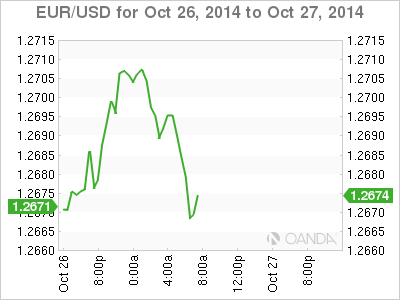

EUR/USD looked listless for most of last week and this trend has continued, as the pair trades quietly in the mid-1.26 range. German Ifo Business Climate continues to lose ground and dropped to 103.2 points. On Sunday, the ECB released the results of its stress tests of European banks and the results were considered positive overall. In the US, today’s highlight is Pending Home Sales. The markets are expecting a strong improvement, with an estimate of 1.1%.

German Ifo Business Climate continues to weaken, as the indicator dipped to 103.2 points in September. This was short of the estimate of 104.6 points and marks the sixth straight release that the indicator has lost ground. German GDP contracted in Q2, and another contraction in Q3 would indicate a recession in the Eurozone’s largest economy. German growth has been hurt as exports have been hit by EU sanctions against Russia, weak Eurozone demand and slower growth in China, Germany’s third largest trading partner.

On Sunday, the ECB released the results of its stress tests of European banks. The exercise marked a comprehensive and rigorous review of the health of 130 European banks. No German or French banks failed the test, but the third largest Italian lender, Banca Monte Paschi, posted a capital shortfall and will have to explain to the ECB how its plans to eliminate the shortfall. The ECB is trying to restore confidence in the European banking sector and encourage more borrowing and spending on the part of consumers and businesses.

In the US, last week’s jobless numbers were softer than expected. Unemployment Claims rose to 284 thousand, much higher than the previous reading of 264 thousand, and above the estimate of 269 thousand. However, the markets were not too concerned, as the four-week average, which is less volatile than the weekly release, dipped to 281,000, a 14-year low. Meanwhile, weak inflation levels continue to point to slack in the economy. On Wednesday, this trend continued with soft consumer inflation numbers. CPI and Core CPI both posted small gains of 0.1%.

EUR/USD 1.2681 H: 1.2714 L: 1.2666

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD recovers toward 1.0850 as risk mood improves

EUR/USD gains traction and rises toward 1.0850 on Friday. The improvement seen in risk mood makes it difficult for the US Dollar (USD) to preserve its strength and helps the pair erase a portion of its weekly losses.

GBP/USD stabilizes above 1.2700 after downbeat UK Retail Sales-led dip

GBP/USD staged a rebound and stabilized above 1.2700 after dropping to a weekly low below 1.2680 in the early European session in response to the disappointing UK Retail Sales data. The USD struggles to find demand on upbeat risk mood and allows the pair to hold its ground.

Gold rebounds to $2,340 area, stays deep in red for the week

Gold fell nearly 4% in the previous two trading days and touched its weakest level in two weeks below $2,330 on Thursday. As US Treasury bond yields stabilize on Friday, XAU/USD stages a correction toward $2,340 but remains on track to post large weekly losses.

Dogecoin inspiration Kabosu dies, leaving legacy of $22.86 billion market cap meme coin behind

Kabosu, the popular Shiba Inu dog that inspired the logo of the largest meme coin by market capitalization, Dogecoin (DOGE), died early on Friday after losing her fight to leukemia and liver disease.

Week ahead – US PCE inflation and Eurozone CPI data enter the spotlight

Dollar traders lock gaze on core PCE index. Eurozone CPIs in focus as June cut looms. Tokyo CPIs may complicate BoJ’s policy plans. Aussie awaits Australian CPIs and Chinese PMIs.