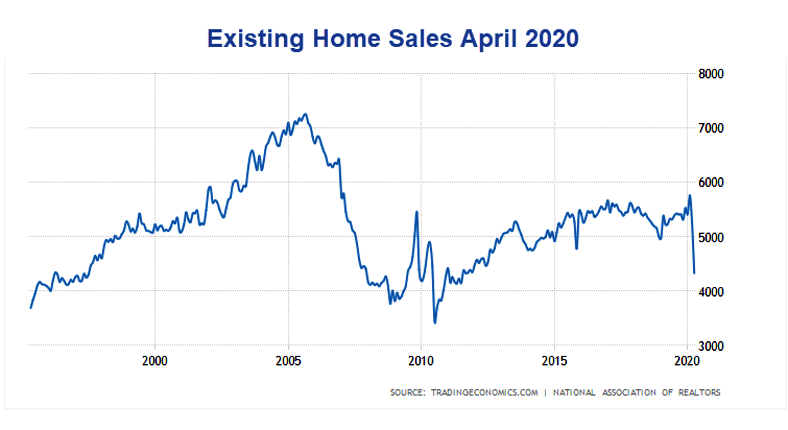

Existing home sales have plunged. Price will follow.

The National Association of Realtors (NAR) reports Existing Home Sales Wane 17.8% in April

Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, dropped 17.8% from March to a seasonally-adjusted annual rate of 4.33 million in April. Overall, sales decreased year-over-year, down 17.2% from a year ago (5.23 million in April 2019).

"The economic lockdowns – occurring from mid-March through April in most states – have temporarily disrupted home sales," said Lawrence Yun, NAR's chief economist. "But the listings that are on the market are still attracting buyers and boosting home prices."

Immense Cheerleading

Supposedly listings "are still attracting buyers" despite the fact that sales are down 17.8% on top of a 8.5% decline in March.

Note that April's existing-home sales are the lowest level of sales since July 2010 and the largest month-over-month drop since July 2010.

Prices Rise

The median existing-home price for all housing types in April was $286,800, up 7.4% from April 2019 ($267,000), as prices increased in every region. April's national price increase marks 98 straight months of year-over-year gains.

"Record-low mortgage rates are likely to remain in place for the rest of the year, and will be the key factor driving housing demand as state economies steadily reopen," Yun said. "Still, more listings and increased home construction will be needed to tame price growth."

Not the Bottom in Transactions

April will not mark the bottom in sales. Here's why.

-

Existing sales are recorded at closing whereas new sales are counted at signing.

-

April sales represent transactions that occurred in February and March.

May sales (transactions in March and April) are sure to be worse. Even June sales could be worse.

Expect Prices to Drop Too

Yun's statements regarding sales price constitutes more cheerleading.

-

Prices are up in April only because data is so skewed by the huge drop in sales.

-

Many people pulled listings due to Covid-19. Sellers will want prices they could have gotten in February, but alas, those prices are gone.

-

The hit to personal income ensures that a decent chunk of would-be buyers just vanished.

Grim Economic Data

-

May 8: Over 20 Million Jobs Lost As Unemployment Rises Most In History

-

May 15: Retail Sales Plunge Way More Than Expected

-

May 15: Industrial Production Declines Most in 101 Years

To expect buyers to return en masse and price to hold up as well is irrational.

Looking to Buy? Wait!

Ignore the cheerleading from the NAR. Better prices await buyers who are patient.

This material is based upon information that Sitka Pacific Capital Management considers reliable and endeavors to keep current, Sitka Pacific Capital Management does not assure that this material is accurate, current or complete, and it should not be relied upon as such.

Recommended Content

Editors’ Picks

USD/JPY holds above 155.50 ahead of BoJ policy announcement

USD/JPY is trading tightly above 155.50, off multi-year highs ahead of the BoJ policy announcement. The Yen draws support from higher Japanese bond yields even as the Tokyo CPI inflation cooled more than expected.

AUD/USD consolidates gains above 0.6500 after Australian PPI data

AUD/USD is consolidating gains above 0.6500 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.