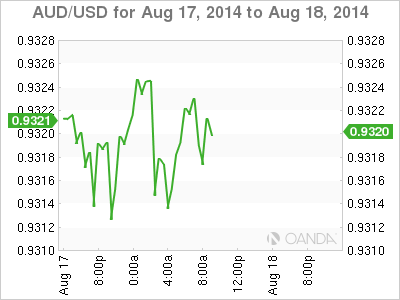

AUD/USD is steady on Monday, as the pair trades in the low-0.93 range early in the North American session. On the release front, Australian New Motor Vehicles fell 1.3% in July, marking a six-month low. The markets are keeping a close eye on the RBA policy meeting minutes, which will be released early on Tuesday.

With the US continuing to suffer from low inflation levels, markets expectations have been low for key inflation indicators. On Friday, PPI, the primary gauge of inflation in the manufacturing sector, slipped to 0.1%, down from 0.4% a month earlier. This matched the estimate. Weak inflation is one reason why the Federal Reserve is in no rush to raise interest rates, as low inflation points to slack in the economy. Meanwhile, US Preliminary UoM Consumer Sentiment slipped to 79.2 points, its lowest level since October. This follows weak retail sales numbers earlier in the week. This means that an improvement in the US labor market has not translated into stronger consumer confidence and spending, which are critical for economic growth.

Elsewhere in the US, Unemployment Claims came in higher than expected. The indicator climbed to 311 thousand, marking a six-week high. The estimate stood at 307 thousand. Employment indicators are being closely scrutinized by analysts, as the strength of the labor market is one of the most important factors influencing the Federal Reserve regarding the timing of an interest rate hike. A rate increase is expected by mid-2015, but stronger economic data, especially on the employment front, could hasten a move by the Fed. Earlier in the week, JOLTS Job Openings hit its highest level in 13 years, although it too missed expectations.

Australian confidence indicators looked solid last week, helping the Aussie hold its own against the US dollar. Westpac Consumer Sentiment climbed 0.8%, its strongest gain since October 2012. Earlier in the week, NAB Business Confidence reached 11 points, its fourth straight increase. Stronger confidence levels should translate into increased economic growth, which would be positive news for the Australian dollar.

AUD/USD 0.9318 H: 0.9328 L: 0.9309

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD hovers near 1.0700 even as USD struggles ahead of data

EUR/USD has erased gains to trade flat near 1.0700 in the European session on Thursday. The pair comes under pressure even as the US Dollar struggles, in the aftermath of the Fed policy announcements and ahead of more US employment data.

GBP/USD turns south toward 1.2500, US data eyed

GBP/USD is consolidating the rebound above 1.2500 in European trading on Thursday. The pair struggles, despite the US Dollar weakness on dovish Fed signals. A mixed market mood caps the GBP/USD upside ahead of mid-tier US data.

Gold price pulls back as market sentiment improves

The Gold price is trading in the $2,310s on Thursday after retracing about three-tenths of a percent on reduced safe-haven demand. Market sentiment is overall positive as Asian stocks on balance closed higher and Oil prices hover at seven-week lows.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.