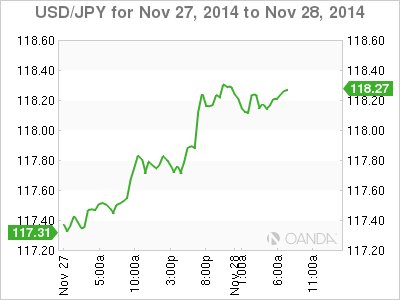

USD/JPY is stable on Friday, as the pair trades in the low-118 range. Japan released a host of data on Thursday, as consumer spending and inflation releases met expectations. On Friday, Japanese Housing Starts declined but beat the estimate. There are no US releases on Friday, following the Thanksgiving holiday on Thursday.

Japan released a batch of events on Thursday, and most were very close to their estimates. Tokyo Core CPI, the most important inflation index, dipped for the fourth straight month, coming in at 2.4%. Still, this was good enough to edge above the estimate of 2.5%. Retail Sales posted a gain of 1.4%, just shy of the forecast of 1.5%. Preliminary Industrial Production fell to just 0.2%, but this beat the estimate of -0.4%. Household Spending came in at -4.0%, its seventh straight decline. This beat the estimate of -4.8%.

The Japanese yen continues to trade at low levels, and BoJ Governor Haruhiko Kuroda addressed this earlier in the week, noting that the soft yen was having a negative effect on the Japanese economy. The yen received a boost after the BoJ minutes showed that some policymakers opposed the BoJ’s decision to expand its stimulus program in October. At that time, the BoJ shocked the markets when it increased its government debt purchases from JPY 60-70 trillion to 80 trillion per year. The yen reacted by dropping sharply and continues to trade at low levels against the dollar.

USD/JPY 118.19 H: 118.34 L: 117.86

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD holds firm above 1.0700 ahead of German inflation data

EUR/USD trades on a firm footing above 1.0700 early Monday. The pair stays underpinned by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 155.00 on likely Japanese intervention

USD/JPY is recovering ground after crashing to 155.00 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold price bulls move to the sidelines as focus shifts to the crucial FOMC policy meeting

Gold price struggles to capitalize on its modest gains registered over the past two trading days and edges lower on the first day of a new week, albeit the downside remains cushioned.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.