The global stock markets did not have any sharp trend on Wednesday despite the positive data on increase of the U.S. wholesale inventories for April by 1.1% against expectations of 0.5%. This figure is included in the calculation of the GDP changes. Probably, low investor activity prevents the "rally" from continuation because they are confident about further price growth.

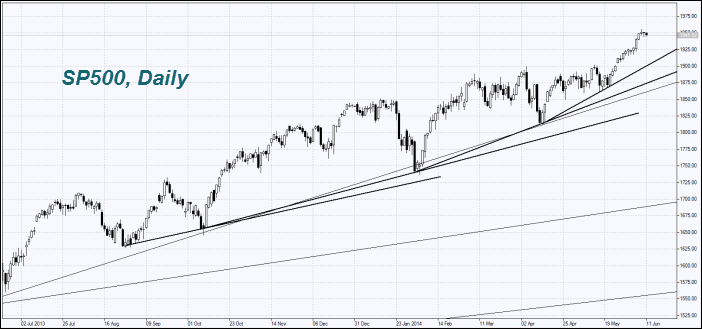

Yesterday trading volume on U.S. exchanges was 17% below the average for three months and made 5.2 billion shares. The S&P 500 index has grown within 32 months at least by 10% without any significant corrections, while its average non stop growth continuation since 1945 has been only 18 months. The last correction was observed only in 2011, from April to October. Note that market participants now expect aggregate profits of the companies included in the S&P 500 to increase in 2014 by 7.4%. There were more optimistic growth forecasts of 9.7% in January. In our opinion, the main growth driver for the U.S. stocks was the QE program or redemption of government bonds by printing money. During the three QE stages, since March 2009, the S&P 500 rose by 188%. Now this program is reduced by $10 billion per month. We do not exclude the U.S. stock market correction along with the QE completion and the Fed's monetary policy tightening (rate hikes). Recall that its next meeting will be held next week. Yesterday the yield of 10-year U.S. government bonds (notes) set a new monthly high at 2.65%. Today we do not expect any significant economic data from the U.S. and the Eurozone.

The U.S. futures, as well as European stocks are falling down this morning. The World Bank (WB) has lowered its forecast for the global economic growth this year from 3.2% to 2.8% in January. The U.S. GDP growth forecast is lowered from 2.8% to 2.1%. The World Bank expects EU economy to grow by 1.1%, Japanese economy by 1.3% this year.

Japanese Nikkei corrected upwards today after yesterday's fall. The MSCI indexes excluded South Korea and Taiwan indexes from the list of indices of developed countries. Thus, only Japan is left among the Southeast Asian countries. This has contributed to increased demand for Japanese stocks from large international hedge funds that invest, focusing on indices composed by MSCI. Tonight at 23-50 СЕТ Industrial Orders in Japan for April will be released. In our opinion, the forecasts are negative.

Due to uncertain growth in global stock indices, the price of gold reached a 2-week high. Earlier, we noted that it moves opposite to the U.S. securities market. This can be used to create a personal composite instrument.

The Copper price stabilized. Investors have not decided yet what is more important - the Qingdao port lending investigation, which could reduce the demand in China or the cumulative reduction of copper reserves on London, New York and Shanghai exchanges by 42% to the lowest level since 2008, indicating that there is a high demand for this metal.

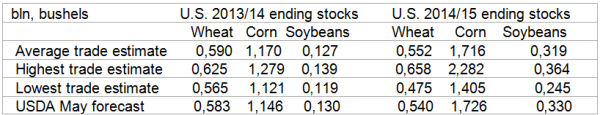

Today the USDA will publish its report containing the forecasts for the crop and stocks of cereals at 16:00 CET, which can affect the quotes. The consensus forecast is presented in the table. Note that the Wheat quotations were supported by forecast of reduction of its harvest in Australia due to El Niño by 1% despite the agricultural land increase by 2%. Investors do not exclude further negative meteorological forecasts.

Recommended Content

Editors’ Picks

AUD/USD extends gains due to improved risk appetite

The Australian Dollar maintained its winning streak for the fourth consecutive session on Monday, buoyed by a hawkish sentiment surrounding the Reserve Bank of Australia. This optimism bolsters the strength of the Aussie Dollar, providing support to the AUD/USD pair.

USD/JPY snaps three-day losing streak above 153.50, Yellen counsels caution on currency intervention

The USD/JPY pair snap a three-day losing streak during the Asian trading hours on Monday. The uptick of the pair is bolstered by the modest rebound of the US Dollar and US Treasury Secretary Janet Yellen’s comments on potential Japanese interventions last week.

Gold price rebounds on downbeat NFP data, softer US Dollar

Gold price snaps the two-day losing streak during the Asian session on Monday. The weaker-than-expected US employment reports have boosted the odds of a September rate cut from the US Federal Reserve. This, in turn, has dragged the US Dollar lower and lifted the USD-denominated gold.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.