Fleet footed Mario Draghi deserves the plaudits for the aggressive actions untaken last week. Following the ECB's surprise rate cut has led to some serious volume spikes in forex trading - volume and volatility provides opportunity, something that has been amiss for far too long with this asset class. More importantly, the ECB managed a way to surprise capital markets with lower interest rates and announced a plan that looks a lot like QE. Both necessary moves, but more importantly, all executed with a much more aggressive tone. This is something that has been lacking from the "non-proactive" perception that the ECB is so tagged with. Nonetheless, there is still so much to do as the ECB is still falling short. Many believe that Euro policy makers are continuing to supplying too "little" monetary stimulus, and may even be compounding that error by advertising its own impotence.

Fiscal policy is ineffective

The fear that Euro fiscal policy cannot lead to inflation would suggest that there is a massive need for further monetary stimulus. Currently, the ECB's target for inflation is close to, but below their desired +2%. Actual inflation is now +0.3% and is nowhere close to the authorities desired level, even worse, their forecasts show inflation running well below their target +2% for the next two-years - 2016 is +1.4%. So, last week's announced new measures, added to the minor changes Draghi and company announced in June go far enough? The actual rate cuts are relatively inconsequential - benchmark lending from +0.15% to +0.05%, while deposits held at the central bank were cut from its negative -0.1% to -0.2%. Many feel that the direct effects will be insignificant. It's a start, but much more is required to be done, hence the introduction of both the ABS and LTRO programs.

Euro data brings mixed emotions

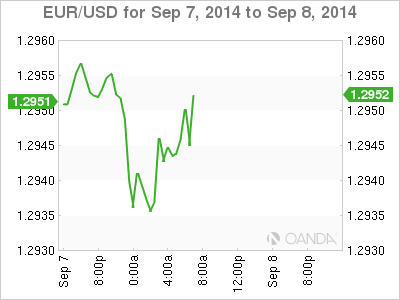

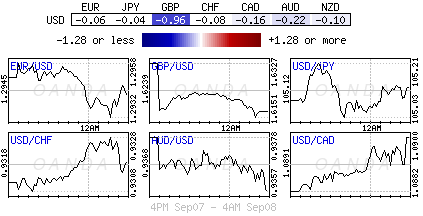

This morning's Euro data is providing some mixed fortunes for the 18-member single currency. The massive drop in the EZ sentix (-9.8 vs. 3.2) is certainly a wake up call for EUR traders and this despite Draghi's efforts last week. Germany is the backbone of Europe, and this morning's monthly record trade surplus stole the headlines (+22.2B vs. +17.3B), possibly pointing to a strong Q3. However, caution is in the details, investors should remain weary of the import drop - it's bad news. If you add this to the EU/US sanctions imposed on Russia, which will eventually only add to Europe's growth woes, the suggested Q3 boon may be way off the mark. Despite the intense bearish speculation is to fade most EUR (€1.2944) rallies. The single unit is currently being underpinned by more EUR/GBP (€short covering.

Look further east

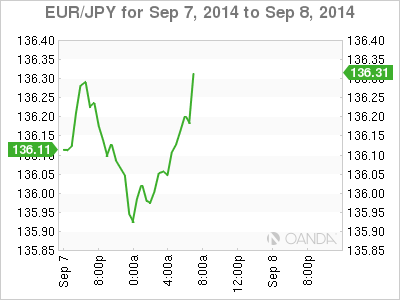

Not all things are necessarily bad for the EUR. Nevertheless, its 'liquidity' will help to support Asian equity market valuations and will provide that region with cheap finance to support its buoyant economies. Europe's political and economic woes will eventually send more trade deals to Asian. Even the go to and over crowded "carry" trade will be capable of kicking on from here. The ECB's stated intentions of cheaper financing will continue to feed these trades - borrowing the cheap EUR to invest in higher-yielding assets like the AUD, and this despite the RBA's intentions of trying to talk it down (AUD$0.9347). Europe's virtually free-money policies have failed to raise and steady the eurozone's consumer lending or to stimulate investment spending leading to investors to seek returns elsewhere. Despite the intense bearish speculation the comfort trade is to fade a EUR rally, however is €1.2920 breaks with conviction then a percentage of the market will be forced to have a rethink.

Cable plummets on polls

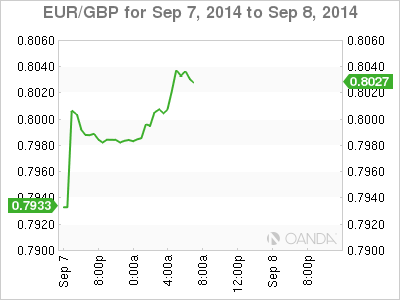

Among the dollar majors this morning, the biggest fluctuation has been seen in Sterling, which has fallen just under 2-cents from last Friday's close to £1.6112, a 10-month low. Investors are unnerved by the uncertainty related to the possibility of Scotland referendum for independence after a "YouGov" survey revealed that supporters of independence are in the lead for the first time by a 51-49% margin. The Scottish Referendum vote is scheduled for next week on September 18. The market is becoming more fearful not just of an outright defeat, but of the Quebecoise scenario (what occurred in Canada). It's where a narrow rejection of independence leaves open a risk of many further votes. This will obviously have a massive impact on UK banking, gilts (+2.49%), direct investment in Scotland from everywhere and on the Pound itself. When Quebec wanted independence, Canada as a nation suffered. Even a "yes" vote will unnerve capital markets until all the details were clearly ironed out.

Despite the YouGov poll grabbing all the headlines, another poll commissioned by the independence party has the "no" vote ahead by +4%. For GBP, uncertainty will be rife until the vote, with volatility to remain high allowing further stops capable of being hit before any reversal. Many are looking at EUR/GBP (€0.8035) as the best vehicle to express their bullish bet on the pound. If "no" is the answer, then investors will be influenced mostly by the large divergence between ECB and BoE monetary policy.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD flirts with daily tops near 1.0730

The continuation of the selling pressure in the Greenback now lends further oxygen to the risk complex, encouraging EUR/USD to revisit the area of daily highs near 1.0730.

USD/JPY looks stable around 156.50 as suspicious intervention lingers

USD/JPY remains well on the defensive in the mid-156.00s albeit off daily lows, as market participants continue to digest the still-unconfirmed FX intervention by the Japanese MoF earlier in the Asian session.

Gold advances for a third consecutive day

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.