Federal Reserve Preview: Forecasting 5% interest rates? Dollar to move on dot-plot, Powell's pledges

- The Federal Reserve is set to raise rates by 75 bps for the third time.

- Forecasts for the next moves are critical for the initial market reaction.

- Fed Chair Powell's willingness to accept a recession is also critical.

One cat is out of the sack – the Federal Reserve is set to stick to the baseline market expectation and raise rates by 75 basis points and refrain from a bigger move. Why am I saying it with growing confidence? Because Nick Timiraos said so. He is the Wall Street Journal's reporter who conveyed a last-minute – and hawkish – change from the Fed in June. His preview averts mentioning the size of the move – which means it will stay in the realm of market expectations.

Yet in my preview, I provide promises for fireworks in markets – both based on future moves. Let's start:

Raising rates to fight steaming hot inflation

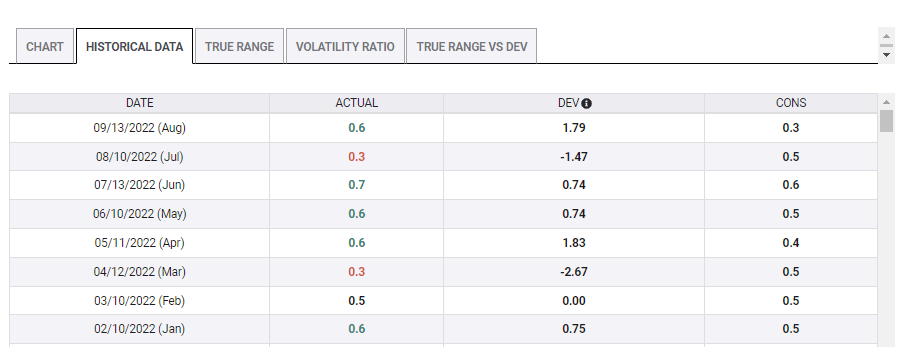

It is hard to exaggerate the importance of Wednesday's Federal Reserve decision to financial markets. They are on the edge after last week's inflation report stunned investors with a whopping 0.6% leap in the Core Consumer Price Index. That was double the early estimates:

Core CPI beat estimates in five of eight months this year:

Source: FXStreet

It showed that while the drop in gasoline prices stabilized the headline inflation, price pressures have become broader and more entrenched. That is the Fed's nightmare scenario – of people expecting higher inflation, a self-fulfilling prophecy. The stock market crash was cruel, the dollar's ascent rapid, and bond markets opened the door to a 100 bps hike.

Source: CME Group

Dot plot is critical for the dollar

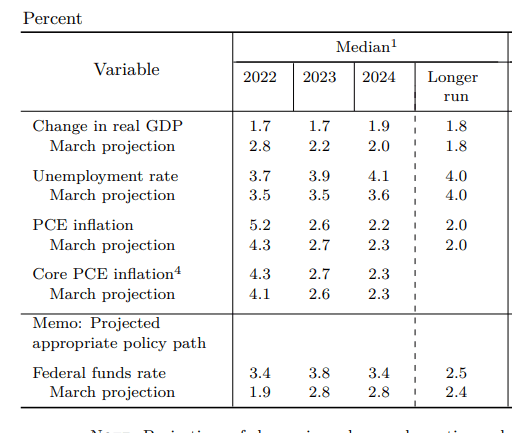

Assuming a 75 bps hike, the focus will be on the "dot plot" – the bank's forecasts for growth, inflation, unemployment and interest rates, the most important measure. In June, the median Fed forecast for borrowing costs stood at 3.8% in 2023: Which looks like ancient history.

Source: Federal Reserve

Before its blackout period, the Fed has been stressing it would refrain from cutting rates next year and that the peak interest rate would be just above 4%. That is a small upgrade to that 3.8% projection.

Calculating chances of rate hikes from bond market pricing becomes harder when looking into the future. Nevertheless, markets foresee borrowing costs hovering in the 4-4.5% by the end of next year.

Important: Therefore, a forecast close to 5% for end-2023 would be significantly hawkish, sending the greenback higher. It would exceed market estimates. Conversely, a more modest 4.50% level would allow for a "buy the rumor, sell the fact" outcome, grinding the greenback lower.

The bank's projections for borrowing costs at the end of this year and the next are also significant. With only two meetings left after September, projections for 2022 are considered more reliable than ones for 2023. Markets currently price a high chance that interest rates will end the year at a rate of 4.25-4.50%, which would be 125 bps above a 3.00-3.25%, assuming a 75 bps hike.

Anything below 4.4% at the end of this year would be dollar negative, while anything exceeding 4.4% would imply the Fed is going for a fourth consecutive 75 bps rate hike in November. That would add to the mayhem in markets.

What is more significant, the forecast for 2022 or for 2023? I would argue that next year matters more than this year. As the Fed promised to raise rates and keep them high, the terminal rate matters more than the next short-term move.

In case the Fed signals another big rate hike but a long pause afterward, it could trigger a relief rally in stocks and the dollar to sink.

Important: front-loading is dollar negative. Ongoing uncertainty is dollar positive.

Powell and the R-word

Last but not least, Fed Chair Jerome Powell is slated to hold a press conference at 18:30 GMT, 30 minutes after the announcement. Any hints about the next moves that contradict the dot-plot in some way could trigger further action.

Powell's comments on the probabilities of a recession – and how willing the Fed is able to endure one – are also critical. So far, the bank has been allowing stock markets to fall, with one member even glowing with joy after the market's negative response to previous Fed hawkishness.

Important: acknowledging recession risks – and accepting them – would further boost the dollar. It would show the Fed is set to continue raising rates even in the face of economic adversity, a crusade against inflation.

On the other hand, signaling concerns about an increase in unemployment would weigh on the dollar. The Fed has two mandates: price stability and full employment. It is easy to focus on inflation when the labor market is steaming hot. Yet like inflation, unemployment could also rise.

Final thoughts

Trading the Fed is complicated. Last-minute moves in markets can result in a counter-trend just after the release. The reaction to the dot plot could later be erased in response to the Fed Chair's remarks, and the final verdict to the bank's actions come only on the following day.

The broad trend in markets is dollar strength and only a Fed "pivot" to a slower pace of hikes would change that. I do not see that happening – because inflation is high and wide, and the labor market is steaming hot. The Fed's two mandates are screaming "we must cool the economy."

I expect the bank to vow to fight inflation until things change – and without any hopes of a slowdown, hated uncertainty will send markets down. That would be good news for the safe-haven dollar.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.