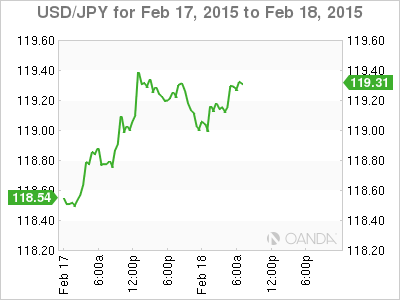

The Japanese yen is almost unchanged on Wednesday, as USD/JPY trades in the mid-119 range. On the release front, the BOJ released its policy statement, with the BOJ saying that it would maintain its accommodative monetary stance. Later in the day, Japan releases Trade Balance. In the US, it’s a busy day, with the release of Building Permits and PPI. The highlight of the day is the Federal Reserve minutes.

There were no surprises from the BOJ policy statement, as the central bank said that it would continue to increase base money by 80 trillion yen/year. With inflation sagging and well short of the BOJ’s 2% target, the central bank has little choice but to continue its accommodative monetary stance. The divergence with the Federal Reserve, which is expected to raise rates, will likely continue to weigh on the Japanese yen, which is again flirting with the symbolic 120 level.

Japanese manufacturing data started the week on a positive note, as Revised Industrial Production gained 0.8%, bouncing back from a decline in the previous release. This was within expectations, as the estimate was 1.0%. Last week, Japanese Core Machinery Tools jumped 8.3% in December, its strongest gain since March. This easily beat the estimate of 2.4%.

The markets are keeping a close eye on the Fed minutes, which will be released later on Wednesday. With the US economy showing strong growth and positive employment numbers, there are widespread expectations for a rate hike as early as the summer. Any hints regarding a hike could provide a strong boost for the US dollar against its major rivals.

USD/JPY 119.36 H: 119.41 L: 118.88

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700 as USD struggles ahead of data

EUR/USD is posting small gains above 1.0700 in the European session on Thursday. The pair remains underpinned by a sustained US Dollar weakness, in the aftermath of the Fed policy announcements and ahead of more US employment data.

GBP/USD stays firm above 1.2500 amid US Dollar weakness

GBP/USD is consolidating the rebound above 1.2500 in European trading on Thursday. The pair's uptick is supported by a broadly weakness US Dollar on dovish Fed signals. A mixed market mood could cap the GBP/USD upside ahead of mid-tier US data.

Gold price trades with modest losses amid positive risk tone, downside seems limited

Gold price edges lower amid an uptick in the US bond yields, though the downside seems cushioned. A positive risk tone is seen as another factor undermining demand for the safe-haven precious metal.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.