Gold

Mars transit through Scorpio has ended and I'm expecting a nominal 18 week cycle low. We are in the 18th week. This cycle has a range of 15 to 21 weeks.

Gold could turn down at any point here, probably this coming week, but the time period around the Mars retrograde of April 17th +- a few td's, would be the best timing for a deeper low.

I'm ignoring shorter term cycles until this nominal 18 week cycle low is in. After Mars turns retrograde it will move back into Scorpio on May 27th. This should be an important period for Gold and precious metals. One exception is heliocentric Mercury in Gemini. There are often important turns during heliocentric Mercury transit through Gemini. This is from April 2 through April 6th.

March 11 looks like it was the peak of the cycle. I'm now looking for Gold to trend down into the nominal 18 week cycle trough which should be in the first half of April and as just pointed out near the Mars retrograde date of April 17th.April.

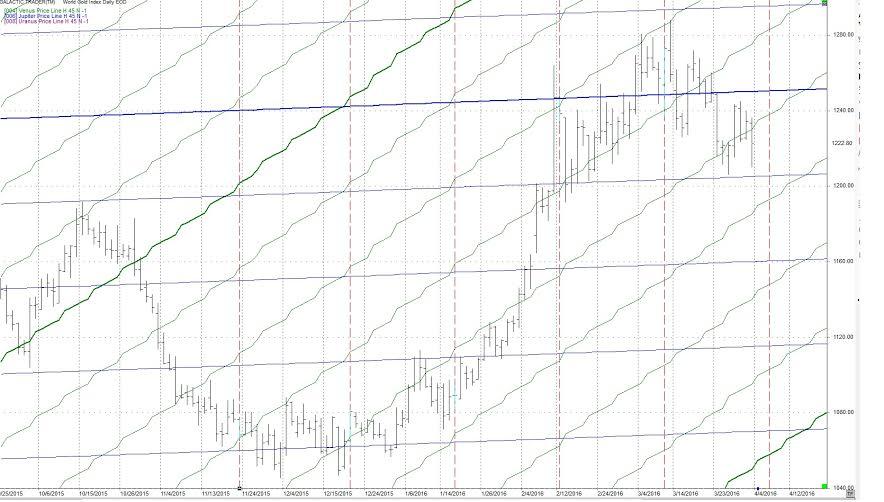

Watch the fib retracements on the following chart for both support and resistance areas. Markets will often go down and be between the 50% and 38.2% Fibonacci retracements. In this case that would be a low between 1165-1194.

Notice Gold price is lower than the 15 day sma which is pointed down and getting close to the 45 day sma. Price moving below the averages are typical for a market entering the 18 week cycle low.

The 15 day sma is the 1/2 cycle to the 6 week cycle and the 45 day sma is the 1/2 cycle to the 90 day or 18 week cycle. All days being td's (trading days).

I'm also expecting Gold to rise again in the spring time frame. I should have forecast dates for the next report. May 27 would be a good start.

On the following daily Gold chart notice Gold started to follow the heliocentric Venus (green) price line up, went down on the 27 cd cycle and now seems to be falling. I'm expecting Gold will move down. The 27 cd cycle hit March 9, 2016, close to the Solar Eclipse and Sun opposing Jupiter. This was 2 days off the Gold high on March 11. The next 27 cd cycle is April 6th.

As with other price lines the values are based on the heliocentric longitude of the planet in question and the longitudinal value is converted to price. The 27 day cycle is the Moon cycle. That is it takes 27 days for the Moon to orbit the Earth. It then takes 2+ days to catch up because the earth has moved during the Moon's rotation. 27 days is also the number of Earth days for the Sun to make one rotation at it's equator.

This blog will cover the stock market from a timing perspective. As such there will be no coverage of fundamental analysis. The approach will be to look for market cycles which are timed with Astrological cycles. When found technical analysis will be used to fine tune entries and exits. Most articles will include examples. For those who are dubious because it "just should not work", read a few posts. You may be very surprised. I am a certified accountant, computer programmer and astrologer. NORMAL STUFF The projections and information provided does not constitute trading advice, nor an invitation to buy or sell securities. The material represents the personal views of the author. Anyone reading this blog should understand and accept they are acting at their own risk. Each person should seek professional advice in view of their own personal finances.

Recommended Content

Editors’ Picks

EUR/USD declines below 1.0700 as USD recovery continues

EUR/USD lost its traction and declined below 1.0700 after spending the first half of the day in a tight channel. The US Dollar extends its recovery following the strong Unit Labor Costs data and weighs on the pair ahead of Friday's jobs report.

GBP/USD struggles to hold above 1.2500

GBP/USD turned south and dropped below 1.2500 in the American session on Thursday. The US Dollar continues to push higher following the Fed-inspired decline on Wednesday and doesn't allow the pair to regain its traction.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.