Key Highlights

-

Euro gained traction recently against the US Dollar, and currently trading with a bullish bias.

-

There is a bullish trend line formed on the hourly chart of the EURUSD pair, which may act as a support if the pair moves down.

-

Today, the Euro Area Producer Price Index (PPI) will be released by the Eurostat, which is forecasted to decrease by 0.6% in Feb 2016, compared with the previous month.

-

Earlier during the Asian session, the Australian TD Securities Inflation released by The University of Melbourne - Faculty of Economics and Commerce posted 0% in March 2016.

EURUSD Technical Analysis

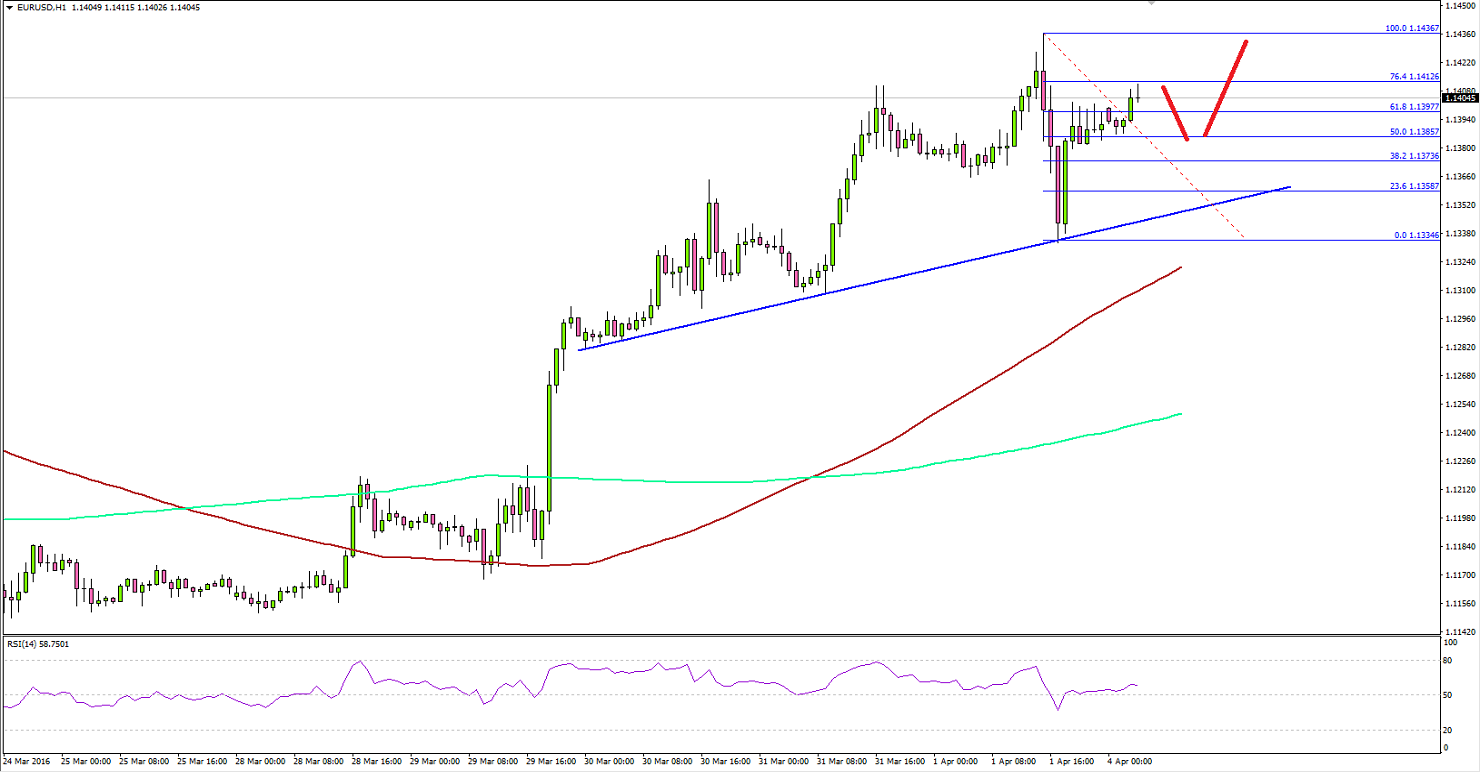

The Euro traded above 1.1400 resistance area against the US Dollar recently, and it looks like poised for more gains in the short term. There is a bullish trend line formed on the hourly chart of the EURUSD pair, which may act as a support for the pair if it moves down or corrects lower from the current levels.

On the upside, the 1.1420-30 area can be seen as a resistance, which must be breached by the bulls if they have to take the pair higher.

On the downside, a short-term support can be at 1.1380.

Euro Area PPI

Today, the Euro Area Producer Price Index (PPI), which is an index that measures the change in prices received by domestic producers of commodities will be released by the Eurostat. The forecast is slated to decrease by 0.6% in Feb 2016, compared with the previous month. In terms of the yearly change, the Euro Area PPI is expected to decrease by 4%.

Moreover, the Euro area unemployment rate will also be released, which may impact the Euro in the short term.

Titan FX is registered and regulated in New Zealand under FSP388647. Our global headquarters and operational hub is located in Auckland, New Zealand.

Recommended Content

Editors’ Picks

Australian Dollar maintains ground amid subdued US Dollar, US Nonfarm Payrolls awaited

The Australian Dollar rises on hawkish sentiment surrounding the RBA prolonging higher interest rates. Australia’s central bank is expected to maintain its current rate at 4.35% until the end of September. US Nonfarm Payrolls is expected to print a reading of 243K for April, compared to 303K prior.

EUR/USD: Optimism prevailed, hurting US Dollar demand

The EUR/USD pair advanced for a third consecutive week, accumulating a measly 160 pips in that period. The pair trades around 1.0760 ahead of the close after tumultuous headlines failed to trigger a clear directional path.

Gold bears take action on mixed signals from US economy

Gold price fell more than 2% for the second consecutive week, erased a small portion of its losses but finally came under renewed bearish pressure. The near-term technical outlook points to a loss of bullish momentum as the market focus shifts to Fedspeak.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.