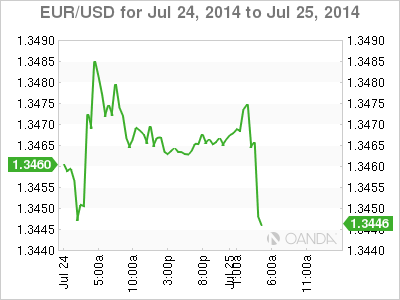

EUR/USD is almost unchanged on Friday, as the pair's lack of movement continues. In the European session, the pair is trading in the mid-1.34 range. In economic news, German Ifo Business Climate, slipped to a nine-month low. German Consumer Climate looked very sharp, rising to 9.0 points. In the US, today's highlight is Core Durable Goods Orders. The markets are expecting a healthy gain after a decline in the May release. On Thursday, US Unemployment Claims sparkled but New Home Sales were well short of expectations.

German indicators measuring confidence in the economy sent mixed signals on Friday. Ifo Business Climate, a key indicator, dipped to 108.0 points, its lowest since September. At the same time, Consumer Climate continued its upward trend, hitting 9.0 points, just above the estimate of 8.9 points. German data can have a major impact on the euro, as the country boasts the largest economy in the Eurozone. If the markets show concern about the weak business climate figure, we could see the euro under pressure during the day.

In one of the first signs that the ECB's recent rate cuts may be bearing fruit, Eurozone PMIs posted encouraging numbers on Thursday. German Services and Manufacturing PMIs improved in June and beat their estimates. Services PMI was particularly impressive, hitting a three-year high, at 56.6 points. In the Eurozone, Services PMI easily beat the estimate, while Manufacturing PMI met expectations. French data, however, failed to keep pace with its European counterparts. Manufacturing PMI came in below the 50-point level, the mark that indicates expansion, for a second straight month, indicating contraction in the manufacturing sector. Services PMI pushed above 50 for the first time since March.

In the US, Unemployment Claims tumbled, as the key indicator fell to 298 thousand, its lowest level since February 2008. This surprised the markets, which had expected a reading of 301 thousand. The strong release continues a string of solid employment data, and the dollar could get a boost from the good news. As well, good news on the employment front is bound to increase speculation about a rate increase by the Federal Reserve.

US housing data was dismal on Thursday, as New Home Sales slumped to a three-month low. The key indicator fell to 406 thousand, compared to 504 thousand in the previous release. The markets were way off in their forecast, with an estimate of 485 thousand. There was much better news earlier in the week, as Existing Home Sales jumped to 5.04 million, surpassing the estimate of 4.94 million. This was the best showing we've seen since October.

EUR/USD 1.3466 H: 1.3476 L: 1.3461

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.