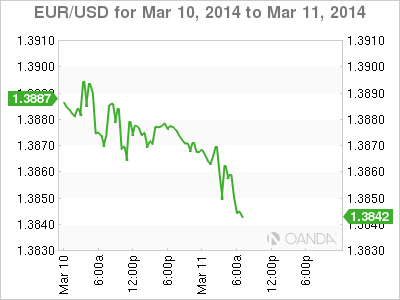

EUR/USD has edged lower in Tuesday trade, but the pair remains at high levels. In the European session, the euro is trading in the mid-1.38 range. German Trade Balance dipped to a three-month low and fell short of the estimate. In the US, today's highlight is JOLTS Job Openings. The markets are not expecting much change in the February release.

After last week's ECB rate, Mario Draghi sounded optimistic, saying that the Eurozone was showing modest recovery. That assertion is certainly questionable if we take Germany out of the equation, as major economies like France and Italy continue to struggle. German releases have looked good recently, but Trade Balance weakened in February, and additional weak numbers out of the Eurozone's largest economy could spell trouble for the euro.

Nonfarm Payrolls wrapped up the week on a high note, as the key employment release jumped to 175 thousand in February, up from 1113 thousand a month earlier. This was well above the estimate of 151 thousand. The Unemployment rate edged up to 6.7%, slightly above the estimate of 6.6%. With a solid Unemployment Claims earlier last week, the markets can breathe more comfortably as the Fed is likely to take its scissors and trim QE next week for the third time. New York Fed President William Dudley stated last week that the threshold to alter the Fed's program to wind up QE was "pretty high". In other words, short of a serious economic downturn in the US economy, we can expect the QE tapers to continue.

Mario Draghi and his crew at the ECB helped the euro shoot up on Thursday, but this time it was due to a lack of action by the central bank, rather than a change in monetary policy or any dramatic comments by Draghi. There had been speculation that the ECB might lower deposit rates into negative territory or even commence a mini-QE scheme. In the end, the Bank held the course, with Draghi reiterating his well-worn script that the ECB's high degree of accommodative monetary policy would continue for as long as needed. He also noted that the Eurozone economy was recovering at a moderate pace, and shrugged concerns about inflation levels well below the ECB's target of 2%. Draghi may be able to point to encouraging data out of Germany to bolster his case that the region is headed in the right direction, but the data from other major economies, such as France and Italy, raise questions about the health of the Eurozone.

EUR/USD 1.3852 H: 1.3876 L: 1.3834

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD declines below 1.0700 as USD recovery continues

EUR/USD lost its traction and declined below 1.0700 after spending the first half of the day in a tight channel. The US Dollar extends its recovery following the strong Unit Labor Costs data and weighs on the pair ahead of Friday's jobs report.

GBP/USD struggles to hold above 1.2500

GBP/USD turned south and dropped below 1.2500 in the American session on Thursday. The US Dollar continues to push higher following the Fed-inspired decline on Wednesday and doesn't allow the pair to regain its traction.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.