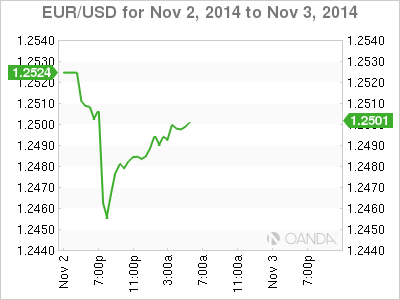

EUR/USD is showing little movement on Monday, as the pair trades at the 1.25 line in the European session. On the release front, Eurozone and Spanish Manufacturing PMI were very close to the forecast. The Italian reading softened and pointed to contraction. In the US, today’s highlight is ISM Manufacturing PMI. The markets are expecting little change in the upcoming release, with an estimate of 56.5 points.

It was a rough week for German releases, as the Eurozone’s largest economy continues to struggle. On Friday, Retail Sales were dismal, plunging by 3.5%. This marked the sharpest decline since October 2007. The markets had expected a decline of 0.8%. Consumer Climate and CPI softened in September, although Unemployment Change was better than expected. The euro is sensitive to German data, and the struggling currency will have difficulty holding its own against the US dollar if German numbers don’t show improvement.

It was another solid performance from US GDP on Thursday, which posted a strong gain of 3.5% in Q3, higher than the estimate of 3.1%. Although this was short of the Q2 reading of 4.0%, the two readings mark the strongest six-month gain we’ve seen in 10 years. Unemployment Claims increased slightly to 287 thousand, slightly higher than the previous reading of 284 thousand. However, the four-week average remains at multi-year lows, pointing to an improving labor market.

The US dollar posted strong gains on Wednesday, boosted by a hawkish Fed policy statement. The Fed said that the labor market is strengthening and inflation remains on target, although it did note that the labor market participation rate remains low. As expected, the Fed completed the taper of its QE3 program, an expected but still symbolic move. The asset-purchase program was initially started in 2008, at the height of the economic crisis, in order to boost a weak US economy and maintain interest rates at ultra-low levels. The termination of the QE is a symbolic step which is a vote of confidence from the powerful Fed that the US economy is on the right track.

EUR/USD 1.2494 H: 1.2511 L: 1.2541

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after German inflation data

EUR/USD trades modestly higher on the day above 1.0700. The data from Germany showed that the annual HICP inflation edged higher to 2.4% in April. This reading came in above the market expectation of 2.3% and helped the Euro hold its ground.

USD/JPY recovers above 156.00 following suspected intervention

USD/JPY recovers ground and trades above 156.00 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.