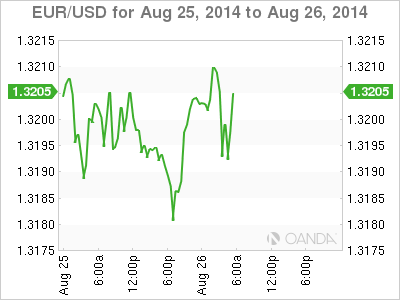

It's been an uneventful start to the week, as EUR/USD is trading just below the 1.32 line in Tuesday's European session. On the release front, there are no events out of the Eurozone, so the pair could take its cue from today's key US releases, Core Durable Goods Orders and CB Consumer Confidence. Both indicators are expected to soften in July.

In the US, recent numbers have been solid, but the markets have mixed feelings about Tuesday's data. Core Durable Goods Orders is expected to dip to 0.5% in July. The estimate for Durable Goods Orders stands at 7.4%, and some analysts are predicting a much higher gain in July. The reason? A huge increase in the purchase of passenger planes in July. Traders should be prepared for some short-term volatility in this indicator, which could have a positive but brief impact on the US dollar. Consumer confidence is at high levels, and CB Consumer Confidence is expected to post another strong reading.

The week started off with disappointing news out of Germany, as the indicator dropped to 106.3 points, its lowest reading since June 2013. Last week, German Manufacturing and Services PMIs pointed to weaker growth in July, as the largest economy in the Eurozone continues to display signs of weakness. The Euro is sensitive to key German data, and the currency will have difficulty holding its own against the dollar if German numbers fail to beat expectations.

Financial leaders and central bankers met at Jackson Hole for a conference late last week, and the markets were all ears as Fed chair Janet Yellen delivered the keynote address on Friday. Any hopes for some dramatic news were dashed, as Yellen did not provide any clues as to the timing of a rate hike. She reiterated that the US job market still needed to improve, so employment numbers remain a crucial factor in any rate move by the Fed. There is a divergence in monetary stance between the ECB and the Fed, as the Fed is winding up QE, while the ECB may be forced to provide stimulus to the prop up the sagging Eurozone economy.

EUR/USD 1.3191 H: 1.3211 L: 1.3179

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.