Greek debt relief not a solution

EUR bear’s feeling the squeeze at elevated levels

RBA’s Stevens may have tipped his hand on rates

BoE looking at lower for longer after disappointing GDP

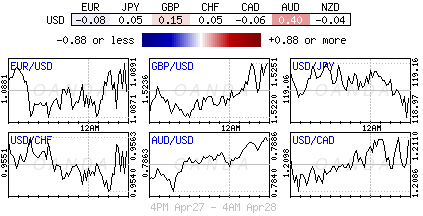

Yesterday, the Greek bond market managed to make an aggressive about turn after news that a Greek government reshuffle diminished the role of Finance Minister Varoufakis in the Euro/IMF bailout negotiations. Today that trend remains your friend; with Greek bonds continuing their rally as the market interprets Prime Ministers Tsipras move as a softening of Athens negotiating stance. Greece’s action is giving the EUR further support ahead of tomorrows FOMC meeting.

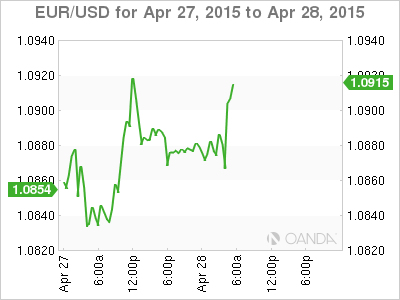

The single unit has managed to print a three-week high (€1.0927) on the belief that a EU/Greek political compromise is but days away. Greek two-year yields are down a percentage point to +21%, having hit nearly +30% last week. The inverted yield curve (short rates higher than long rates) continues to suggest a considerable chance of a Greek default, however, signs of relief will hint of the possibility of a solution.

FOMC in the crosshairs

This week’s main event is tomorrow’s FOMC meeting, and the reason why investors are trying desperately not to make any strong moves ahead of the outcome. The problem is that a pre-meet creeping EUR will be making life rather difficult for the EUR bear. They are now much more vulnerable to a EUR short squeeze topside than before.

U.S. policymakers are expected to convey the message that first-quarter data was an aberration, and that they see growth proceeding at a ‘moderate’ pace. With recent retail sales and employment data continuing to show signs of weakness has the USD underperforming and allowing investors to push the timing of the first U.S. rate hike further out the curve.

With the EUR at such elevated levels pre-meeting, fading FED rate hike expectations, supported by a soft patch of U.S. data since the March meet, will risk the squeeze of even more EUR shorts post FOMC. June had been the forerunner for the first-rate hike, but fixed-income dealers are now looking to September or even beyond for the Fed’s rate normalization process to begin. The possibility that the Fed meets dovish expectations, especially with the dollar at current levels against the majors, could easily instigate an elongated EUR short squeeze beyond last months capped highs in the €1.10’s.

The one directional long dollar trade is stretched, coupled with the fact that investors have been more than willing to sell the EUR on rallies, and with no just reward, is making the EUR bear rather nervous. Previously in March, Asian Central Banks had a demand for the USD. With U.S. yields on the back foot, and the possibility of a dovish Fed, these Central Banks will not be in too much of a hurry to want to own dollars. Last month they were the sellers of EUR’s above €1.1000 and were also key in establishing the EUR’s top after the March NFP print.

Most of the dollar longs are against the EUR (+78% vs. +50% in early March). With such a high concentration, a ‘hawkish’ surprise tomorrow could see the market wanting to reestablish dollar longs against the crosses rather than the EUR outright.

Commodity Currencies in the black

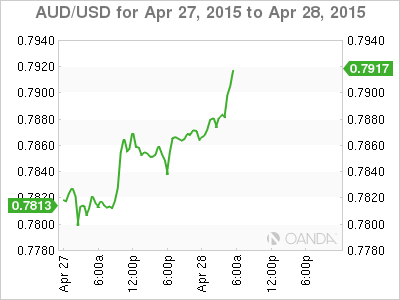

The RBA’s Governor Stevens was Australasia’s main focus of attention in the overnight session. Like most commodity and interest rate sensitive currencies, the AUD has been on a tear of late, supported by investors betting that China will take more action to support their economy with stimulus of one kind or another (iron ore is Australia’s biggest export). The AUD is visiting levels that a usually boisterous central banker had issues with (AUD$0.7910). Investors were looking for clues ahead of next week’s RBA meeting. Would a “hot” AUD require another rate cut? Pre-speech, fixed income dealers had priced a +56% possibility of a rate cut by the RBA.

It seems that the Governor did not disappoint, as he expressed concern that the low interest rate environment in Australia makes for a very challenging retirement system. The market seems to have interpreted the remarks as indication that the RBA will likely stand pat next month. Investors will now be waiting for the Fed for directional clues.

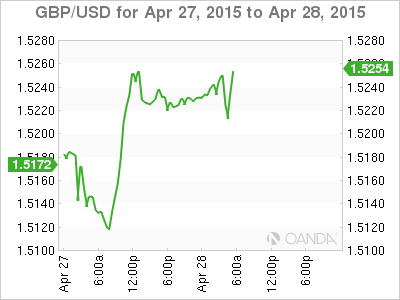

Sterling’s feathers cannot be ruffled

The pound is on the verge of braking its seven-week top (£1.5285) and targeting a new handle (£1.5350) despite UK election event risk and worse than expected Q1 GDP data this morning. Sterling is being dragged higher, like all the other majors, by an underperforming USD.

The UK’s Q1 GDP figures show that growth was largely due to the service sector (+0.5%) q/q, with negative contributions from construction (-1.6%) and agriculture (-0.1%). Results like this would suggest that the BoE is expected to maintain its lower-for-longer policy. Governor Carney will not be expected to shift market thinking until there is a material change to inflation risk and wages. GBP positioning will follow the herd for now, at least until investors get a better understanding of Fed thinking.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after German inflation data

EUR/USD trades modestly higher on the day above 1.0700. The data from Germany showed that the annual HICP inflation edged higher to 2.4% in April. This reading came in above the market expectation of 2.3% and helped the Euro hold its ground.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.