EUR/USD

The dollar advanced versus most competitors on Monday, posting sharp gains against the pound and the euro amid renewed Brexit fears. The shared currency was also weighed by disappointing PMIs readings in the Eurozone and advances in stocks amid higher oil prices. During the New York session, data showed US national activity improved, with the Chicago Fed index rising to 0.28 in January while Markit manufacturing PMI for February came in slightly below expectations at 51.0. EUR/USD fell sharply and bottomed out at 1.1003, where the 200period SMA in 4 hours chart halted the decline at the beginning of the American session. Despite a mild recovery by the end of the day, the pair closed with losses resuming the broader decline after a shortlived bounce seen on Friday. Technically, shortterm picture favours a downward continuation as in the hourly chart the pair consolidates at daily lows and indicators remain flat well below their midlines. However, in 4 hours chart, the RSI remains in oversold territory which might signal further consolidation or even a limited bounce before the next leg lower.

Support levels: 1.1000 1.0962 1.0903

Resistance levels: 1.1050 1.1090 1.1140

GBP/USD

The pound was among the worst performers in the FX space on Monday as the currency was hit by growing fears of a Brexit. Prime Minister David Cameron scheduled a UK referendum for June 23rd for Britons to vote on whether they want to remain in or leave the European Union. He later defended EU deal before the Parliament and said Britain will have a ‘special status’ following his renegotiation. However, London Mayor Boris Johnson and six of the 23 members of Cameron's Cabinet continue to campaign for the exit. GBP/USD plummeted and broke below January’s lows to hit its lowest level since March 2009 at 1.4056, although it managed to trim losses during the American afternoon to end around 1.4150. In the 1 hour chart, the RSI has already corrected from oversold levels, while the pair hovers below a bearish 20SMA. In the 4 hour chart indicators have bounced from lows but are far from suggesting a lasting recovery. Next downside targets stands at the 1.4000 zone with a break exposing the 1.3840 area.

Support levels: 1.4050 1.4000 1.3900

Resistance levels: 1.4200 1.4260 1.4305

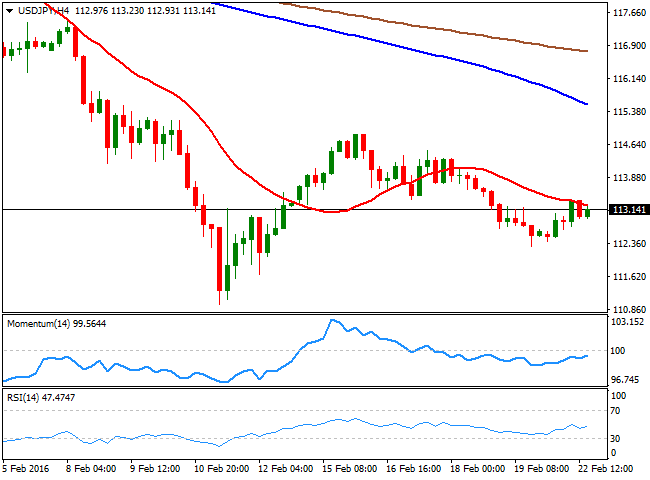

USD/JPY

USD/JPY finished the day higher, posting its first gain in 3 days, as the dollar strengthened broadly, although the USD rally was tempered during the New York session following softer than expected US manufacturing PMI. The pair pulled back from a peak of 113.38, but the downside was contained around 112.90 during the American afternoon. From a technical point of view, the 1 hour chart shows indicators have turned south, with Momentum crossing the 100 level upside down which suggests upside potential might be limited. In the 4 hours chart, the pair remains limited by the 20SMA while indicators have turned flat below their midlines, supporting the shorter term view. A decisive break above 113.50 is needed to pave the way for further gains over the upcoming sessions.

Support levels: 112.30 111.65 111.00

Resistance levels: 113.50 114.00 114.30

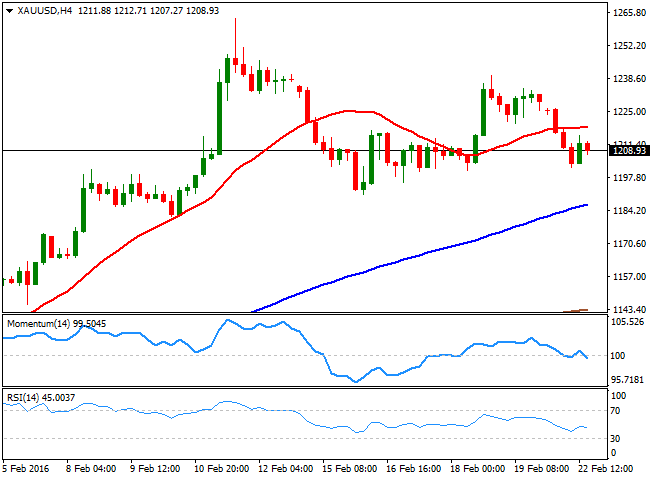

GOLD

Gold fell by more than 2% on Monday to a low of $1,201 a troy ounce as the rally in the oil prices led investors to switch from safe haven metal to riskier assets. The rise in the USD index further added to the bearish pressure on the yellow metal. The metal finished the day lower around $1,207 and according to the 4 hour chart the downside stands exposed as RSI is bearish at 44 levels and the prices trades below 20SMA. In the daily chart, the indicator is extending the decline that began from the overbought territory but the 20SMA is rising and thus could ensure the downside is limited around $1,190 levels. Overall, the downside is favoured unless a break above $1,218 leads to RSI moving above 50.00 levels.

Support levels: 1,190 1,182 1,175

Resistance levels: 1,218 1,226 1,235

WTI CRUDE

Oil prices at both sides of the Atlantic rallied on Monday, with WTI futures settling 6% higher at $33.35/barrel. Asian desks responded to the drop in the US oil rigs by sending prices up while a fresh wave of buying was seen in Europe after the Parisbased International Energy Agency, said in its report the US production could drop sharply as low prices will crowdout investment. Bullish momentum may gain pace tomorrow if the American Petroleum Institute data shows a slower rise or a drop in US inventories. In the daily chart, prices point to further upside as RSI stays bullish at 56.00. In the 4 hours chart, the Momentum indicator has managed to rise above its midline and the RSI is well into the bullish territory above 50.00. Still, prices would need to clear offers around $34.19 and add credence to the bullish indicators. The rising 20SMA in the same chart also indicates limited downside potential.

Support levels: 32.80 32.35 31.33

Resistance levels: 34.19 34.80 36.82

DAX

The German DAX ended 185.54 points or 1.98% higher at 9,573 on Monday as rally in oil prices triggered a flight to risk assets across Europe. The preliminary data released by Markit showed German private sector activity lost steam in February; however investors remained focused on oil and other commodities’ advance. Shares in airliner Lufthansa and sports company Adidas were the only losers in the DAX 30 index while German lender Deutsche bank rose 3.95%. On technical charts, the 4 hours chart shows the index managed to close well above its 100SMA. A bullish crossover between 20SMA and 100SMA would add further credence to the bullish indicators. The daily indicators have turned bullish by rising above their midlines, which indicates the continuation of the bullish move seen today.

Support levels: 9,500 9,413 9,373

Resistance levels: 9,629 9,660 9,700

DOW JONES

Wall Street surged on Monday, helped by a sharp rally in oil prices that lifted energy stocks. The DJIA gained 228 points or 1.39% to end at 16,620.52. The Nasdaq added 1.47% to end the day at 1570.60 and the SandP 500 added 1.36% to close at 1943.90. Monday's stock gains were broad, with all 10 major SandP sectors higher. Shares in Chevron gained 2.6%, tracking the 6% rise in the oil prices. The dismal manufacturing PMI reading hardly came as a surprise, hence received little attention from the trading community. From the technical view, the DJIA index appears overbought as per the 4hour RSI. However, with 20SMA rising, the downside potential appears limited. On the daily charts, the momentum indicator and the RSI remain in line with further bullish move, especially following the close above 16,619. Overall, the upside is favoured and the index could be bought on dips.

Support levels: 16,546 16,463 16,277

Resistance levels: 16,753 16,946 17,031

FTSE 100

The UK’s FTSE gained 87.50 points or 1.47% as equity traders shrugged off Brexit fears and cheered the rally in oil and commodity markets by sending mining stocks higher. Shares in Anglo American rose 10.8% as copper prices rose to a 2week high. Glencore shares strengthened 11.8% while other major gainers were mining heavyweights like Antofagasta, Rio Tinto. Meanwhile, shares in HSBC fell 0.7% after the bank reported a surprise pretax loss of $858 million. On the daily technical chart, the index failed to take out falling trend line resistance, but managed to end on a positive note after having trimmed gains from its daily highs. In the 4 hours chart, 20SMA and 200SMA are pointing to a bullish crossover, while daily indicators are sitting well above their midlines, in bullish territory. Hence, shortterm bullish tone may prevail with falling trend line acting as strong resistance. The index sits well above its 20SMA, which could keep the bears at bay.

Support levels: 6,000 5,863 5,768

Resistance levels: 6,072 6,141 6,222

The information set forth herein was obtained from sources which we believe to be reliable, but its accuracy cannot be guaranteed. It is not intended to be an offer, or the solicitation of any offer, to buy or sell the products or instruments referred herein. Any person placing reliance on this commentary to undertake trading does so entirely at their own risk.

Recommended Content

Editors’ Picks

AUD/USD holds steadily as traders anticipate Australian Retail Sales, Fed’s decision

The Aussie Dollar registered solid gains against the US Dollar on Monday, edged up by 0.55% on an improvement in risk appetite, while the Greenback was crushed by Japanese authorities' intervention. As Tuesday’s Asian session begins, the AUD/USD trades at 0.6564.

EUR/USD finds support near 1.0720 after slow grind on Monday

EUR/USD jostled on Monday, settling near 1.0720 after churning in a tight but lopsided range as markets settled in for the wait US Fed outing. Investors broadly expect US rates to hold steady this week, but traders will look for an uptick in Fed guidance for when rate cuts could be coming.

Gold prices soften as traders gear up for Fed monetary policy decision

Gold price snaps two days of gains, yet it remains within familiar levels, with traders bracing for the US Fed's monetary policy decision on May 1. The XAU/USD retreats below the daily open and trades at $2,334, down 0.11%, courtesy of an improvement in risk appetite.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Relief wave on altcoins likely as BTC shows a $5,000 range

Bitcoin price has recorded lower highs over the past seven days, with a similar outlook witnessed among altcoins. Meanwhile, while altcoins display a rather disturbing outlook amid a broader market bleed, there could be some relief soon as fundamentals show.

Gearing up for a busy week: It typically doesn’t get any bigger than this

Attention this week is fixated on the Federal Reserve's policy announcement scheduled for Wednesday. While the US central bank is widely expected to remain on hold, traders will be eager to discern any signals from the Fed regarding the possibility of future interest-rate cuts.