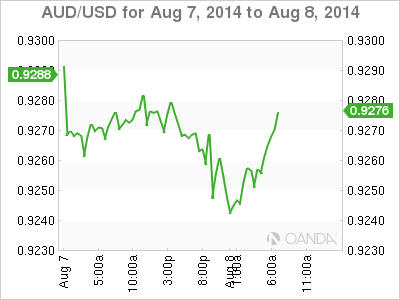

AUD/USD has steadied on Friday, after sustaining sharp losses a day earlier. In Friday's European session, the pair is trading in the high-0.92 range. On the release front, RBA released its quarterly Monetary Policy Statement. Australian Home Loans posted a weak gain of 0.2% last month, well short of expectations. In the US, there are no major events on the schedule.

The RBA released its monetary policy statement on Friday, and there wasn't much good news for the markets. The statement noted that the RBA has lowered its forecast for GDP of 2-3% in the year through June 2015, down from 2.25-3.25% in the May projection. Following suit, the forecast for core inflation dropped from 1.75-2.75%, down from 2.25-3.25%. The RBA added that the unemployment rate was likely to "remain elevated for some time". Australia's unemployment rate, which jumped in July, leaped above the US rate for the first time since 2007. This underscores a divergence in monetary policy outlook between the two countries - the US is expected to raise rates next year, while the RBA is unlikely to take similar action with a weak economy. The RBA statement also took note of the high value of the Australian dollar, which has gained about 6% since February.

In Australia, key employment data was dismal on Thursday. Employment Change came in at -0.3 thousand, well off the estimate of +13.5 thousand. As well, the unemployment rate jumped to 6.4%, up from 6.0%. The markets had expected unemployment levels to remain unchanged. Earlier in the week, the RBA held interest rates at 2.50%. The rate has been pegged at this low level since July 2013.

On Thursday, US Unemployment Claims dipped back below the 300 thousand level. The key indicator dropped to 289 thousand, beating the estimate of 305 thousand. The four-week claims average, which is less volatile than the weekly count, dipped to 293,500, its lowest level since February 2006. The stronger numbers point to increased hiring in response to stronger demand, which in turn has contributed to gains in income and stronger consumer spending. An improving job market is critical for economic growth, and the dollar has gained broad strength as key US data points upwards.

PMI releases are closely tracked by analysts, as they are important gauges of the strength of the manufacturing and services sectors. On Tuesday, ISM Non-manufacturing PMI looked sharp, rising to 58.7 points last month. This easily beat the estimate of 56.6, and was the index’s best showing since February 2011. This follows an excellent Manufacturing PMI reading last week, with the index climbing to 57.1 points, a three-year high. There was more positive news on Tuesday, as Factory Orders had an impressive July, gaining 1.1%. These solid numbers point to healthy expansion in the US manufacturing and services sectors, and has boosted the greenback against its major rivals.

AUD/USD 0.9280 H: 0.9282 L: 0.9239

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD retreats to 1.0750 area as USD recovers

EUR/USD stays under modest bearish pressure and trades slightly below 1.0750 in the European session on Wednesday. Hawkish comments from Fed officials help the US Dollar stay resilient and don't allow the pair to stage a rebound.

GBP/USD drops below 1.2500 ahead of Thursday's BoE event

GBP/USD stays on the back foot and trades in negative territory below 1.2500 after losing nearly 0.5% on Tuesday. The renewed US Dollar strength on hawkish Fed comments weighs on the pair as market focus shifts to the BoE's policy announcements on Thursday.

Gold stays near $2,310 as US yields edge higher

Following a quiet Asian session, Gold retreated slightly to the $2,310 area. Hawkish tone of Fed policymakers help the US Treasury bond yields edge higher and make it difficult for XAU/USD to gather bullish momentum.

SEC vs. Ripple lawsuit sees redacted filing go public, XRP dips to $0.51

Ripple (XRP) dipped to $0.51 low on Wednesday, erasing its gains from earlier this week. The Securities and Exchange Commission (SEC) filing is now public, in its redacted version.

Softer growth, cooler inflation and rate cuts remain on the horizon

Economic growth in the US appears to be in solid shape. Although real GDP growth came in well below consensus expectations, the headline miss was mostly the result of larger-than-anticipated drags from trade and inventories.