Analysis for August 19th, 2014

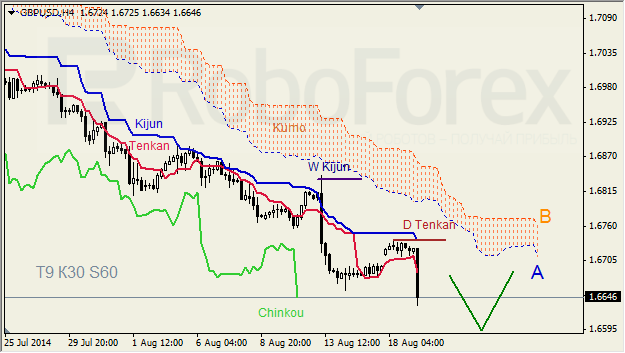

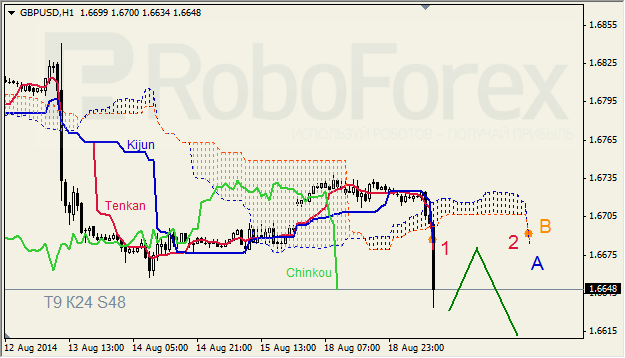

GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD, Time Frame H4. Tenkan-Sen and Kijun-Sen are very close to each other below Kumo and still influenced by “Dead Cross”; all lines are directed downwards. Ichimoku Cloud is still going down, Chinkou Lagging Span is below the chart, and the price rebounded from the resistance from D Tenkan-Sen downwards. Short‑term forecast: we can expect decline of the price and attempts of a correction inside Kumo.

GBPUSD, Time Frame H1. Tenkan-Sen and Kijun-Sen, as well as Senkou Spans A and B, are very close to each other below Kumo (1); all lines are directed downwards. Ichimoku Cloud is closed (2), and Chinkou Lagging Span is below the chart. Short‑term forecast: we can expect an ascending correction, although considering such impulse, the price is unlikely to be able form “return of the price to the cloud’s border after breaking it” pattern.

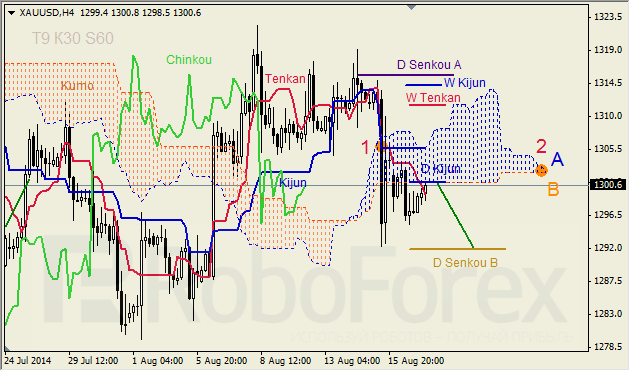

XAUUSD, “Gold vs US Dollar”

XAUUSD, Time Frame H4. Tenkan-Sen and Kijun-Sen are still influenced by “Dead Cross” (1). Ichimoku Cloud is closed (2), Chinkou Lagging Span is below the chart, and the price is near Kumo’s lower border. Short-term forecast: we can expect a steady resistance from D Kijun-Sen and H4 Senkou Span B, and the movement of the price inside D Kumo towards its lower border.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD drops to near 1.0650 ahead of Fed policy

EUR/USD continues its decline for the second consecutive day, hovering around 1.0650 during Asian trading hours on Wednesday. With European markets largely closed for Labour Day, investors are expecting the Federal Reserve's latest policy decision.

GBP/USD holds below 1.2500 ahead of Fed rate decision

The GBP/USD pair holds below 1.2490 during the early Wednesday. The downtick of the major pair is supported by the stronger US Dollar amid the cautious mood ahead of the US Federal Reserve's interest rate decision later on Wednesday.

Gold sellers keep sight on $2,223 and the Fed decision

Gold price is catching a breather early Wednesday, having hit a four-week low at $2,285 on Tuesday. Traders refrain from placing fresh directional bets on Gold price, anticipating the all-important US Federal Reserve interest rate decision due later in the day.

Ethereum dips below key level as Hong Kong ETFs underperform

Ethereum experienced a further decline on Tuesday following a disappointing first-day trading volume for Hong Kong's spot Bitcoin and ETH ETFs. This comes off the back of increased long liquidations and mixed whale activity surrounding the top altcoin.

Federal Reserve meeting preview: The stock market expects the worst

US stocks are a sea of red on Tuesday as a mixture of fundamental data and jitters ahead of the Fed meeting knock risk sentiment. The economic backdrop to this meeting is not ideal for stock market bulls.