EUR/USD is showing marginal movement on Tuesday, as the pair trades slightly below the 1.11 line in the European session. On the release front, French CPI posted a gain of 0.3%, within expectations. Eurozone Employment Change will be released later in the day. In the US, we’ll get a look at Retail Sales and PPI. The markets are braced for slight declines from these key indicators. On Wednesday, the FOMC will set interest rates and release a monetary policy statement.

After a quiet start to the week, the markets will get a look at key US inflation and retail sales reports later on Tuesday. The Producers Price Index, which measures inflation in the manufacturing sector, is expected to decline by 0.2%. The forecasts for Retail Sales and Core Retail Sales are also soft, with small declines expected. If these key indicators fall below zero, it would point to contraction in inflation and consumer spending, and the dollar could lose ground as a result.

The Federal Reserve will be in the spotlight on Wednesday, as the Fed concludes a two-day policy meeting. Most experts are expecting the Fed to remain on the sidelines and not raise rates, given current economic conditions. Although the US economy continues to expand, growth has been softer in 2016 compared to the red-hot pace which marked the economy in H2 of 2015. The primary trouble spot in the economy is the inflation picture, as inflation levels remains very low, a result of weak global demand and low oil prices. Fed policymakers are divided on how to respond to persistently low inflation. Some FOMC members favor preempting inflation with a rate hike, while others feel that the economy is currently too fragile for such a move. The Fed will likely maintain its tightening bias and continue to monitor key economic indicators. If the US economy shows strength in H1 of 2016, a rate hike will be a strong possibility in the middle of the year.

EUR/USD Fundamentals

Tuesday (March 15)

3:45 French Final CPI. Estimate 0.2%. Actual 0.3%

6:00 Eurozone Employment Change. Estimate 0.2%

8:30 US Core Retail Sales. Estimate -0.2%

8:30 US PPI. Estimate -0.2%

8:30 US Retail Sales. Estimate -0.1%

8:30 US Core PPI. Estimate 0.1%

8:30 US Empire State Manufacturing Index. Estimate -10.3 points

Wednesday (March 16)

8:30 US Building Permits. Estimate 1.20M

8:30 US Core CPI. Estimate 0.2%

14:00 FOMC Economic Projections

14:00 FOMC Statement

14:00 FOMC Federal Funds Rate

14:30 FOMC Press Conference

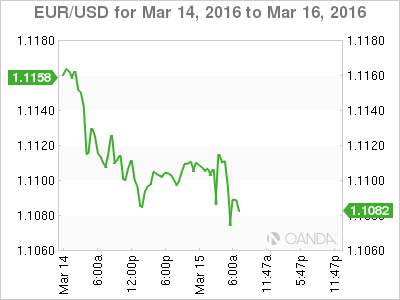

Open: 1.1100 Low: 1.1071 High: 1.1080 Close: 1.1089

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.0847 | 1.0941 | 1.1087 | 1.1172 | 1.1278 | 1.1387 |

EUR/USD was flat in the Asian session and has posted small losses in European trade

1.1089 remains busy and is a weak support line. It was tested earlier and could break during the day

1.1172 is a resistance line

Further levels in both directions:

Below: 1.1087, 1.0941, 1.0847 and 1.0708

Above: 1.1172, 1.1278 and 1.1387

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD hovers near 1.0700 ahead of US data

EUR/USD struggles to build on Wednesday's gains and fluctuates in a tight channel near 1.0700 on Thursday. The US Dollar holds its ground following the Fed-inspired decline as market focus shifts to mid-tier US data releases.

GBP/USD holds steady above 1.2500 following Wednesday's rebound

GBP/USD stays in a consolidation phase slightly above 1.2500 on Thursday after closing in the green on Wednesday. A mixed market mood caps the GBP/USD upside ahead of Unit Labor Costs and Jobless Claims data from the US.

Gold retreats to $2,300 despite falling US yields

Gold stays under bearish pressure and trades deep in negative territory at around $2,300 on Thursday. The benchmark 10-year US Treasury bond edges lower following the Fed's policy decisions but XAU/USD struggles to find a foothold.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.