Key Highlights

Euro enjoyed decent gains against the US Dollar recently until it found sellers around 1.1110.

Euro Area Manufacturing Purchasing Managers Index (PMI) will be released by the Markit Economics, which is expected to come in around 52.0 for July 2015.

Chinese official non-manufacturing PMI, released by China Federation of Logistics and Purchasing (CFLP) came in at 53.9, up from the last reading of 53.8.

Australian AIG performance of the Mfg Index released by the Australian Industry Group posted a nasty increase from 44.2 to 50.4.

EURUSD Technical Analysis

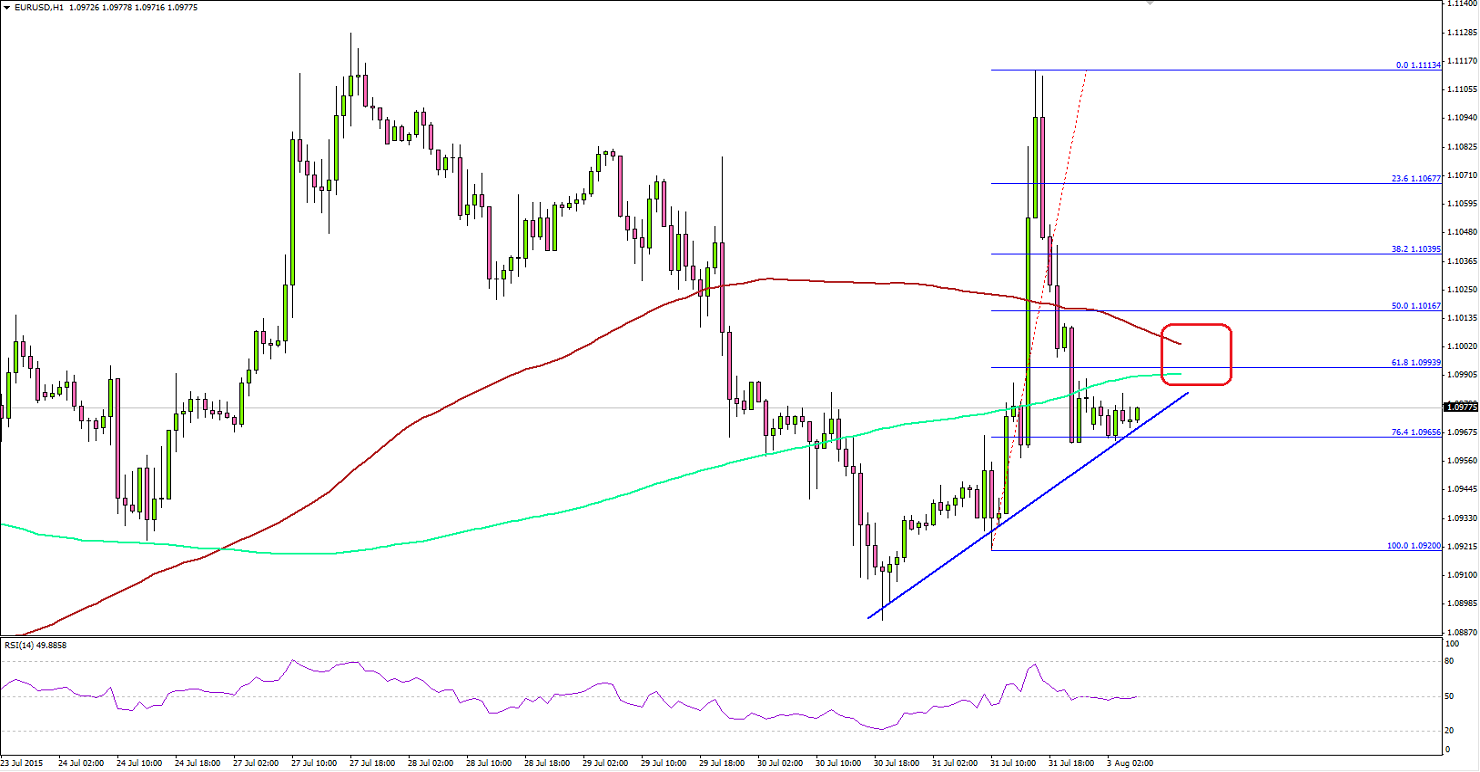

The EURUSD pair recently spiked higher to trade near 1.1110 resistance zone where it found sellers, which ignited a downside reaction. The selling interest was very strong, as sellers managed to clear the 100 and 200 hourly simple moving average. However, there was a support formed around the 76.4% Fib retracement level of the last leg from the 1.0920 low to 1.1113 high.

Moreover, there is also a bullish trend line on the hourly chart, which is acting as a hurdle for sellers but we cannot discard the fact that there is a lot of bearish pressure on the pair. So, if the pair stays below the 100 hourly SMA more losses are likely. A break below the highlighted trend line could take the pair towards the last swing low of 1.0920.

On the upside, if the pair moves above both the key SMA’s, then it might call for a chance of trend. A major barrier is around the 1.1060-80 resistance area, followed by the last swing high of 1.1110.

Titan FX is registered and regulated in New Zealand under FSP388647. Our global headquarters and operational hub is located in Auckland, New Zealand.

Recommended Content

Editors’ Picks

EUR/USD declines below 1.0700 as USD recovery continues

EUR/USD lost its traction and declined below 1.0700 after spending the first half of the day in a tight channel. The US Dollar extends its recovery following the strong Unit Labor Costs data and weighs on the pair ahead of Friday's jobs report.

GBP/USD struggles to hold above 1.2500

GBP/USD turned south and dropped below 1.2500 in the American session on Thursday. The US Dollar continues to push higher following the Fed-inspired decline on Wednesday and doesn't allow the pair to regain its traction.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.