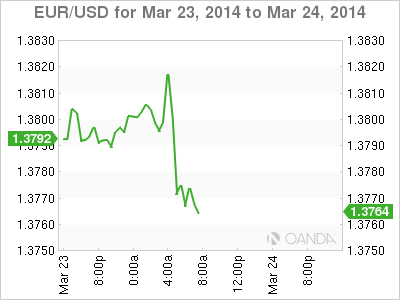

EUR/USD has lost ground on Monday, as the euro's downward trend continues. In Monday's European session, the pair is trading in the mid-1.37 range. In economic news, Euro PMIs were a mix. French PMIs beat the estimates, but German PMIs were a disappointment. Eurozone PMIs matched expectations. Over in the US, the week starts off with just one release, Flash Manufacturing PMI.

The week started with a host of PMI releases out of the Eurozone. French Manufacturing and Services PMIs both pushed above the 50 mark, which indicates expansion. The German numbers were a disappointment, as the Manufacturing and Services PMIs missed their estimates. As for the Eurozone numbers, both releases improved in February and met expectations.

German economic indicators have been one of the few bright lights in the Eurozone economy, but the German locomotive is also suffering from persistently low inflation. Last week, the German Producer Price Index came in at a flat 0.0%, short of the estimate of +0.2%. As well, German Wholesale Price Index posted a decline of 0.1%, its fourth drop in five releases. Mario Draghi continues to insist that there is no inflation problem in the Eurozone, but the markets may not share his optimism, as Eurozone inflation indicators continue to look listless.

The US dollar surged against its major rivals following the Federal Reserve's policy meeting on Wednesday, the first meeting headed by Janet Yellen. The decision to trim QE by another $10 billion was widely expected, but her comments at the follow-up press conference gave the dollar a big boost against its major rivals. Yellen said that the Fed was on track to wind up QE in the fall, and could start to raise interest rates six months later. This is a more aggressive approach towards higher rates than the markets had expected, and the dollar responded by posting strong against the euro.

EUR/USD 1.3771 H: 1.3824 L: 1.3767

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD hovers near 1.0700 ahead of US data

EUR/USD struggles to build on Wednesday's gains and fluctuates in a tight channel near 1.0700 on Thursday. The US Dollar holds its ground following the Fed-inspired decline as market focus shifts to mid-tier US data releases.

GBP/USD holds steady above 1.2500 following Wednesday's rebound

GBP/USD stays in a consolidation phase slightly above 1.2500 on Thursday after closing in the green on Wednesday. A mixed market mood caps the GBP/USD upside ahead of Unit Labor Costs and Jobless Claims data from the US.

Gold retreats to $2,300 despite falling US yields

Gold stays under bearish pressure and trades deep in negative territory at around $2,300 on Thursday. The benchmark 10-year US Treasury bond edges lower following the Fed's policy decisions but XAU/USD struggles to find a foothold.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.