The mighty dollar aims to exit this highly charged geopolitical week on the front foot, and this despite the 'many' in forex who remain sitting on the sidelines ahead of a slew of data next week. Investors continue to search for a better sense of direction, rather than being confined to shifting the 'goal' posts - they want to build new ones.

Yesterday's weekly jobless claims took an unexpectedly big dip, with initial claims falling to their lowest level in eight years, managing to push the four-week average to a seven-year low. Data like that can only raise expectations for next week's U.S non-farm payrolls. Nonetheless, prudent investors will probably heed to the possibility of seasonal distortions for the big slide, while others eyeing yields, will acknowledge it as just another piece of evidence that Fed tightening would be needed sooner rather than later. US rates are currently being priced in to start backing up in H2 2015.

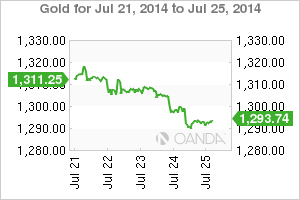

Rate divergence cannot come soon enough for the forex market. When it finally arrives it will help with today's twin problems of sustainable 'volatility and market volume.' They are the missing ingredients for firmer intraday opportunity. Current forex grafting has been handcuffed by G7 loose interest rate policies and a plethora of option deals. Geopolitical events have been short lived in 2014, providing minimum and short lasting contained intraday moves. Investors can be happy with a strong US earnings season, it continues to boost the bottom line balances of many portfolios, the one-game in town that gives the perception of a 'licenses to print money.' Nevertheless, the cry of overvaluation due to 'cheap' money does seem to be getting louder.

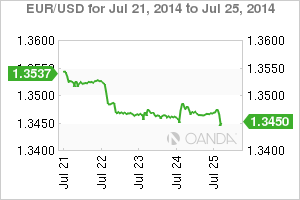

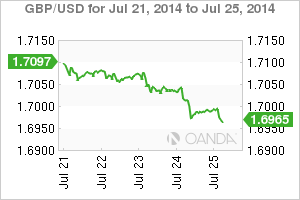

The 18 member single unit, the EUR, continues to have its struggles. It's currently perched, sitting atop yearly outright lows (€1.3450), still lacking the confident ability to move in either direction with purpose. The lack of a positive EUR bounce certainly heightens bearish opportunities. Many long-term investors seem comfortable with their 'patience trade' (initiated in the early part of H1). While the speculators continue to set up short positions, looking for a likely trigger for stops (€1.3430-40 significant).

German data is not helping the single unit's cause this morning. Germany's Ifo has come in softer all around, with the business climax index falling to 108, versus a modest dip to 109.4. It's the same story for the current conditions index, down to 112.9 versus 114.5, while the expectations component eased to 103.4 versus 104.5. The report certainly supports the concerns about the Euro-zones growth prospects. However, this disappointing report does fall in the wake of Thursday's strong PMI data from Germany and the Euro-zone. The astute investor should be taking solace from the latter well before the former. Today's Ifo headline is also heavily swayed by current geopolitical tensions. Investors are concerned that Germany faces growth risks in Q3. Their economy has supposedly flatlined in Q2. Even the IMF has jumped onto the lower global growth expectations bandwagon this week, again cutting global expectations. The fund said the world economy should expand by 3.4% this year, down from its April forecast of 3.7%.

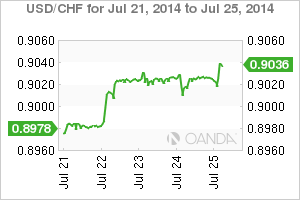

The EUR continues to be pegged back, and now through significant technical and psychological levels (new year lows below €1.3473), the much talked about €1.3400 (€1-billion vanilla) option barrier test seems inevitable, especially on fresh momentum. The creeping rise of short US yields is supporting the USD somewhat, however, the EUR bear must first wait out some corporate or option hedging. This combined with some short EUR/Cross covering heading into the weekend is making the EUR's timeline for demise lengthen.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD remains under pressure from RBA rate decision

AUD/USD spiked lower by more than 20 pips following the RBA rate announcement to test the key psychological support at 0.6600. Losing this key level could see the currency pair trek lower towards the 100-hour EMA support near 0.6580.

EUR/USD edges lower to near 1.0750 due to the upward correction in the US Dollar

EUR/USD snaps its four-day winning streak, trading around 1.0760 during the Asian hours on Tuesday. However, the Euro found support from higher-than-expected Eurozone Purchasing Managers Index data released on Monday.

Gold price extends its upside as markets react to downbeat jobs data

Gold price extends its recovery on Tuesday. The uptick of the yellow metal is bolstered by the weaker US dollar after recent US Nonfarm Payrolls (NFP) data boosted bets that the Federal Reserve would cut interest rates later this year.

Bitcoin miner Marathon Digital stock gains ground after listing by S&P Global

Following Bitcoin miner Marathon Digital's inclusion as an upcoming member of the S&P SmallCap 600, the company's stock received an 18% boost, accompanied by an $800 million rise in market cap.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.