ECB’s QE providing Greek buffer

Central Banks to dominate this weeks proceedings

FOMC is the main event

Forex unfazed with U.K elections

No significant news has hit the markets regarding Greece over the weekend. Capital markets continue to witness the dealings of Greece acting like a petulant child being scolded by its guardian. The more the parent pushes, the more obstinate the youngling becomes. No progress is bad news given that Greek sovereign debt remains on a downward trajectory, as the government gets closer to running out of cash.

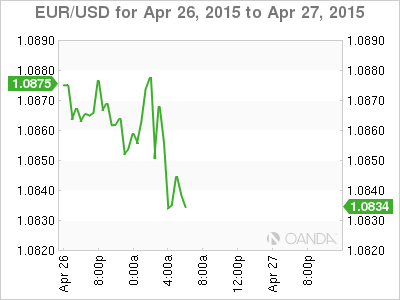

In reality, there is still a complete lack of apparent progress with respect to Greece and its creditors reaching any sort of agreement. The next schedule Eurogroup meeting is scheduled for May 11th. Reports are circulating that the deadline for a Greek agreement could be extended until May 25th. This would give the Greek government approximately five-weeks to ratify, just in time before the June-end final deadline.

The obvious reason why investors have not panicked to date is that the ECB’s QE program is providing a considerable boost. Nevertheless, despite the rest of Europe willing to reach a deal to deliver much needed funding for Greece, whispers of a plan B are beginning to circulate. The latest from Athens meanwhile sees over +70% of population leaning in favor of a debt agreement with EU and only +23% indicating that they were prepared to leave the Eurozone. The ball is in Greece’s corner, however the rest of Europe is quickly losing patience.

There are a number of macro indicators to watch out for this week – U.S. Q1 GDP on Wednesday, while on Friday we get China PMI’s and U.S. ISM. Critical March data for Japan including the CPI, unemployment, consumer spending and industrial output will be reported. Price data including April flash harmonized index of consumer prices ranks high in importance for the Eurozone given its recent the flirtation with deflation.

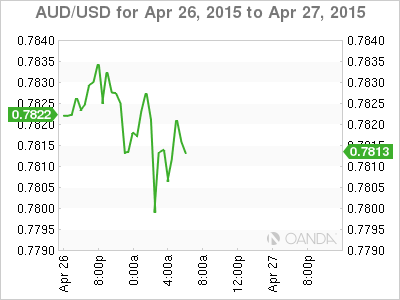

It’s also a busy week on the central bank front, led by the FOMC, although the BoJ, CBB and CBR will also announce their policy decisions. Later this evening investors will take their cue from the RBA’s governor Stevens. The governor is due to speak at the Australian Financial Review Banking and Wealth Summit in Sydney. Expect the market to pay close attention to his comments, the first since the release of Q1 CPI last week. His testimony is considered particularly critical, since the fixed income market is nearly evenly split (+56% vs. +44%) on the probability of another rate cut next week. The governor and hiss fellow cohorts remain vocal on how overvalued the AUD has been (AUD$0.7815). Over the last couple of trading sessions commodity and interest rate sensitive currencies have found some relief. Aussie bulls should be cautious.

FOMC Is The Main Event

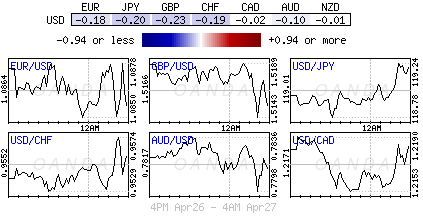

Nevertheless, it’s the Fed that will be keeping capital markets on its toes and the main reason why capital markets are shying away from taking any strong moves ahead of the FOMC outcome.

On Wednesday, U.S. policy makers are expected to convey the message that Q1 data was an aberration and that they see growth proceeding at a ‘moderate’ pace. A year on, the dynamics are a tad different for the Fed. Last year, economic activity had already started to pick up after a harsh winter, the recent retail sales and employment data continues to show signs of weakness and the reason why the USD has been underperforming of late – investors have been pushing the timing of the first rate hike further out the curve. June had been the forerunner for the first rate hike, but most fixed income dealers are looking now to the end of the year or even the beginning of next for the Fed to begin their rate normalization process.

Forex Unfazed with U.K Elections

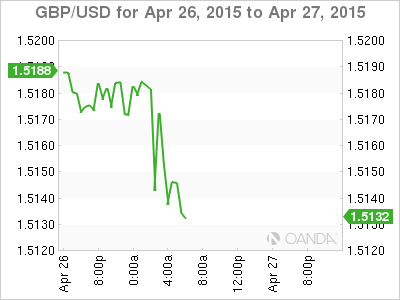

Of late, sterling has been quietly bid, dumfounding the bears and confusing the markets. The Greek fiasco has obviously lent support to the pound (£1.5126), certainly more than the market had been expecting. The U.K election is less than two weeks away and continues to be widely seen as unpredictable. Nevertheless, the forex market seems currently unfazed about the political outcome.

The event risk is that the situation could change very quickly, just like last Septembers Scottish referendum. The vote was nearly upon us before the markets woke up to the potential risks. Looking at two week forward vols, they are trading at +10.1%, which suggests that the market does not expect election related uncertainty to persist. The danger is that the market does not seem to be pricing in a hung parliament or even the probability of a second general election. Investors should be wary that it’s too quiet on the sterling front.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.