Market focus temporarily shifts from Greece to U.S Payrolls

Investors expect strong NFP print after yesterday’s ADP

Trading to be hampered by liquidity constraints

Sweden’s Riksbank flatfoots market again

This morning’s focus temporarily shifts from Greece to the U.S, where the granddaddy of economic indicators, the non-farm payroll (NFP) report, could give up a subtle hint to the timing of the Fed’s first rate lift-off. Capital markets are expected to be active, at least until U.S trading desks thin out enough for the long-weekend, just after New-York’s mid-day.

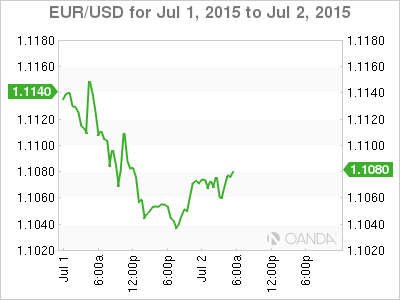

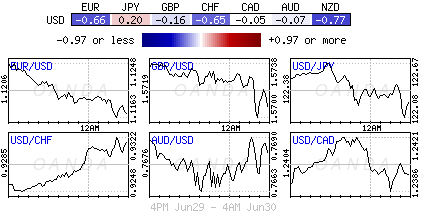

All week, traders have been held captive by the barrage of Greek headlines, which has instigated brief risk-off and on position taking, depending on what’s been said. Nevertheless, the USD heads into this morning’s employment report being well supported by yesterday’s strong ADP (+237k) and ISM (53.5) reading. The dollar is trading stronger against every other G10 currency as position squaring dominates ahead of payrolls and Sunday’s referendum amid thin liquidity conditions.

The expectations for a Fed rate hike as early as September will likely trade aggressively one way or another; at least until the Greek referendum (July 5) results are known and assimilated by the market. If Greek related market turmoil does happen to erupt and have a massive negative impact on the market, then this could actually influence the Fed’s first-rate lift off for 2015. But for now, that is a next week question. Despite many investors willing to take a wait-and-see stance until after Sunday’s Greek event risk, others are willing to shift their focus back to U.S fundamentals and NFP gets no bigger. Today’s price movement is expected to be whippy due to the anticipated liquidity constraints.

The ‘Buck’ is Well Supported

Today’s market sentiment is upwardly biased for the USD for two reasons. Firstly, yesterday’s ADP print, and secondly, the markets anticipation that the Greeks will vote to back the eurozone’s bailout conditions on the weekend (various polls suggest +47% for and +43% against). Market consensus for today’s jobs headline is looking for a payroll growth print of +230k with an unemployment rate to tick down to +5.4% from +5.5%, and a +0.2% average earnings print. Nevertheless, especially after last weekend’s price action on the Asian open where the EUR plummeted (€1.1186 to €1.0995) and portfolio managers pared back they euro-bond exposure, will certainly dissuade many individuals from holding large positions into this weekend. Be forewarned, price action is expected to be erratic.

Riksbank Stumps Markets Again

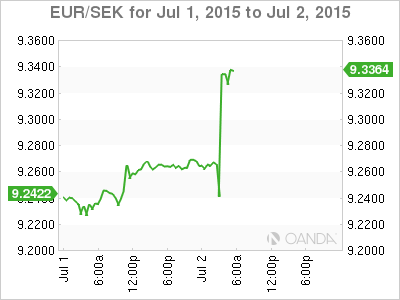

The Swedish Central Bank flatfooted the market again this morning and cut interest rates further into negative territory while expanding its QE program. The Riksbank cut its repo rate to -0.35% from -0.25% and extended its bond buying program by SEK45b. Perhaps more importantly, Swedish policy makers are prepared to make their monetary policy ‘more expansionary’ if needed. The accompanying statement noted that monetary easing is needed as uncertainty aboard had risen and that it was difficult to assess the consequences related to Greece.

The market will now be concerned that the Riksbank could act “between” meetings. If they do, they are a number of options open to policy makers. It’s possible for them to cut their Repo Rate even further into negative territory, and again increase monthly QE amounts. Finally, the Central Bank could intervene directly in the forex market.

The Riksbanks Governor Ingves in this morning’s post rate decision press conference noted that Greece’s problems were “no big issue” for Sweden, but events there are increasing economic uncertainty in Europe. He noted that Swedish monetary policy was having an impact on inflation and reiterated that inflation had bottomed and is heading back higher. The SEK currency is broadly weaker across the board after the unexpected rate cut and expanded QE. The EUR/SEK went from €9.2450 to approach €9.37 directly after the release.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.