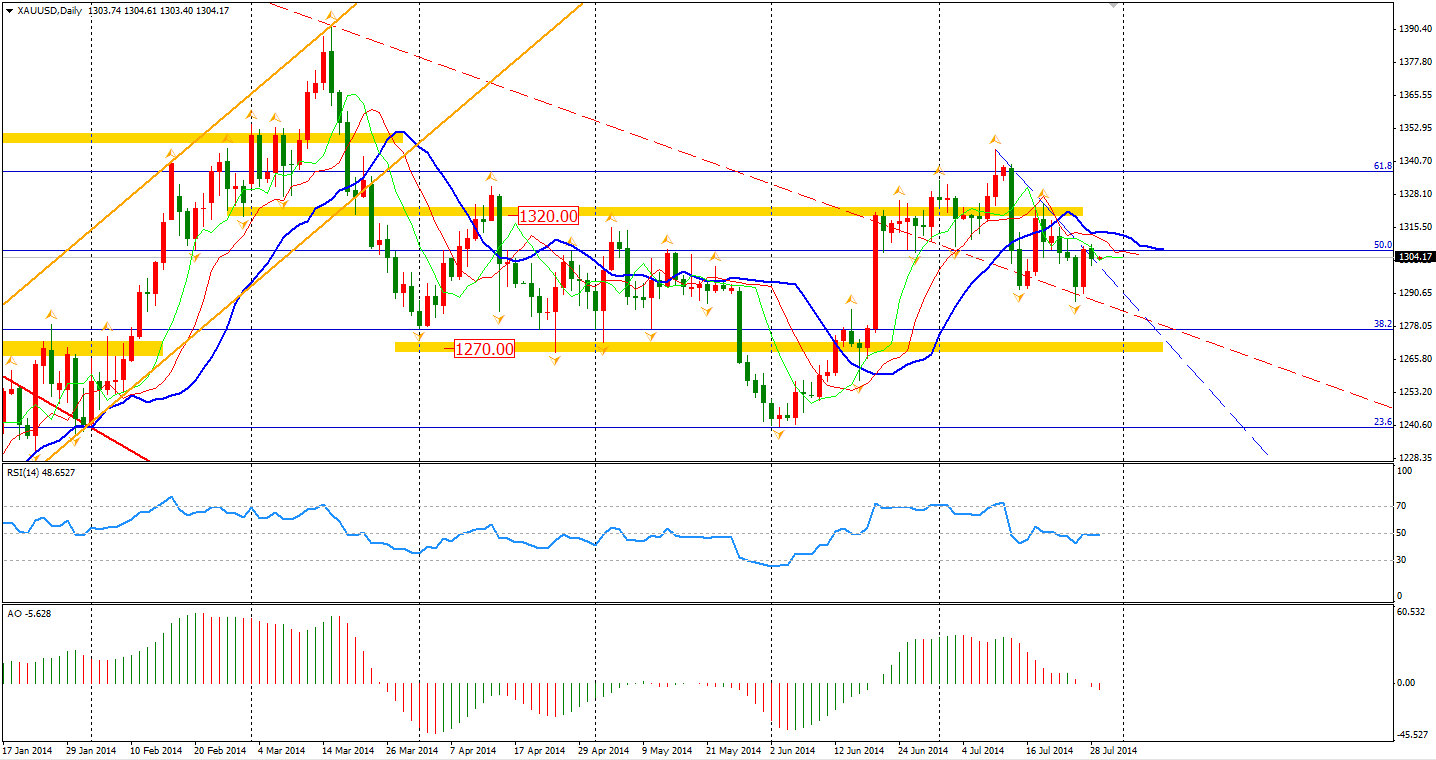

Its last sovereign default in 2001 dragged the country into deep recession causing society and political system turmoils. Now, 13 years later, this potential default may again isolate the Argentina from international financial markets and will raise the financial burden of its neighbours, like Brazil. The whole Latin America will be hit by this setting off a chain reaction in the global financial markets. It may be the first domino in a new round of financial crisis. Usually, US dollar and safe-haven assets like Gold will gain from such risk events.

The Aussie Dollar fell from the top of its sideway range implying a continual weakness. The pattern seems to be bearish for the mid-term as the Aussie should not move beyond the 0.9460 and the downward trend line of October 2013. Local traders may be on the lookout for Building Approval data this Thursday and PPI on Friday.

In the Asian market, Chinese stocks were inspired by bright industrial firms’ profits and potential privatization reforms of state-controlled banks. Shanghai Composite surged 2.41% to 2178, a seven month high. The Nikkei Stock Average gained 0.46%. The Australian ASX 200 closed flat at 5577. In the European stock markets, the FTSE closed 0.05% lower, the DAX fell 0.48%, and the French CAC advanced 0.33%. The U.S. closed with little changes as investors are waiting for FOMC meeting and data release in this week. The Dows rose 0.13% to 16983. The S&P 500 closed flat at 1979, while the Nasdaq Composite Index lost 0.1% to 4445.

Today may still be a quiet trading day. Only the U.S. CB Consumer Confidence released at midnight may catch traders’ eyes.

MXT Global Pty Ltd ACN 157 768 566 AFSL 428901. Trading derivatives and forex carries a high level of risk to your capital and should only be traded with money you can afford to lose. Ensure you read our FSG, PDS and Terms & Conditions, and seek independent advice, to fully understand the risks, before deciding to enter into any transactions with MXT Global. The general information on this website is not directed at residents in any country or jurisdiction where such distribution or use would contravene local law or regulation.

Company disclaimer for reports:

#The views and content above are Anthony Wu's own and do not reflect the views of MXT Global.

The research contained in this report should not be construed as a solicitation to trade. All opinions, news, research, analyses, prices or other information is provided as general market commentary and not as investment advice.

MXT Global does not warrant the completeness, accuracy or timeliness of the information supplied, and shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on the service and its content.

No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.#

Recommended Content

Editors’ Picks

EUR/USD clings to marginal gains above 1.0750

EUR/USD trades in positive territory above 1.0750 in the second half of the day on Monday. The US Dollar struggles to find demand as investors reassess the Fed's rate outlook following Friday's disappointing labor market data.

GBP/USD edges higher toward 1.2600 on improving risk mood

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the modest improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold climbs above $2,320 as US yields push lower

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Three fundamentals for the week: Two central bank decisions and one sensitive US Premium

The Reserve Bank of Australia is set to strike a more hawkish tone, reversing its dovish shift. Policymakers at the Bank of England may open the door to a rate cut in June.