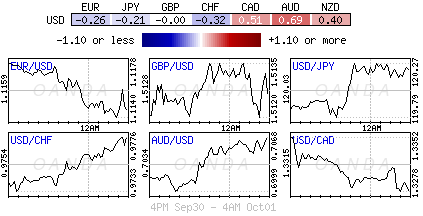

For equities in particular, Q3 ended yesterday solidifying their worst quarterly performance in four-years. In the three- month period, global stocks lost over -$11T in value. In forex, trading ranges have been relatively contained as investors continue to seek central bank directional guidance. Nonetheless, the investing rules are not about to change in the home stretch.

Central Banks continue to have a stranglehold on capital markets. G7 policy makers are under pressure to be assertive. The Reserve Bank of Australia (RBA) and Bank of Japan (BoJ) meet next week, and even though Governor Stevens is not expected to loosen monetary policy, it would not be a surprise given the IMF’s global growth concerns. The BoJ’s Governor Kuroda will only disappoint if he is not aggressive enough in carrying out PM Abe’s promises – vowed to continue aggressive monetary easing and boost fiscal spending, promising to do “whatever is necessary” (an ECB coined theme) to put Japan’s economy on a robust growth path. For now, forex continues to take its cues from equities. Plummeting global indices have supported risk aversion trading strategies and until investor psyche changes, that FX trend remains your friend.

Fed ‘ducks and dives': Given the Fed’s recent history of revising its policy position, markets remain skeptical about the likelihood of a rate increase this year. The Fed had been saying for several months that it would raise the federal funds rate when the labor market approached full employment and when FOMC members could anticipate that annual inflation would reach +2%. But, although both conditions were met in early September, Ms. Yellen and company decided to leave the rate unchanged, explaining that it was concerned about “global economic conditions and about events in China in particular.” Benign U.S inflation has a number of fixed income dealers pushing the Fed’s first-rate increase in a decade out to March 2016.

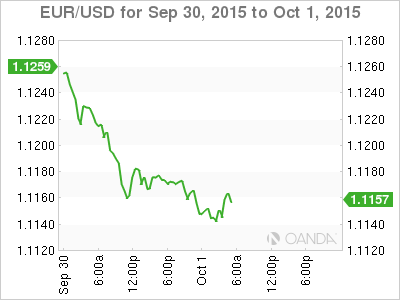

Investors seek proof of rate divergence: With the EUR range bound, investors are still pursuing reasons for a stronger dollar. Will the market get this before year-end? Fixed income is now expecting the ECB to announce an extension of its QE program beyond September 2016 at next months meeting. For December, Fed fund futures are pricing in a +39% probability that the Fed will hike rates, even with the market liquidity constraints. The combination of more ECB easing and Fed tightening should be enough proof to push the single unit solidly below the psychological €1.10 handle. How much lower will depend on the Central bank accompanying rhetoric. If the respective Central Bankers hold true to form, market consensus expects the euro to close out the year threatening its 2015 lows.

“Steady as she goes”: Data from China overnight showed that the world’s second-largest economy remains on shaky ground, but doing a tad better than the consensus. Official manufacturing PMI was in contraction for the second consecutive month (49.8 vs. 49.7 e), but not as poor as feared, while Caixin also improved and beat out projections (47.2 vs. 47). Analysts noted that that the pressure driving the decline of Chinese manufacturing has somewhat eased, although demand remains relatively moderate. The release has given a sense of safety to the market, allowing risk sentiment to improve. It’s worth noting that markets in China are closed for the holidays and did not have a chance to react to the releases.

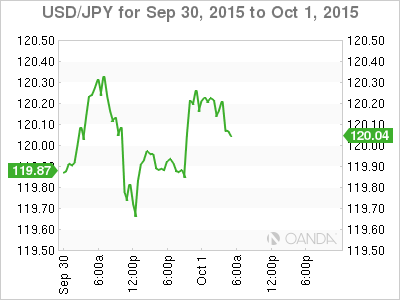

More pressure on the BoJ: Japans Q3 Tankan survey (mood amongst the big manufactures about present business conditions) from the Bank of Japan (BoJ) came in mixed overnight. The manufacturer index was actually below consensus (12 vs. 15), while non-manufacturing topped estimates (25 vs. 21). Certainly a relief for policy makers was the CAPEX component (capital expenditure) beating expectations (+10.9% vs. +8.7%). This would suggest that Japanese businesses appear to be retaining their investment plans despite the slowdown in China. Does this ease the pressure on the BoJ to act at next week’s policy meeting? Critics suggest that the BoJ is too optimistic about the economy and are calling for more easing.

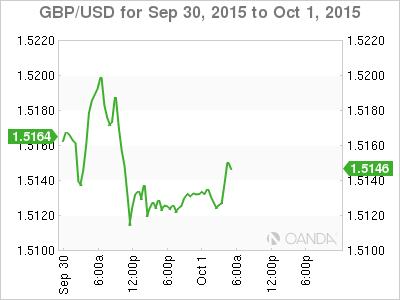

Euro regional PMI’s continue to disappoint: U.K factories are giving additional signs of weaker activity and likely slowed in Q3. The Markit manufacturing PMI slipped to a three-month low last month (51.5 vs. 51.6), mostly on the back of a weakened demand from China and a stronger pound (£1.5133). While Germany, Europe’s largest economy is having its own issues. Its September PMI came in lower than expected, falling to 52.3 from 53.3. Despite rising U.S demand boosting German exports, pre- and post-production inventories slipped. Even though the data would suggest support for German GDP, then there is Volkswagen!

Germany shifts into damage control mode: With VW making one in nine of all cars globally produced, the emissions scandal is expected to have a significant impact on Europe’s largest economy. Currently, the magnitude of the fallout is immeasurable due to the possible international fallout, but first guestimates by analysts expect a negative impact of around -1.1% of GDP.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after German inflation data

EUR/USD trades modestly higher on the day above 1.0700. The data from Germany showed that the annual HICP inflation edged higher to 2.4% in April. This reading came in above the market expectation of 2.3% and helped the Euro hold its ground.

USD/JPY recovers above 156.00 following suspected intervention

USD/JPY recovers ground and trades above 156.00 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.