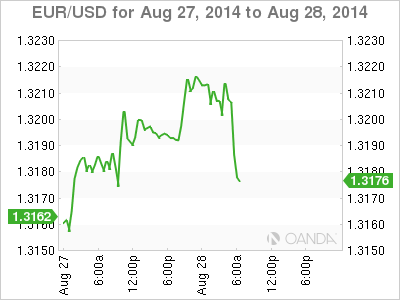

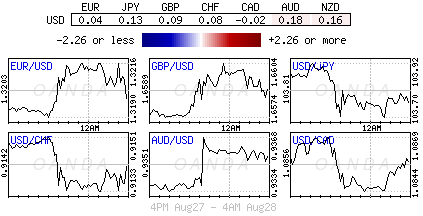

Overall, it's the correct position, but horrible timing on entry price averages - that's what the weak EUR 'bear' position holders are probably feeling at this moment as the 18-member 'single' unit trades up through the psychological €1.3200 handle and feel that it wants to gather more upside momentum. Certainly clouding some of this morning's price action will be month-end demand. For most of this week, the EUR has mostly resided just ahead of its yearly lows (€1.3155), and somewhat handcuffed to a plethora of option barriers and month-end requests. However, it now seems that the market may have gotten too far ahead of ECB outlook.

So far this Thursday, trading has been mostly centered on current ECB expectations. Bunds and US Treasury prices are beginning to give up some of their recent gains, allowing yields to back up, while the EUR advances outright on speculation of 'no' new ECB policy action actually happening next week (September 4th). Despite softer Euro data of late, sources indicate that Draghi and company are unlikely to act unless tomorrow's Euro inflation numbers (HCIP) show the Eurozone sliding towards deflation. Nevertheless, the chance of new stimulus being introduced without first taking into consideration the impact and take up of the TLTRO program starting in a matter of weeks would not have been policy prudent.

ECB will not act hastily

Speculation of a proactive ECB has grown since President Mario Draghi struck a dovish tone at the Jackson Hole central bankers' meeting last week, indicating that Euro policy makers could be moving closer to quantitative easing (QE). Departing from his original speech text, Draghi noted last Friday that "financial markets have indicated that inflation expectations exhibited significant declines at all horizons" in August. To date, Euro policy makers have been transparent in their communications. The chance of an imminent stimulus is low even after Draghi expressing his concerns about market expectations of inflation. Time and time again, he has repeated that the ECB is ready to respond with "all available tools should the need arise." However, under the TLTRO program, the ECB expects +€1trillion to be taken up and they will want to gage the effectiveness in channeling money back into the "real economy" before becoming too trigger-happy. The ECB is definitely looking at a program to buy ABS (Asset Backed Securities) and further details could be announced next week on structure and execution. The Euro bear seems to have got caught in the Jackson Hole Euro stimulus vortex euphoria.

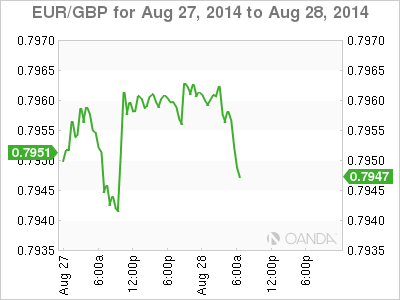

It not just policy expectations or month-end demand supporting the EUR this morning, there are also several yards of EUR/USD strikes nearby for Friday's cut. On the topside, €1.3235-40 (€677m) and €1.3250 (€2billion) being the most significant. On the downside, support is found cluttered near €1.32 for about €1.5billion. All levels will act like a magnet at some stage. Not helping is the contrarian Asian Central Bank (ACB) interest. They are making the EUR bear's life that bit more difficult in the final stretch of August. ACB's have been seen buying both EUR's and GBP overnight to most likely pare back some of their 'net' shorts (dollar longs). For the most part, reserve flows have been guiding the EUR/USD recently, and the ACB's supposed drawdowns are most probably being used to smooth currency strength and could add to the EUR's current squeeze.

Weaker EUR data can wait

A steeper than expected rise for Eurozone M3 this morning has helped to lift the EUR from its overnight lows. The broadest measure of money supply increased +1.8% y/y, exceeding expectations (+1.4%). It's a start, but well below the ECB's reference value of +4.5% that Euro policy makers consider consistent to maintain an inflation rate just below +2% over the medium-term. In Germany, Hesse (+0.0% m/m, +0.7% y/y) and Bavaria (+0.1% m/m, +0.8% y/y) CPI was reported largely unchanged on the month, providing no surprises or support for the EUR. However, softer German jobless numbers (+1k m/m) and Eurozone loan data will continue to work to curb the EUR's bullish reaction. Nevertheless, the market seems singularly focused on tomorrows Euro CPI so a further short-squeeze is highly likely. A modest market correction rather than one-directional flow is healthy for price action.

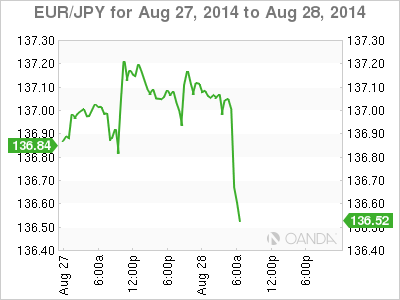

Russia is not immune

The MICEX is plummeting amid the increasing focus on the involvement of Russian soldiers in Ukraine. This is not new news, however, the sudden uptick in focus suggests that Europe needs to show some sort of reaction. Risk aversion price action will continue to see a pre-weekend uptick - only natural because of event risk exposure. Gold so far has risen for a third consecutive day as tensions between Ukraine and Russia support the metal's safe haven appeal. Thus far, it has added $1.46 an ounce to $1,283.91, slowly moving away from its two-month low of $1,273.06 hit last week.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD trades above 1.0700 after EU inflation data

EUR/USD regained its traction and climbed above 1.0700 in the European session. Eurostat reported that the annual Core HICP inflation edged lower to 2.7% in April from 2.9% in March. This reading came in above the market expectation of 2.6% and supported the Euro.

GBP/USD recovers to 1.2550 despite US Dollar strength

GBP/USD is recovering losses to trade near 1.2550 in the European session on Tuesday. The pair rebounds despite a cautious risk tone and broad US Dollar strength. The focus now stays on the mid-tier US data amid a data-light UK docket.

Gold price remains depressed near $2,320 amid stronger USD, ahead of US macro data

Gold price (XAU/USD) remains depressed heading into the European session on Tuesday and is currently placed near the lower end of its daily range, just above the $2,320 level.

XRP hovers above $0.51 as Ripple motion to strike new expert materials receives SEC response

Ripple (XRP) trades broadly sideways on Tuesday after closing above $0.51 on Monday as the payment firm’s legal battle against the US Securities and Exchange Commission (SEC) persists.

Mixed earnings for Europe as battle against inflation in UK takes step forward

Corporate updates are dominating this morning after HSBC’s earnings report contained the surprise news that its CEO is stepping down after 5 years in the job. However, HSBC’s share price is rising this morning and is higher by nearly 2%.