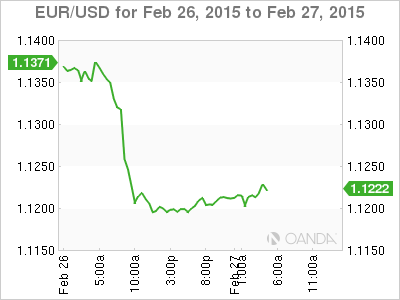

EUR/USD has stabilized on Friday, as the pair trades in the low-1.12 range in the European session. The euro took a dive on Thursday in response to better-than-expected US durables data. Durable Goods Orders jumped 2.8%, while Core Durable Goods improved to 0.3%. Friday is busy on the release front. In the Eurozone, today’s highlight is German Preliminary CPI, with the markets expecting a respectable gain of 0.6%. The US will release its second estimate of GDP for Q4, with a forecast of 2.1%. This is lower than the initial estimate of 2.6% in January.

It had been an uneventful week for EUR/USD, but that all changed on Thursday, as the euro shed 160 points following strong US durables data. Durable Goods Orders led the way with an excellent gain of 2.8%, easily beating the forecast of 1.7%. Core Durable Goods broke a string of four straight declines, posting a gain of 0.3%. However, this fell short of the estimate of 0.6%.

Greece and its international creditors have agreed to extend the bailout agreement after Greece’s list of economic reforms was accepted by the country’s creditors on Tuesday. Under this agreement, the Greek government has promised to continue with privatization plans and to meet budget targets. Still, the extension is a stop-gap measure and with sharp differences remaining between Greece and its creditors, the bailout crisis is far from over. If Greece and Germany again lock horns and raise doubts about whether Greece will remain in the Eurozone, we could see the euro lose ground.

Janet Yellen testified before Congressional committees on Tuesday and Wednesday, saying that the Fed was “unlikely” to raise interest rates in the next few months, given current economic conditions. Her remarks seemed aimed at quelling rising speculation about a rate hike sometime in mid-2015, which has helped boost the US dollar’s performance against its major rivals. Yellen noted that the continuing economic growth should lead to unemployment continuing to fall, but wages and inflation need to move higher before the Fed raises interest rates.

EUR/USD 1.1221 H: 1.1231 L: 1.1196

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after German inflation data

EUR/USD trades modestly higher on the day above 1.0700. The data from Germany showed that the annual HICP inflation edged higher to 2.4% in April. This reading came in above the market expectation of 2.3% and helped the Euro hold its ground.

USD/JPY recovers above 156.00 following suspected intervention

USD/JPY recovers ground and trades above 156.00 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.