- Expectations for a 75 basis point hike rocket higher in Treasury futures.

- Consumer forecasts for annual inflation jump to 5.4% in June from 3.3%.

- New Fed Projection Materials will show higher interest rates and inflation.

Federal Reserve Chair Jerome Powell does not like to surprise the markets.

Yesterday, someone at the Fed seems to have given the Wall Street Journal a background interview, the kind where no one is quoted, even anonymously, speculating that Federal Reserve officials are considering a 75 basis point hike on Wednesday.

“And that’, in the words of Robert Frost’s famous poem, “has made all the difference.”

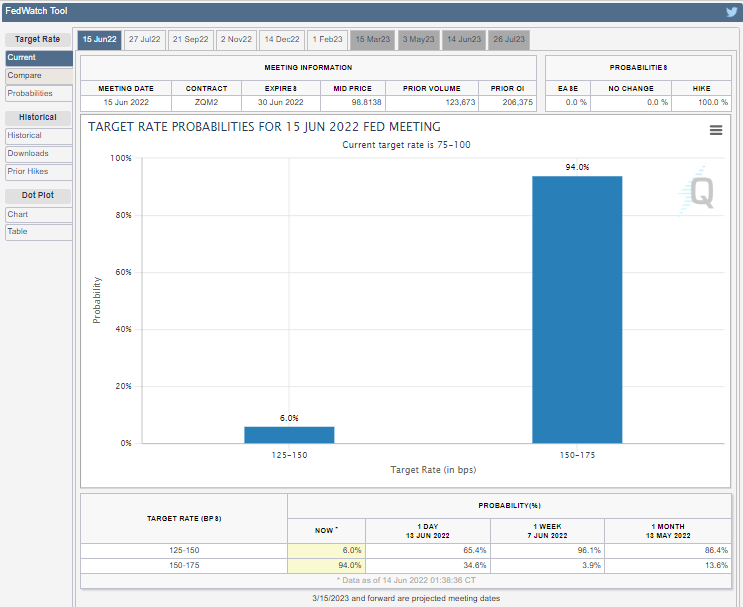

Treasury futures went from about a 70% certainty for a 50 basis point hike before the article, to a near 94% certainty for 75 points after.

CME

Since the May 4 Federal Open Market Committee (FOMC) meeting, markets had assumed that at least two more half-point hikes were on the way. Mr. Powell said as much in his press conference though, not surprisingly, he tempered the promise.

“What we need to see is clear and convincing evidence that inflation pressures are abating and inflation is coming down. And if we don’t see that, then we’ll have to consider moving more aggressively,” Mr. Powell said.

What the Fed has seen is precisely the opposite.

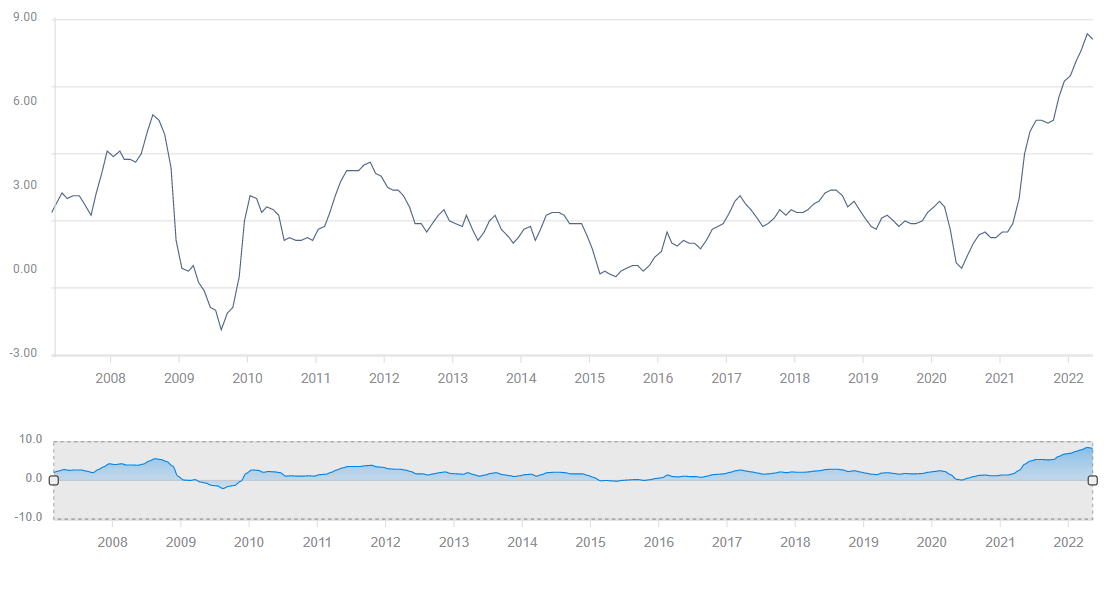

CPI and Michigan inflation expectations

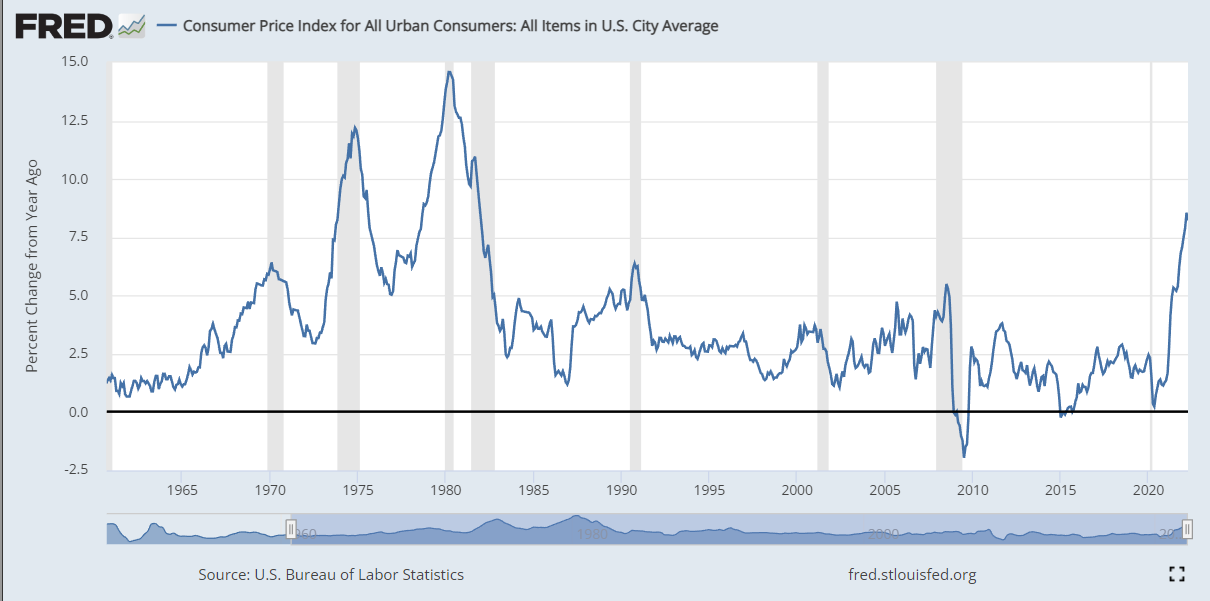

The Consumer Price Index (CPI) was supposed to have topped out in March at 8.5% annually. April’s drop to 8.3% was evidence that inflation had peaked. The May increase to 8.6%, a new four-decade high and the monthly jump of 1% destroyed that narrative. Part of the reason was the 7% rise in oil prices for the month, an increase that has remained.

CPI

Another shock was the Michigan Consumer Survey inflation expectations for June. The inflation rate anticipated in a year soared to 5.4% from 3.3% in May. It was the highest reading since 2008.

Inflation expectations are closely watched by the Fed. When they are anchored-that is unchanging despite rising prices-the threat is much lower that consumers will incorporate higher prices in their purchasing and wage decisions. A vault of 2.1% in one month is the definition of unanchored expectations.

The Fed has a long history of misapprehending inflation. Last year’s prolonged insistence that price increases were ‘transitory’, has probably made the governors sensitive to charges that policy is far behind the curve. A bigger problem is that it is true. The Fed kept rates at zero and its bond purchase program running far too long. The governors did not seem to appreciate that the labor market was recovering on its own and did not need additional support.

Labor market and GDP

Chair Jerome Powell has been instrumental in moving the central bank’s policy focus to the labor market and job creation.

Until last year, excessive inflation had not been a US problem for more than two decades. The Fed spent most of the prior decade trying and largely failing to raise the price index to its 2% target. So maybe it is understandable why the members did not appreciate the very new and different situation created by the pandemic and lockdowns. Nonetheless, inflation is their responsibility and there were many public warnings, most notably from Lawrence Summers, that monetary policy was helping to create runaway inflation.

Perhaps the governors have come to appreciate that inflation is the chief threat to the lifeblood of the US economy, consumer spending.

Price increases are, as usual in an inflationary spiral, outstripping wages gains. Family budgets are diminished every month by general inflation, a burden that falls very unevenly on the poorest households. In addition, food and gasoline are rising faster than the overall price index. Gasoline is up an astonishing 63% in twelve months.

After nearly a year of rampant price increases, with no relief in sight, markets fear that American families will soon begin to cut back on spending. If that happens a recession is nearly assured.

Economic growth in the second quarter is estimated by the Atlanta Fed to be running at 0.9%. It will not take much of a drop in consumption for US GDP to become negative.

Central bank monetary policy works against inflation with a six-month to a year lag. The only potential immediate impact is on consumers’ inflation expectations. Can a dramatic escalation of the Fed’s inflation campaign convince consumers to keep spending? The governors’ hope for a soft-landing depends on that slim chance.

With first quarter GDP at -1.5%, the traditional definition of six consecutive months of declining growth is just around the corner.

Conclusion: Three rate hike scenarios

75 basis points

A 75 basis point increase is now the base scenario. Markets were moving toward this possibility before the WSJ article on Monday but the movement became a race after the publication.

Treasury yields have rocketed higher in June with the 10-year more than 30 points above its old post-pandemic high and the 2-year flirting with an inversion.

Equities have entered bear market territory in the NASDAQ and S&P 500 averages, with the Dow trailing not far behind. The dollar has scored heavily in every major pair and is driven by the twin motivations of rising US interest rates and the fear of a global recession.

These trends will be enhanced by a three-quarters-of-a-point increase.

100 basis points

Less likely than the base scenario but the differential is probably much smaller than the market realizes.

In order for interest rate hikes to be effective against inflation, the fed funds have, in the past, been increased above inflation. With CPI at 8.6% that is not possible now, but the FOMC members may wish to raise the base rate as much as they can before a recession precludes further hikes.

Second quarter GDP will be reported on July 28, one day after the July FOMC meeting. If the governors increase 100 basis points at the next two meetings, and then are forced to halt by a public outcry over recession, the bank will have achieved its likely year-end goal of a 3.0% upper target.

If the Fed chooses a 1% hike, recent equity, Treasury yield and dollar trends will intensify.

50 basis points

The lowest probability scenario. There is no chance the WSJ article was a flight of speculation by its author, Nick Timiraos. It was deliberate Fed communication. The Fed has a two-week comment blackout period before every FOMC meeting. Given that constraint, this was the only way for the bank to alert markets to its intention.

Were the Fed to surprise everyone with a 50 point fed fund increase, equites would boom, while Treasury yields and the dollar would be stripped of some, but not all of their recent gains.

Projection Materials and the Fed balance sheet

The Fed updates its rate, inflation and GDP predictions four times a year. In the March release the fed funds year-end forecast was 1.9%, GDP was expected to be 2.8% and PCE inflation 4.1% for core and 4.3% overall. The fed funds rate was expected to be 2.8% at the end of 2023 and 2024. Growth would moderate to 2.2% next year and 2.0% the following, with inflation at 2.7% and core at 2.6% in 2023. These numbers, especially for this year and next, are greatly outmoded.

Through April, PCE inflation has averaged 6.30% this year and core PCE is 5.15%. Growth was -1.5% in the first quarter and is currently estimated at 0.9% in the second. The extent of the upward revisions to fed funds, and PCE inflation will provide additional signals for Fed policy. Market reactions will be straightforward, with higher estimates reinforcing the choice of rate increase.

In May, the Fed set a range for reducing its $9 trillion balance sheet, half acquired after the 2008 financial crisis and half this year and last in response to the lockdown-induced economic collapse. The roll-off of maturing securities would begin at $47.5 billion a month in June, split $30 billion for Treasuries and $17.5 in mortgage-back securities and rise to $95 billion in three months, doubling each category.

Fed governors have two possible modifications that would indicate higher interest rates. The full $95 billion reduction could be implemented immediately. This would be symbolic but little more as the slightly faster roll will have no impact on the $9 trillion balance sheet.

The governors could opt for active selling from the bank's portfolio. This would send a very strong signal to the credit markets that the Fed wants higher rates. This also seems unlikely as it would excite open-ended speculation as to where the Feds wants Treasury and commercial rate to land and would make for an uncertain business and economic environment.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 core inflation forecasts, disappointing the Japanese Yen buyers.

AUD/USD consolidates gains above 0.6500 after Australian PPI data

AUD/USD is consolidating gains above 0.6500 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price flatlines as traders look to US PCE Price Index for some meaningful impetus

Gold price lacks any firm intraday direction and is influenced by a combination of diverging forces. The weaker US GDP print and a rise in US inflation benefit the metal amid subdued USD demand. Hawkish Fed expectations cap the upside as traders await the release of the US PCE Price Index.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.