Fed Interest Rate Decision Preview: Chair Powell will determine market response

- No change in fed funds rate or the bond program forecast .

- Fed to begin preparing markets for a future bond taper.

- New economic forecasts for GDP and inflation will hint at the Fed agenda.

- Currency, equity and credit markets will move forcefully at the suggestion of higher rates.

Markets waiting expectantly for a change in Federal Reserve policy as inflation courses through the US economy and growth soars will be disappointed on Wednesday afternoon, but the governors are likely to signal that tapering their bond purchases has become an active discussion.

The Federal Reserve Open Market Committee (FOMC) statement could offer a more positive view of the US economy as a prelude to policy shift, but the gradations of optimism will probably be left to Chair Jerome Powell in his press conference following the rate announcement.

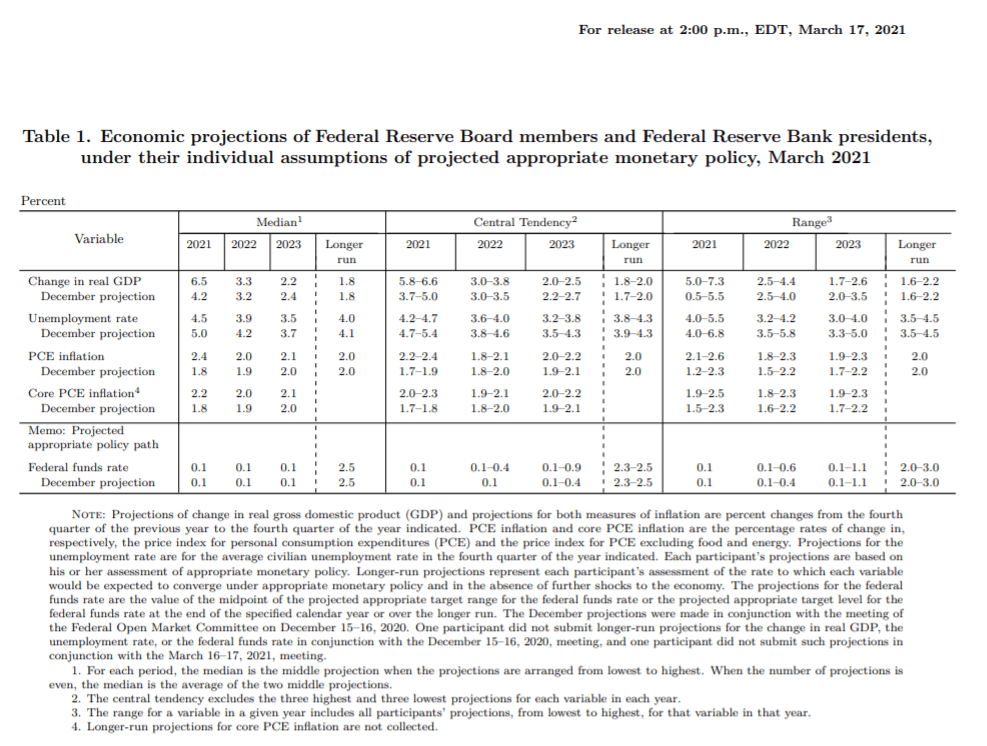

Projection Materials

This year's second set of quarterly economic projections will offer a more sanguine view of the US recovery, reflecting reality.

In the March Projection Materials, PCE inflation was forecast to be 2.4% at the end of 2021 and core at 2.2%. Economic growth was predicted to be 6.5% and the unemployment rate to be 4.5%. Those estimates will undoubtedly improve.

There is a small chance that an increase for the fed funds rate in 2023 could be incorporated. In the March projections, the rate was unchanged at 0.1% through the end of 2023, though the spread of the estimates increased from 0.1% to 0.4% in 2022 to 0.1% to 0.9% in 2023.

Increases in inflation or GDP will be taken by the markets as a Fed signal that the economy can withstand higher interest rates.

Bond tapering

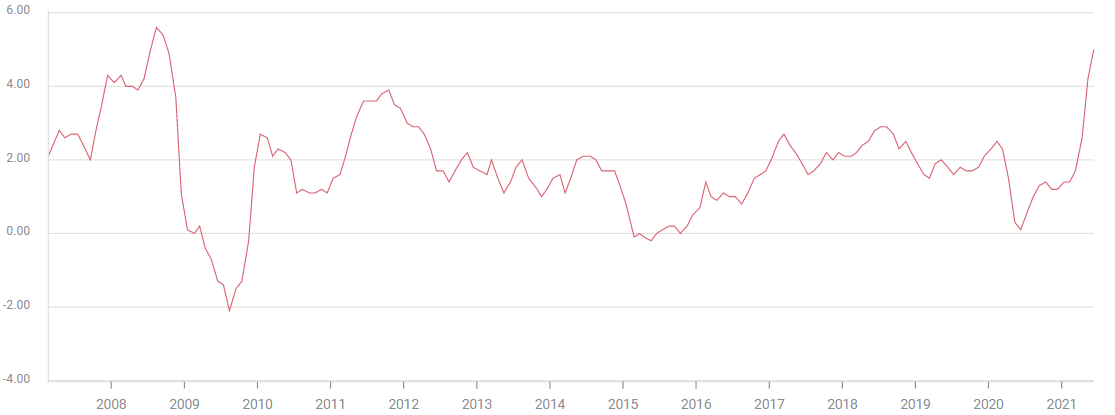

Soaring US consumer prices are driving speculation that the Fed will soon begin to reduce its $120 billion a month in credit market purchases as a means of forestalling inflation.

Consumer price increases have more than tripled since January to 5%. The Producer Price Index at 6.6% in May promises a long run of manufacturing increases that will be passed on to purchasers.

CPI

At the April meeting some officials had “suggested that if the economy continued to make rapid progress toward the Committee’s goals, it might be appropriate at some point in upcoming meetings to begin discussing a plan for adjusting the pace of asset purchases.”

As revealed in the minutes of that meeting, the note excited a swift but temporary market response.

Several other officials including Robert Kaplan, President of the Dallas Fed, and Treasury Secretary Janet Yellen have commented that the time may be approaching for adjusting monetary policy.

The Fed historically has given markets a long lead for policy changes. Until now indications of a change have been limited to comments and that single mention in the April minutes.

Were the Fed to incorporate the possibility of a taper in its statement or in Mr. Powell’s prepared remarks, the observations will be surrounded with qualifications that the economy still has a long way to go and that the governors consider current inflation a transitory problem.

The Fed wants to avoid a repetition of the 2013 “taper tantrum'' which saw Treasury rates skyrocket, prompted by then Chairman Ben Bernanke’s unexpected reference to ending the bank’s quantitative easing purchases.

10-year Treasury yield

CNBC

Many analysts expect the Fed to use its annual symposium in Jackson Hole, Wyoming in August, a more informal setting than the FOMC meeting, to unveil details about unwinding its bond program. If that were the case, a taper would likely begin at the end of the year or early in 2022.

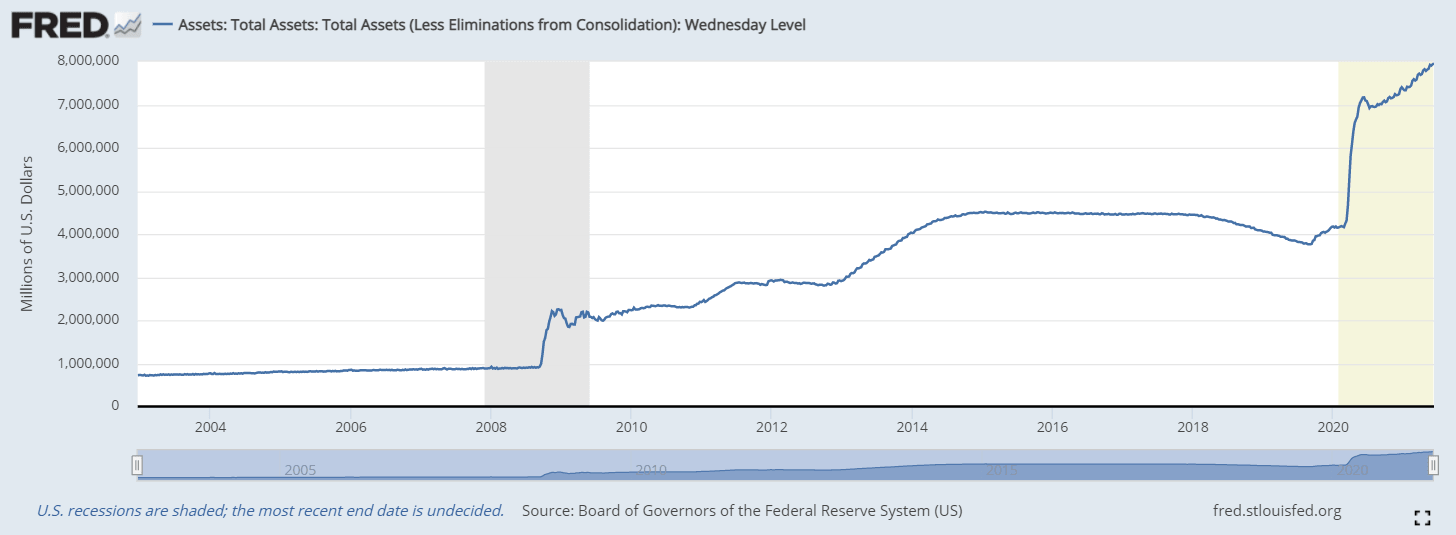

Quantitative easing and fed funds

Treasury rates have risen sharply this year as markets have anticipated that US economic growth and inflation will eventually reverse the Fed's monetary accommodation.

Tapering the bond program is the necessary first step in reducing and eliminating the massive liquidity provisions that the bank enacted in March 2020 to fight the economic collapse of the lockdowns.

Once the Fed starts to scale back its bond purchases, it could take months or even years to complete depending on the progress of the economy. It would also be very difficult to reverse the taper once started should the economy falter.

The governors will want to be as certain as possible that the economy has fully recovered from the lockdowns. The logical endpoint of the taper and a restored US economy would be a return to a higher and more normal interest rate environment.

Federal Reserve, total assets

The rising interest rates that will accompany a taper pose a risk for the equity and housing markets that have profited mightily from the ultra-accommodative monetary policy of the past 16 months. The Fed will want that adjustment to be as gradual as possible, fearing the economic impact of a sudden lurch in rates more than their ultimate destination.

Conclusion

Mr Powell will surely be asked more than once about tapering and the bond program in his press conference. How he answers will determine, more than anything else, the market response and the proximity of the taper.

In April, Mr. Powell used the phrase “substantial further progress” to describe the US economic conditions that would permit a change in Fed policy.

He utilized the locution so often and to the denial of any other economic details it became obvious that he and the governors did not want to discuss the particulars of the US economy.

At the April 28 FOMC, the 10-year Treasury yield was at 1.66%, not far from the high three weeks earlier of 1.746%.

Mr. Powell was evidently concerned that should he refer to the progress of the US economy, especially the then recent March payroll report of 916,000 (since revised to 770,000), the credit market would take that as permission to send Treasury rates sharply higher.

Subsequent events have borne out the Fed view. April payrolls crashed to 278,000 and May’s recovery to 559,000 has made only a small dent in the 9.3 million jobs on offer in April.

Markets are poised for the taper. Equities and Treasury prices are prepared for a sharp sell-off and the dollar for a concomitant gain.

The Fed is running out of time. This may be the final meeting where traders will give the FOMC a pass, before soaring prices force the credit markets to make their own choice.

Be that as it may, Mr. Powell will do his best to delay that reckoning until the fall.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.