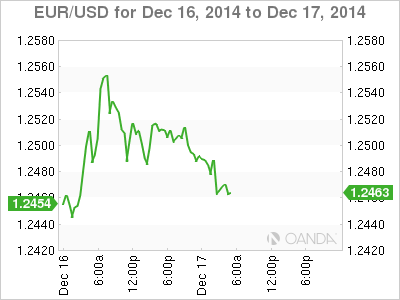

EUR/USD is steady on Wednesday, as the pair trades in the mid-1.24 range in the European session. On the release front, Eurozone CPI edged lower to 0.3%, matching the forecast. In the US, the FOMC will release its policy statement, and we’ll get a look at November CPI. The markets are expecting a small decline of 0.1%.

The Federal Reserve will be in the spotlight on Wednesday, as the FOMC issues its monthly policy statement. With the US economy continuing to grow, the markets are confident that the Fed will take action and raise interest rates in the first half of 2015. One key question is whether the Fed will adjust its forward guidance; that is, will the Fed make use of policy statements to provide the markets with more information about its projections regarding interest rate policy. If this does occur, there will be less uncertainty about the Fed’s monetary policy and this could boost the US dollar against its major rivals.

Eurozone inflation remains at low levels, and there were no surprises as Eurozone CPI dipped to 0.4% in November, down from 0.4% a month earlier. Persistent efforts from the ECB have not improved matters, and the danger of deflation has risen with the crash in oil prices. Germany, the locomotive of the Eurozone, has not been immune to weak inflation, with German Final CPI coming in at a flat 0.0% in November.

The week started off on a positive note in the Eurozone, as German Manufacturing PMI improved to 51.2 points, up from 50.0 points a month earlier. A reading above the 50-point level indicates expansion. The Eurozone released improved to 50.8 points, up from 50.4 points. French Manufacturing PMI showed little change, coming in at 47.9 points. The index has been under 50 since April, indicative of ongoing contraction. Services PMIs were mixed, as the German release weakened, while the Eurozone and French readings improved.

EUR/USD 1.2450 H: 1.2515 L: 1.2449

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD stays depressed near 1.0650, awaits US data and Fed verdict

EUR/USD holds lower ground near 1.0650 amid a softer risk tone and broad US Dollar strength on Wednesday. With European markets closed for Labor Day, the pair awaits the US employment data and the Fed policy announcements for the next directional move.

GBP/USD keeps losses below 1.2500 ahead of US data, Fed

GBP/USD holds lower ground below 1.2500 early Wednesday. The stronger US Dollar supports the downtick of the pair amid the cautious mood ahead of the top-tier US employment data and the all-important Fed policy announcements.

Gold sellers keep sight on $2,223 and the Fed decision

Gold price is catching a breather early Wednesday, having hit a four-week low at $2,285 on Tuesday. Traders refrain from placing fresh directional bets on Gold price, anticipating the all-important US Federal Reserve interest rate decision due later in the day.

Ethereum dips below key level as Hong Kong ETFs underperform

Ethereum experienced a further decline on Tuesday following a disappointing first-day trading volume for Hong Kong's spot Bitcoin and ETH ETFs. This comes off the back of increased long liquidations and mixed whale activity surrounding the top altcoin.

Federal Reserve meeting preview: The stock market expects the worst

US stocks are a sea of red on Tuesday as a mixture of fundamental data and jitters ahead of the Fed meeting knock risk sentiment. The economic backdrop to this meeting is not ideal for stock market bulls.