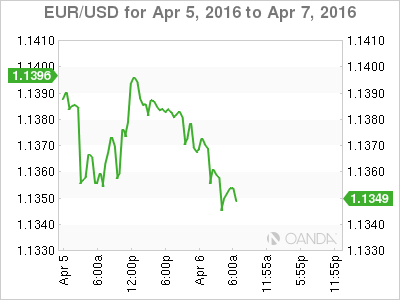

The euro has posted slight losses on Wednesday, continuing the lack of substantial movement that has characterized the pair so far this week. In the European session, EUR/USD is trading at 1.1350. On the release front, Germany Industrial Production dropped 0.5%, which was above expectations. Eurozone Retail PMI fell to 49.5 points. In the US, the Federal Reserve will deliver the minutes from its last policy meeting, and we’ll also hear from two Fed members, Loretta Mester and James Bullard. On Thursday, the US releases Unemployment Claims, and Janet Yellen and Mario Draghi will delivers speeches.

German manufacturing indicators continue to point to contraction in the manufacturing sector. German Industrial Production posted a decline of 0.5% in February, marking its third decline in four months. On Tuesday, German Factory Orders posted a sharp decline or 1.2%, a third consecutive decline. The German manufacturing sector has been hurt by the Chinese slowdown, as the Asian giant is one of Germany’s major exports markets. With no signs that weak global demand will improve anytime soon, Germany’s manufacturing sector will likely continue to sputter and also weigh on the Eurozone manufacturing sector. Meanwhile, there was no relief from Eurozone Retail PMI, which dipped to 49.2 points, pointing to contraction in consumer spending. This was the fourth contraction in five months, as worried European consumers are holding their purse strings tight.

Will the real Fed please stand up? The markets have been treated to mixed messages from the US central bank, and this lack of communication is certainly not looked well upon the markets. Last week, Janet Yellen sent the US dollar flying on its backside, following a surprisingly dovish speech in New York. EUR/USD surged some 230 points, as Yellen poured cold water on speculation of an April rate hike. Prior to her speech, several Fed members issued hawkish comments, some going as far as calling for a rate hike at the April policy meeting. Analysts will be paying close attention to the Fed minutes on Wednesday, looking for clues as to further rate projections. The markets are hoping the minutes will provide some clarity about the Fed’s monetary plans. The release of the minutes should be treated as a market-mover, and we could see some volatility in the markets following this release. In addition to the minutes, two FOMC members will deliver remarks on Wednesday.

EUR/USD Fundamentals

Wednesday (April 6)

-

6:00 German Industrial Production. Estimate -1.8%. Actual -0.5%

-

8:10 Eurozone Retail PMI. Actual 49.2

-

14:30 US Crude Oil Inventories. Estimate 3.1M

-

16:20 US FOMC Member Loretta Mester Speaks

-

18:00 US FOMC Meeting Minutes

-

20:30 US FOMC Member James Bullard Speaks

Open: 1.1380 Low: 1.1340 High: 1.1386 Close: 1.1347

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.1087 | 1.1172 | 1.1278 | 1.1378 | 1.1495 | 1.1609 |

-

EUR/USD has posted small gains in the Asian an European sessions

-

1.1378 was tested earlier in resistance and remains under strong pressure. This line could break during the day

-

1.1278 is providing strong support

Further levels in both directions:

-

Below: 1.1278, 1.1172 and 1.1087

-

Above: 1.1378, 1.1495, 1.1609 and 1.1712

-

Current range: 1.1278 to 1.1378

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD stays defensive below 0.6500 ahead of Fed

AUD/USD is on the back foot below 0.6500, consolidating the previous decline early Wednesday. China's holiday-led thin conditions and pre-Fed policy decision caution trading leave Aussie traders on the edge.

USD/JPY holds higher ground near 158.00, Fed in focus

USD/JPY holds the rebound near 158.00 in Asian trading on Wednesday. The US Dollar remains on the bid amid a risk-off market environment, underpinning the major. The interest rate differential between Japan and the US is likely to maintain a bullish pressure on the pair ahead of the Fed decision.

Gold snaps two-day losing streak above $2,280 ahead of Fed rate decision

Gold price posts modest gains around $2,288 on Wednesday during the Asian session. The precious metal edges higher as markets turn to a cautious mood ahead of the Federal Reserve's monetary policy meeting on Wednesday.

Bitcoin price dips into $60K range as spot traders flock to Coinbase Lightning Network

Bitcoin price slid lower on Tuesday during the opening hours of the New York session, dipping its toes into a crucial chart area. It comes as markets continue to digest the performance of Hong exchange-traded funds after their first day of issuance.

Federal Reserve meeting preview: The stock market expects the worst

US stocks are a sea of red on Tuesday as a mixture of fundamental data and jitters ahead of the Fed meeting knock risk sentiment. The economic backdrop to this meeting is not ideal for stock market bulls.