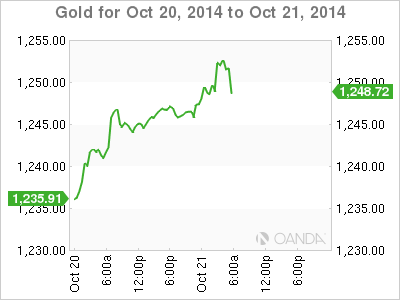

Gold is steady on Tuesday, as the spot price is $1248.16 per ounce in the European session. The metal is trading just shy of $1249.71, which marks a 6-week high. Today’s sole release on the calendar is Existing Homes. The markets are expecting the indicator to improve in the September release.

The US dollar posted strong gains against gold in September and early October, pushing the metal below the $1200 level. However, gold prices have since rebounded close to the $1250 level. Why the renewed appetite for gold on the part of investors? A key reason is that the Federal Reserve has put out signals that it may delay changing its monetary stance and raising interest rates. The Fed has noted that there is still slack in the economy and global economic conditions remain weak. A rate hike is still expected in 2015, but the Fed is unlikely to pull the trigger early in the year. With continuing uncertainty about the timing of a rate hike, gold remains an attractive alternative to the greenback.

US releases wrapped up the week on a high note, as UoM Consumer Sentiment climbed to 86.4 points, its highest reading since July 2007. The markets had expected a reading of 84.3 points. This indicates that the US consumer remains optimistic about the economy and is not overly concerned about warnings of a global slowdown. On the housing front, Building Permits and Housing Starts met expectations. Strong US employment numbers continue to drive the US recovery, as US job claims dropped to 264 thousand, marking a 14-year low. The estimate stood at 286 thousand.

XAU/USD 1248.16 H: 1253.78 L: 1244.10

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

Fed’s Powell said further conviction that inflation is returning to the target is needed before start cutting rates – LIVE

Chair Powell reiterated that the Fed's policy rate remains restrictive, although further confidence that inflation is retreating towards the bank's target is needed before deciding on reducing rates.

EUR/USD extends gains above 1.0700 on Powell’s presser

The selling bias in the Greenback gathers extra pace as Powell’s press conference is under way, lifting EUR/USD to daily tops past the 1.0700 hurdle.

GBP/USD rises above 1.2500 on weaker Dollar

The resumption of the upward pressure sends GBP/USD back above 1.2500 the figure in response to increasing selling pressure hurting the Greenback.

Gold surpasses $2,300 as Dollar tumbles

The precious metal maintains its constructive stance and trespasses the $2,300 region on Wednesday after the Federal Reserve left its FFTR intact, matching market expectations.

A new stage of Bitcoin's decline

Bitcoin's closing price on Tuesday became the lowest since late February, confirming the downward trend and falling under March and April support and the psychologically important round level.