The euro continues to point upwards, as EUR/USD trades in the low-1.38 range in Thursday trade. The euro got a helping hand from German Ifo Business Climate, which beat the estimate. Later in the day, ECB President Mario Draghi will speak at an event in Amsterdam. In the US, there are two major events on the schedule - Unemployment Claims and Core Durable Goods Orders.

There was good news out of Germany on Thursday, as Ifo Business Climate continues to cruise at high levels. The key indicator improved to 111.2 points, beating the estimate of 110.5. The indicator has been above the 110 level throughout 2014, indicating strong optimism in the business sector with regard to the German economy. German data can have a strong impact on EUR/USD, as Germany is the Eurozone's largest economy.

In the US, New Home Sales was a disaster, as the key indicator plunged to 384 thousand in March, down from 440 thousand in the previous release. The weak reading was nowhere near the estimate of 455 thousand, and marked an eight-month low for the key housing indicator. The housing sector is showing signs of weakness, as both New Home Sales and Existing Home Sales have been on a sustained downward trend.

US inflation levels have been lukewarm, but so far the Federal Reserve has done little more than point out that it would like to see inflation move closer to the Fed's target of 2%. The House Price Index, a gauge of activity in the housing sector, rose a respectable 0.6% last month, matching the forecast. It's a different tale in the Eurozone, where inflation continues to be persistently low and there is real concern about deflation, which could inflict serious damage on the fragile Eurozone economy. The ECB has balked at taking any action to deal with inflation, but its hand may be forced if inflation levels don't show some life.

The markets haven't reacted to events in Ukraine so far, but that could change if the violence in the east of the country worsens. Russian President Vladimir Putin has threatened to act on his "right" to invade Ukraine, and has also given the country an ultimatum regarding its gas debt. The gas supply from Russia to western Europe is in danger, and if the situation spills out of control, we could see a sharp response from the markets. US Vice-President Joe Biden is in Kiev for a symbolic visit. The West doesn't have many cards to play against Russia, so every move by Putin will be scrutinized and could impact on the markets.

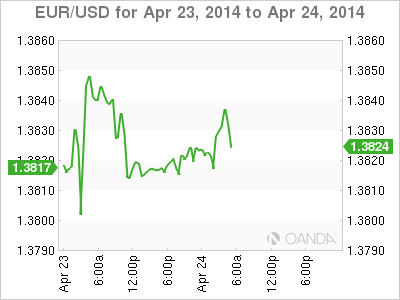

EUR/USD 1.3831 H: 1.3843 L: 1.3812

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700 as USD struggles ahead of data

EUR/USD is posting small gains above 1.0700 in the European session on Thursday. The pair remains underpinned by a sustained US Dollar weakness, in the aftermath of the Fed policy announcements and ahead of more US employment data.

GBP/USD gains traction above 1.2500, Fed keeps rates steady

GBP/USD gains traction near 1.2535 during the early Thursday. The uptick of the major pair is supported by the sharp decline of the US Dollar after the US Federal Reserve left its interest rate unchanged.

Gold needs to reclaim $2,340 for a sustained recovery

Gold price is consolidating Wednesday’s rebound in Asian trading on Thursday, as buyers await more employment and wage inflation data from the United States for fresh trading impetus. Traders also digest the US Federal Reserve interest rate decision and Chair Jerome Powell's words delivered late Wednesday.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Fed meeting: The hawkish pivot that never was, and the massive surge in the Yen

The Fed’s latest meeting is over, and the tone was more dovish than expected, but that is because the rate hike hype in the US was over-egged, and rate cut hopes had been pared back too far in recent weeks.