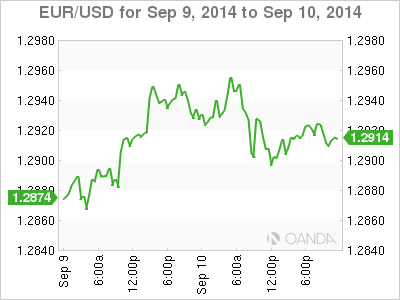

The euro continues to show little movement on Thursday, as EUR/USD trades quietly in the low-1.29 range. On the release front, German CPI slipped to 0.0% last month, matching the forecast. Later in the day, ECB head Mario Draghi will address the Eurofi Financial Forum in Milan, Italy. The markets will be listening closely after Draghi's dramatic rate cuts last week. In the US, today's highlight is Unemployment Claims. The estimate stands at 306 thousand, slightly higher than last week's reading of 302 thousand.

Will the real Germany please stand up? Recent German numbers have been mixed. GDP and Business Climate looked weak, while recent manufacturing data has been sharp. This week started off on a high note, as the trade surplus climbed to EUR 22.2 billion, up from 16.2 billion a month earlier. This easily beat the estimate of 17.3 billion. The strong figure follows impressive German manufacturing data last week, led by Industrial Production, which gained 1.9% in August, its strongest showing in 2014. Inflation (or the lack of) continues to be a major concern in the Eurozone. German CPI dipped to 0.0% last month, down from 0.3%. Low inflation levels continue to weigh on the shaky euro, which finds itself looking upwards at the 1.30 line.

US numbers continue to point to a deepening recovery, but the labor market is showing some troubling signs. JOLTS Job Openings was unchanged in August at 4.67 million, short of the estimate of 4.72 million. On Friday, the eagerly-anticipated Nonfarm Employment Change crashed to 142 thousand, its lowest gain since January. This surprised the markets, which had expected a gain of 226 thousand. Unemployment Claims fell short of the estimate last week and another weak reading on Thursday could temper the dollar's impressive rally.

After months of fighting in eastern Ukraine between government forces and pro-Russian fighters, a ceasefire which began on Friday appears to be holding up, although some sporadic fighting has been reported. Russia has denied assisting the rebels, but both Ukraine and NATO have said that Russian forces have aided the separatists and attacked government positions. The crisis has severely strained relations between the West and Russia, and trade between Europe and Russia has suffered as a result. European countries have already implemented sanctions against Russia and have threatened further sanctions if the latest ceasefire does not hold.

EUR/USD 1.2914 H: 1.2940 L: 1.2897

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD hovers near 1.0700 ahead of US data

EUR/USD struggles to build on Wednesday's gains and fluctuates in a tight channel near 1.0700 on Thursday. The US Dollar holds its ground following the Fed-inspired decline as market focus shifts to mid-tier US data releases.

GBP/USD holds steady above 1.2500 following Wednesday's rebound

GBP/USD stays in a consolidation phase slightly above 1.2500 on Thursday after closing in the green on Wednesday. A mixed market mood caps the GBP/USD upside ahead of Unit Labor Costs and Jobless Claims data from the US.

Gold retreats to $2,300 despite falling US yields

Gold stays under bearish pressure and trades deep in negative territory at around $2,300 on Thursday. The benchmark 10-year US Treasury bond edges lower following the Fed's policy decisions but XAU/USD struggles to find a foothold.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.