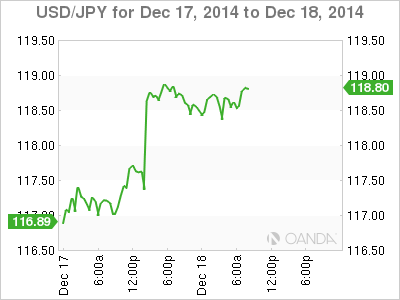

USD/JPY is steady on Thursday, following huge gains by the pair a day earlier. At the start of the North American session, USD/JPY is trading at the 119 line. On the release front, US Unemployment Claims dropped to 287 thousand, beating expectations. Later in the day, the US releases the Philly Fed Manufacturing Index. There are no Japanese releases on Thursday, but the BOJ will release a policy statement early on Friday. An unexpected announcement could cause some movement from USD/JPY.

The Japanese yen took a tumble on Wednesday after the Federal Reserve policy statement. Previous Fed policy statements have usually stated that the Fed would maintain low rates for a “considerable time”, but the December statement changed emphasis, saying the Fed would be “patient” before raising rates. In a follow-press conference, Federal Reserve chair Janet Yellen was less ambiguous, saying that the Fed was unlikely to raise rates for the “next couple of meetings”. The markets took this to mean that a rate hike is in the works, but not before April. The yen was down sharply on the news as USD/JPY gained about 130 points on Wednesday.

Prime Minister Shinzo Abe received a new mandate on the weekend, as the ruling Liberal Democratic Party swept to victory in parliamentary elections, winning a comfortable majority in the lower house of parliament. However, Abe has been hard-pressed to prop up the weak economy and he was recently forced to scrap a controversial sales tax hike. Growth and inflation remain well below the government’s target and the BoJ’s radical monetary easing scheme has ravaged the yen, which remains close to the 120 level. With the BOJ expected to maintain or even ease its monetary stance, we’re unlikely to see much improvement from the Japanese currency in the near future.

USD/JPY 118.99 H: 119.00 L: 118.26

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD holds positive ground above 1.0700, eyes on German CPI data

EUR/USD trades on a stronger note around 1.0710 during the early Monday. The weaker US Dollar below the 106.00 mark provides some support to the major pair. All eyes will be on the Federal Reserve monetary policy meeting on Wednesday, with no change in rate expected.

USD/JPY extends recovery after testing 155.00 on likely Japanese intervention

USD/JPY is recovering ground after crashing to 155.00 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold tests critical daily support line, will it defend?

Gold price is seeing a negative start to a new week on Monday, having booked a weekly loss. Gold price bears the brunt of resurgent US Dollar (USD) demand and a risk-on market mood amid Japanese holiday-thinned market conditions.

XRP plunges to $0.50, wipes out recent gains as Ripple community debates ETHgate impact

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.