Monday May 2: Five things the markets are talking about.

It’s a bank holiday shortened trading week for some (China, Singapore, Taiwan, U.K and Ireland), but for others it’s expected to be a busy week.

The Reserve Bank of Australia meets this coming week – no change in the overnight rate is expected, nevertheless, the odds have fallen since last week’s tepid inflation report.

Elsewhere, manufacturing and composite PMI’s for April will be released and digested around the globe.

Dealers and investors will sign off the week with the U.S’s and Canada’s April jobs reports. Can both economies continue with such a stellar monthly print?

1. China PMIs slow slightly but remain in expansion

China official PMI’s were a mixed bag – both were down slightly from March’s levels, but remained in expansion.

China April Manufacturing PMI (government official: 50.1 vs. 50.3e – second straight expansion; non-manufacturing (services) PMI: 53.5 vs. 53.8 prior.

Amongst the key ‘manufacturing’ components – new export orders matched the headline with 50.1 vs. 50.2 m/m, employment continues to remain under pressure at 47.8 vs. 48.1 m/m, while input prices hit multi-month highs of 57.6 v 55.3 m/m.

A positive for both commodity sensitive currencies and commodities, analysts note that inventories of raw materials fell to a new five-month low of 55.3 vs. 57.6 m/m, suggesting perhaps we have peaked in oversupply?

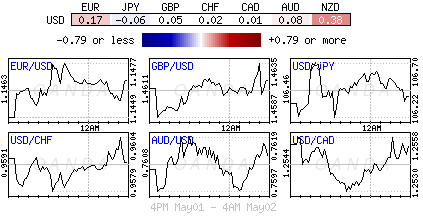

2. Japan: One-sided speculative moves in FX are a concern.

It’s not a surprise to see that Japanese authorities are worried by the recent currency moves.

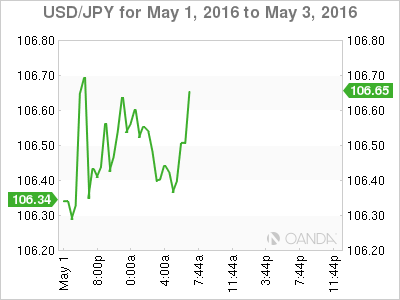

Overnight, Japan’s Finance Minister Aso again reiterated his view that one-sided speculative moves in FX were “extremely concerning.” He vowed that authorities would continue to monitor markets and take action as necessary. Nevertheless, his comments did little to stop the yen climbing.

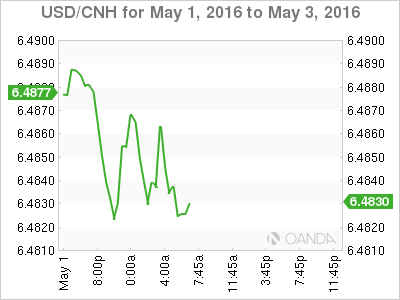

The Bank of Japan (BoJ) in a surprise move last week stood still on rates. The market has been punishing their inaction ever since. Investors pushed the yen to hit a fresh 18-month high against the dollar (¥106.14) in overnight trade.

The BoJ’s inaction has dashed hopes for more stimulus and is forcing the weaker Yen bears to unwind their ‘short’ positions.

3. RBA monetary policy event risk

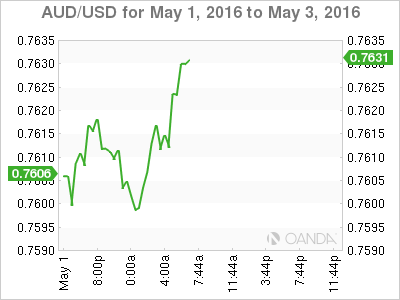

Monetary policy ‘event risk’ shifts down-under to Australia, where last week’s soft Aussie CPI data has made for a much closer decision by Governor Stevens and company tomorrow.

The RBA is facing one of its toughest decisions in some time, backed into a corner between a interest rate cut to offset falling prices, or hold rates steady to avoid hurting “retirement savers” and fueling fresh doubts about the strength of the economy.

As we draw closer to the decision, fixed income markets are leaning slightly in favor of a -25bp cut with a probability of just over 50% (+53% – compared with a near-impossibility just a week ago).

Overnight data would support a cut, but the immediate problem is would banks pass that on?

4. U.S Treasury releases semi-annual currency report

The U.S Treasury Department has put five new countries on their new ‘Monitoring List’ (China, Japan, Korea, Taiwan, and Germany).

Treasury found that no economy currently satisfied all ‘three’ criteria to be named as a currency manipulator; however, five named major trading partners met two of the three criteria.

The report called the recent yen movements “orderly,” and also urged Japan to adhere to G-20 and G-7 commitments regarding exchange rate policies. This is very much in stark contrast with Japanese authorities – their description of the Yen’s moves as being “one-sided” and speculative driven.

5. Gold hits new heights, shy of $1,300.

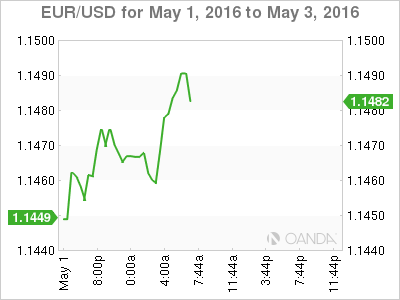

Spot gold prices have managed to hit a fresh 15-month high earlier this morning, supported by a weaker dollar and heightened demand for safe-haven assets.

The ‘yellow’ metal has rallied to $1,298.17 ahead of the N.Y open, up +0.4% from the Friday’s close. For many, it’s expected to be only a matter of time before gold will be able to push through the $1,300 psychological handle.

The U.S dollar fell -2% last week, after the Fed indicated that it would be slow to raise interest rates this year. Not helping the ‘mighty’ dollar was the BoJ leaving their monetary policy unchanged.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after US data

EUR/USD struggles to build on Wednesday's gains and fluctuates in a tight channel near 1.0700 on Thursday. The data from the US showed that weekly Jobless Claims held steady at 208,000, helping the USD hold its ground and limiting the pair's upside.

GBP/USD fluctuates above 1.2500 following Wednesday's rebound

GBP/USD stays in a consolidation phase slightly above 1.2500 on Thursday after closing in the green on Wednesday. A mixed market mood caps the GBP/USD upside after Unit Labor Costs and weekly Jobless Claims data from the US.

Gold retreats to $2,300 despite falling US yields

Gold stays under bearish pressure and trades deep in negative territory at around $2,300 on Thursday. The benchmark 10-year US Treasury bond edges lower following the Fed's policy decisions but XAU/USD struggles to find a foothold.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.